Wade Sample Senate Bill 3: Renewable Portfolio Standards Come to North Carolina

advertisement

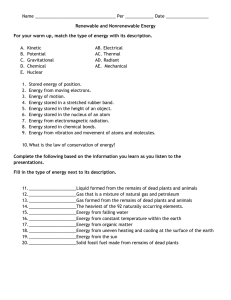

Wade Sample Senate Bill 3: Renewable Portfolio Standards Come to North Carolina Background on RPS Programs Renewable Portfolio Standards (“RPS”) initiatives refer to programs that have been adopted by certain states to increase the use of renewable energy in those states. RPS programs utilize a market-based approach to encourage the production of clean energy. According to the EPA, “[a]n RPS requires electric utilities and other retail electric providers to supply a specified minimum amount of customer load with electricity from eligible renewable energy sources. The goal of an RPS is to stimulate market and technology development so that, ultimately, renewable energy will be economically competitive with conventional forms of electric power.” While RPS programs in every state are unique, they each require electric supply companies to produce a certain percentage of total energy generated with renewable energy. For example, states that have adopted RPS programs have mandated that between 4 and 30 percent of electricity generated in that state must be from renewable energy sources by a certain fixed date. In addition to being adopted in 29 of 50 states, RPS programs have been adopted by Britain, Italy, Poland, Sweden, Belgium and Chile. More than 2,300 megawatts of new renewable energy capacity since 2003 can be attributed to RPS programs. Further, as of February 2009, the Union of Concerned Scientists projects that state RPS will provide support for 76,750 megawatts of new renewable power by 2025―an increase of 570 percent over total 1997 U.S. levels. [percentage of total power supply?] As a specific example, Colorado alone projected that “[b]y substituting renewable for a portion of generation from fossil fuels, the RPS can significantly reduce emissions from Colorado power plants. Depending on the mix of the avoided fuel, emissions of the greenhouse gas carbon dioxide would be reduced by between 16 million and 27 million tons of CO2.” The below graph represents the progress that California has made since implementing a RPS program. 1 Mechanically, RPS programs work in the following manner. First, a state establishes a goal highlighting the percentage of energy that must be generated by renewable sources. Second, in order to accomplish this goal, a state then requires each electricity producer to supply a certain percent of power generated by renewable sources―generally this percentage will increase over time until the ultimate goal is reached. However, in order to foster a free-market approach to achieving these goals, states typically pair RPS programs with Renewable Energy Certificate Trading Programs (“RECs”). RECs provide a tool that allows states to monitor the amount of renewable energy that energy suppliers are providing to customers. When a producer of energy generates a unit of renewable energy, it is typically rewarded with a certificate or credit. The certificate or credit can then be redeemed when the underlying power is provided to consumers or it can be sold to other energy supply companies. [tradable only within state?] Thus, credits are produced and sold based on the most cost-effective methods of renewable power generation. A market exists for these RECs because energy supply companies are forced to redeem certificates equal to their obligation under the RPS program, which is keyed to accomplish the ultimate desired percentage of renewable energy in a state. While no state has an identical REC program, these programs have been established in an effort to allow the private markets to determine the most cost-effective forms of renewable energy. The below chart illustrates this process graphically. 2 Furthermore, sixteen states (about half of the states with RECs) have taken the REC programs one step further by creating Solar Renewable Energy Certificates (“SRECs”). SRECs work identically to RECs; however, they require that some minimum percentage of renewable energy be derived from solar energy. SRECs can be distinguished from the solar multiplier approach used in other states that give 2x and 3x REC credit to solar energy as opposed to other forms of renewable energy. By creating a separate market for solar credits, states are able to ensure that solar energy accounts for a portion of the energy utilized in the state. States typically penalize utilities that fail to meet renewable energy targets by assessing monetary fines. Fines are usually increased for repeat offenders. Importantly, however, all of the states that currently maintain RPS programs have included “cost-caps” and “escape-clauses” in their programs. A cost-cap or escape-clause allows regulators to temporarily suspend a RPS program or exempt utilities from a program. These caps are included because of the difficulty of estimating future energy generation costs and the future demand for energy. Arguably, these escape-clauses prevent utilities from having to pass along prohibitively high rates to consumers. Finally, most states allow utilities to recover the additional costs of producing energy via renewable sources by permitting the utilities to assess a ratepayer surcharge or include the higher costs in the rate base. Unlike feed-in tariffs, which require the purchase of renewable energy resources regardless of cost, RPS programs are typically designed to encourage price competition between different forms of renewable energy. Advocates of RPS programs contend that RPS programs efficiently encourage the most cost-effective forms of renewable energy because they allow the private market to determine the lowest cost forms of renewable energy. The EPA’s