Wade Sample Sustainability and M&A Transactions:

advertisement

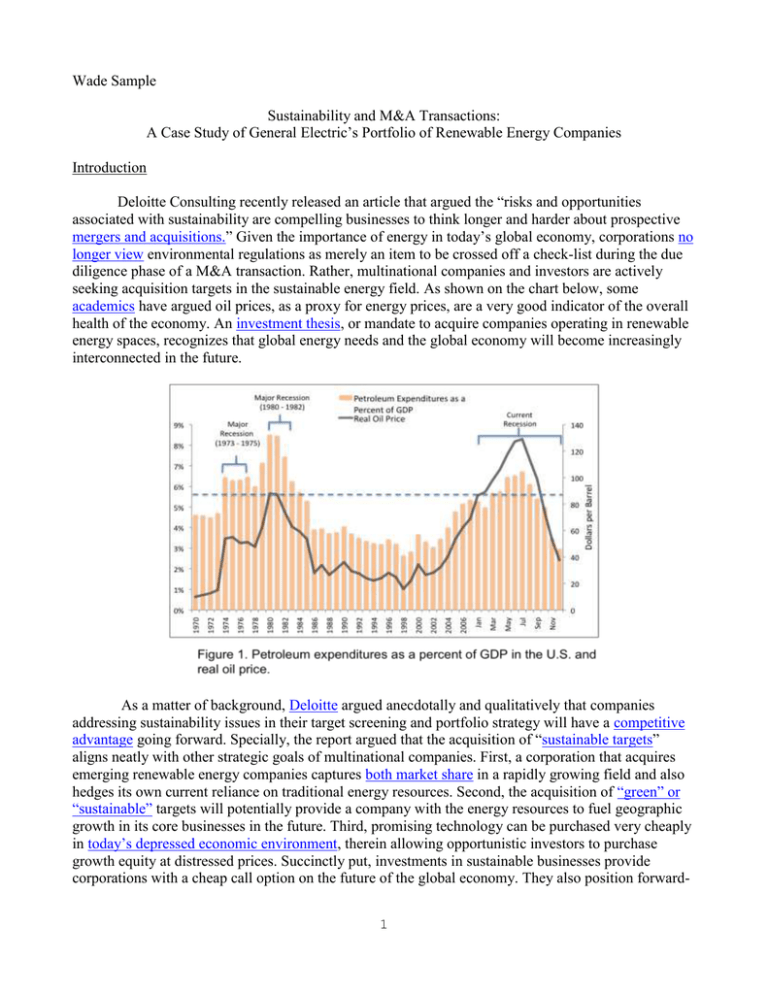

Wade Sample Sustainability and M&A Transactions: A Case Study of General Electric’s Portfolio of Renewable Energy Companies Introduction Deloitte Consulting recently released an article that argued the “risks and opportunities associated with sustainability are compelling businesses to think longer and harder about prospective mergers and acquisitions.” Given the importance of energy in today’s global economy, corporations no longer view environmental regulations as merely an item to be crossed off a check-list during the due diligence phase of a M&A transaction. Rather, multinational companies and investors are actively seeking acquisition targets in the sustainable energy field. As shown on the chart below, some academics have argued oil prices, as a proxy for energy prices, are a very good indicator of the overall health of the economy. An investment thesis, or mandate to acquire companies operating in renewable energy spaces, recognizes that global energy needs and the global economy will become increasingly interconnected in the future. As a matter of background, Deloitte argued anecdotally and qualitatively that companies addressing sustainability issues in their target screening and portfolio strategy will have a competitive advantage going forward. Specially, the report argued that the acquisition of “sustainable targets” aligns neatly with other strategic goals of multinational companies. First, a corporation that acquires emerging renewable energy companies captures both market share in a rapidly growing field and also hedges its own current reliance on traditional energy resources. Second, the acquisition of “green” or “sustainable” targets will potentially provide a company with the energy resources to fuel geographic growth in its core businesses in the future. Third, promising technology can be purchased very cheaply in today’s depressed economic environment, therein allowing opportunistic investors to purchase growth equity at distressed prices. Succinctly put, investments in sustainable businesses provide corporations with a cheap call option on the future of the global economy. They also position forward1 thinking companies to exploit the ultimate synergy in their businesses as energy needs and core businesses are becoming increasingly inseparable. While both are considered analogous for the purposes of this case study, clean energy businesses can be divided into two categories. First, cleantech companies seek to develop proprietary technology that attempts to improve or better utilize energy, water, and waste, in a manner that is environmentally friendly. Second, clean energy companies use clean technology (like those found in wind farms or solar panels) to produce energy using a business model more similar to a utility than a tech company. Total investment in “clean technology companies reached $243 billion in 2010. Of that, over 50% of total investments were made in biofuel, wind, solar photovoltaic, and fuel cell companies. Erik Straser, partner and leader of the cleantech team at the venture capital (VC) firm Mohr Davidow Ventures, commented that “[t]he market size for cleantech will be measured in the trillions of dollars― it’s immeasurably deep.” Thus, there is a recognition among very sophisticated investors that new technologies focused on creating sustainable energy resources are the wave of the future. Underlying the investments thesis of these sophisticated institutional investors is the understanding that the global economy and global energy needs will continue to converge in the future. Despite increasing investments made by financial sponsors and venture capitalists in sustainable businesses, strategic buyers and traditional businesses have not made the same concerted effort to amass a portfolio of investments in sustainable businesses. In fact, clean technology investing “in 2011 is like something out of a Dickens novel: it’s a tale of Tale of Two Markets. Venture capitalists continue to gush over the sector, but markets [and Fortune 500 companies] are less than exuberant.” In fact, venture capitalists devoted 23% of their capital in 2010 