Tax Considerations in a Universal Pension System (UPS)

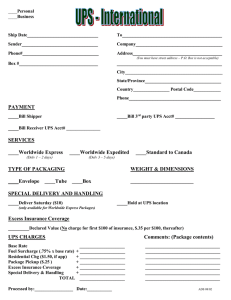

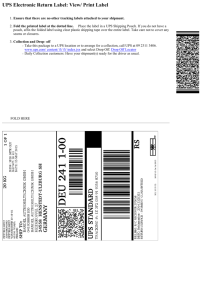

advertisement