Fa n ie M

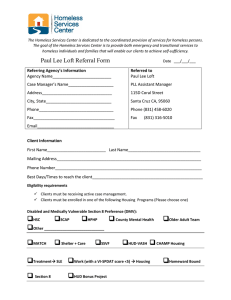

advertisement