to cleantech investments. Despite the recent increase in venture capital investments in sustainable corporations, an ETF tracking cleantech technologies in the public markets has fallen 15% since 2008 while the NASDAQ has been up over 15% in the same time period. This presents an interesting opportunity for forward-thinking corporations to acquire promising technology and growth businesses with competition from only financial sponsors. First, corporations should follow the lead of sophisticated investors who have identified the renewable energy market as one of the most promising sectors of the global economy in the future. Second, there is relatively little competition among other strategic buyers for these promising sustainable businesses; thus, it is likely 2 that corporations investing in these businesses today will pay lesser multiples than they will be forced to pay in the future. Third, since other strategic buyers are reluctant to pursue an acquisition strategy incorporating sustainability, those companies and corporate managers that do pursue an acquisition strategy focused on sustainability will have the opportunity to distinguish themselves from their competitors both strategically and financially. The below chart indicates how the concept of sustainability has evolved from merely understanding the environment to using sustainability to produce profits. GE as a Model for Sustainable M&A Given that relatively few strategic buyers or multinational corporations have pursued an M&A strategy that has emphasized sustainable growth or renewable energy technology, it is very helpful to evaluate General Electric’s forward-thinking and proactive M&A strategy with respect to acquiring “green” and “sustainable” corporations. The GE approach to M&A relies on an acquisition model that targets investments in sustainable acquisition targets based on a purely profit seeking motive. While GE’s investments in clean technology certainly have had many positive ancillary benefits with respect to environmental issues, GE’s sustainable acquisition strategy is a pure profit-seeking strategy that other forward-looking companies should adopt to meet their future energy needs. GE’s bases this strategy on the below CLEAR model. 3 In 2011, Fortune ranked GE the 6th largest firm in the U.S. as well as the 14th most profitable. Other rankings for 2011 include #7 company for leaders (Fortune), #5 best global brand (Interbrand), #82 green company (Newsweek), #13 most admired company (Fortune), and #19 most innovative company (Fast Company). Led by its CEO Jeff Immelt, General Electric has established a corporate culture that recognizes both the public policy and profit-generating benefits of anticipating energy trends related to sustainable investments. With respect to GE’s acquisition strategy, Immelt commented that “[w]e are investing in clean technologies like energy efficiency, wind and solar, nuclear, smart grid and electric vehicles, because we believe it is not a question of ‘if’ but ‘when’ the world will shift toward more sustainable growth” GE’s General Counsel has similarly recognized that a M&A model focused on developing sustainable energy resources is not a luxury; rather, it is necessity given today’s global energy environment. He states “[t]he themes we have been exploring, by convening discussions between GE executives and stakeholders on issues such as conflict minerals, resource scarcity, weak rule of law and a more volatile climate, have now moved from the margins to the mainstream.” . Currently, GE’s subsidiary, GE Energy Financial Services, is responsible for pursuing GE’s M&A strategy dedicated to acquiring sustainable technology. According to GE’s website, GE Energy Financial Services (hereinafter referred to as both “GE” and “GE Energy Financial Services”) “invest[s] globally across the capital spectrum in essential, long-lived and capital-intensive energy assets that meet the world's energy needs.” Based in Stamford, Connecticut, GE Energy Financial Services currently holds $20bn in assets related to the creation of energy. Furthermore, GE Energy Financial Services has invested $6bn in a portfolio of renewable energy assets that includes wind, solar, hydro, and geothermal assets. In addition, GE has invested in smart grid technology. To put these investment dollars in perspective, GE owns power assets that are capable of producing 30 gigawatts of energy, which is equivalent to the installed generating capacity of Norway. On the homepage for GE Energy Financial Services, GE not so subtly characterizes its M&A strategy in the following manner: “GE Energy helps its customers and GE grow through new investments, 4 strong partnerships and optimization of its approximately $20 billion in assets . . . we’ve put billions of dollars into wind, solar, biomass, hydro, geothermal and other renewable power projects.” Importantly, GE’s profit-seeking venture capital arm is guided by an over-arching theme of corporate social responsibility as outlined in GE’s ecomagination initiative. The next section of this Article will discuss specific M&A transactions that GE has pursued in recent years in an effort to align its corporate future with energy independence. Select M&A Wind Acquisitions In 2007, GE purchased 6 wind-farms with a capacity of 410 megawatts in four states (California, Illinois, New Mexico, and Pennsylvania) from Babcock and Brown, an investment firm that was a subsidiary of Wachovia. According to Kevin Walsh, Managing Director of renewable energy at GE Energy Financial Services, “[t]his transaction continues the expansion of the geographic footprint and technology mix of our wind holdings . . . [i]n addition, the portfolio helps the states of Arizona, California, Illinois and Pennsylvania meet their renewable energy targets, and reinforces GE’s commitment to ecomagination.” Ecomagination is GE’s initiative to help its customers meet their own unique environmental challenges while simultaneously expanding its own portfolio of clean energy products. The six wind farms combined are projected to power 100,000 homes annually and to reduce greenhouse gas emissions by 700,000 tons of carbon dioxide per year. Also, in 2007, GE acquired Fenton Wind, the largest wind-farm in Minnesota for $385,000,000. It simultaneously entered into an agreement where enXo, Inc. would operate and maintain the wind-farm. Thus, GE’s acquisition of Fenton Wind allowed GE to purchase a valuable renewable energy producing asset without having to commit to actually running the project. Also, importantly, the project features 137 GE 1.5MW turbines, thus showing GE’s ability to vertically 5 integrate its different businesses to exploit the clean energy movement. The wind-farm is projected to annually “produce electrical energy estimated to be sufficient for more than 66,600 homes, and to reduce greenhouse gas emissions by more than 550,000 tons of carbon dioxide per year, compared with equivalent fossil fuel generation.” In 2005, GE made an equity investment in Alsleben Wind Farm, one of Germany’s largest wind-farms. Alsleben currently produces power sufficient for about 30,000 homes and saves approximately 100,000 tons a year in greenhouse gas emissions, compared with the equivalent fossil fuel generation. GE’s vice-president of renewable energy commented that this “project reinforces our company’s continuing interest in wind power as a key component in helping to develop the balanced energy portfolio that the world will need to meet its future clean energy needs.” Importantly, the 36 wind-turbines commissioned at Alsleben were also produced by GE. Thus, GE’s acquisition of the wind-farm allowed GE to both vertically integrate part of its wind-turbine business and to further develop a source of renewable energy in Europe. Also, in 2005, GE made a $51,000,000 investment in the Kumeyaay Wind Project, a wind farm comprising 25 turbines that generates fifty megawatts of electricity and feeds power into the San Diego Gas & Electric grid. The project currently “produces power sufficient for 30,000 homes and saves 110,000 tons per year in greenhouse gas emissions, compared with equivalent fossil fuel generation. It helps San Diego Gas & Electric meet its target of supplying at least 20 percent of its customers’ electricity from renewable sources by 2010.” Additionally GE has made (i) a €135,500,000 investment in a wind-farm in Germany, (ii) a $300,000,000 equity investment in a 600-megawatt portfolio of wind-farms in Oregon, Minnesota, Illinois, and Texas, (iii) a $141,000,000 equity investment in a 180-megawatt wind farm in the Dakotas, (iv) a $117,000,000 equity investment in an operational 225-megawatt wind farm in Oklahoma, and a (v) $111,000,000 equity investment in three wind farms in Oregon, Kansas, and Iowa that generates a total of 604 megawatts annually. It makes sense that a majority of GE’s M&A transactions targeting sustainable businesses are in the wind space as these acquisitions allow GE to (i) vertically integrate its wind turbine business with the management of electricity generating wind plants, (ii) secure sources of renewable energy across the United States and Europe as both a back-up source of power and revenue generator, and (iii) enter into strategic partnerships with local and state governments that result in GE earning profits and developing political and social capital in the communities in which it operates. Select M&A Hydroelectric Acquisitions In November 2007, GE Energy Services made an investment, consisting of both debt and equity, in the amount of $660,000,000 to acquire the Plutonic Power Corporation, a 196 megawatt hydroelectric project in British Columbia. Financing consisted of a $470mm senior secured credit facility and $190mm in equity. Specifically, the investment was for a “run-of-river hydroelectric project -- one of the most environmentally and commercially friendly hydroelectric technologies.” Run-of-river projects do a much better job than traditional dams of minimizing the environmental effects of a damn including the fact that substantial flooding is not needed and that natural habitats near the damn are not touched. According to GE’s website “[t]he Plutonic project produces enough electrical energy to power 75,000 homes and avoid 455,000 metric tons of greenhouse gas emissions each year. The project will ensure that clean or renewable electricity generation continues to account for at least 90 percent of total generation for the province.” Thus, like the above acquisitions, GE’s 6 acquisition strategy not only produced a valuable income-producing asset, but also generated positive externalities in the local community. While no exact value can be placed on this goodwill, it is evident that this positive political and social capital will be valuable in the future. Select M&A Solar Acquisitions For an undisclosed amount, GE acquired SunPower Corporation in 2008. That investment provided financing for five California solar power projects, totaling approximately eight megawatts. Also, in 2008, GE made a $235,000,000 investment in order to acquire 32 percent of Fotowatio―an owner, operator and developer of nearly 960 megawatts of photovoltaic and concentrated solar power projects in Spain, Italy and the United States. According to GE’s website, Fotowatio uses solar photovoltaic technology, which converts light directly into electricity, as well as concentrated solar power technology, which uses mirrors and tracking systems to focus sunlight into a heat source for use with conventional steam turbines. According to a GE managing director, “Fotowatio is one of the most successful solar power developers in Europe, with a management team that has demonstrated development and operational capabilities.” Conclusions Using General Electric as a model, other Fortune 500 companies should develop M&A strategies focused on acquiring sustainable corporations. By purchasing growth assets and renewable energy producers, corporations will be implicitly recognizing the convergence of global energy needs and the global economy. Just as venture capitalists and other sophisticated buyers have begun amassing portfolios of renewable energy resources, large strategic buyers should consider making renewable energy corporations future M&A targets. As demonstrated by General Electric’s portfolio of clean energy companies, acquiring renewable energy producers will allow corporations to (i) earn immediate financial returns, (ii) develop future energy sources, and (iii) generate positive political and social capital by creating positive environmental externalities. In conclusion, GE has generated profits by hitting the “Sustainability Sweet Spot.” 7