website highlights that RPS Programs, as market-based systems,: (i) achieve policy objectives efficiently and at relatively modest costs (ratepayer impacts range from less than 1 percent increases to 0.5 percent savings); (ii) spread compliance costs among all customers, (iii) minimize the need for ongoing government intervention; (iv) function in both regulated and unregulated state electricity markets; and (v) provide a clear and long-term target for renewable energy generation that can increase investors’ and developers’ confidence in the prospects for renewable energy. Supporters of RPS programs contend that policy benefits of the programs include: (i) environmental improvement (e.g., avoided air pollution, global climate change mitigation, waste reduction, habitat preservation, conservation of valuable natural resources); (ii) increased diversity and security of energy supply; (iii) lower natural gas prices due to displacement of some gas-fired generation, or a more efficient use of natural gas due to significantly increased fuel conversion efficiencies; (iv) reduced volatility of power prices, given stable or non-existent fuel costs for renewable; and (v) local economic development resulting from new jobs, taxes, and revenue associated with new renewable capacity. Critics of RPS programs contend that RPS programs artificially raise renewable energy prices as these programs interfere with the free market. Jeffrey Gray writes that the “economic Achilles heel of current state RPS programs is that they carve out a portion of the larger energy market and unbalance it by imposing legislatively determined demand . . . utilities must purchase RPS-compliant power even if its price cannot otherwise be justified. The economic consequences for utilities seeking to be RPS-compliant include higher costs for facility sites, fuel, and generating equipment.” While this criticism is rational, it is also inevitable that there will be some hiccups in using the political process to encourage the use of renewable resources. [what about externalities?] While not perfect, RPS programs allow the free-market to determine the most cost-effective forms of renewable energy once it is decided that renewable energy is necessary. 3 North Carolina’s RPM Program Based on a study conducted by La Capra, a consulting firm experienced in advising states related to sustainability measures, North Carolina has the capacity both economically and environmentally to increase its generation of renewable energy. Prior to Senate Bill 3 being passed, North Carolina annually produced 1,400 megawatts of utility owned hydroelectric power and 600 megawatts of non-utility owned renewable power. However, the study estimated that North Carolina had 13,000 megawatts of annual renewable energy potential of which 3,400MW could be practically and quickly developed. The below chart shows North Carolina’s mix of electricity sources in 2008 (immediately after Senate Bill 3 was passed). The study detailed that sources of renewable energy potential in North Carolina include Eastern and Western on-shore wind. Further, the use of biomass fuel, by-products of North Carolina’s farming sector, would have the potential to contribute 200 megawatts of renewable energy to the state’s renewable energy generation. In the event that renewable technology improves or becomes cheaper, North Carolina would also have the ability to generate energy via solar photovoltaic and off-shore winds sources; however, those options are not currently economically feasible in North Carolina. Additionally, it is estimated that energy demand in North Carolina could be reduced 14% by implementing additional costeffective energy efficiency measures. As a starting point, La Capra estimated that increasing North Carolina’s RPS target to ~10% would cost a typical residential customer in North Carolina only $0.20 to $3.10 per month. Similarly, total statewide incremental cost relative to the Utilities’ Portfolio in Net Present Value (NPV) to the State over 20 years would be between $319 and $727 million for a 5% RPS and between $1.6 and $2.7 billion for a 10% RPS. As a result of the 2006 study and other public pressure to foster the use of renewable resources in North Carolina, the North Carolina Legislature considered programs that would encourage the policy goal of promoting renewable energy use in North Carolina. Echoing this political sentiment, Michael Shore, an air policy analyst with the Environmental Defense Fund, commented that “[t]he key to a clean and cost-effective energy future is for North Carolina to develop its abundant renewable and efficiency resources . . . It is critical that the General Assembly pass a renewable and efficiency standard this year to clean the air, reduce global warming pollution, and 4 put off the need to build expensive coal and nuclear power plants.” Most convincingly, “by combining energy efficiency and renewable energy, NC would experience a maximum potential electricity rate increase of less than 1% [and would likely lead to] a reduction in the average consumer’s electricity bill due to lower overall electricity usage. The REPS would be about $500 million cheaper than using new coal and natural gas or new nuclear power.” On August 20, 2007, the North Carolina Legislature adopted Senate Bill 3―therein adopting a Renewable Energy and Energy Efficient Portfolio Standard (REPS) program. As the first state in the Southeast to adopt a REPS or RPS, North Carolina established a program that requires “investor-owned utilities in North Carolina . . . to meet up to 12.5% of their energy needs through renewable energy resources or energy efficiency measures [and] [r]ural electric cooperatives and municipal electric suppliers . . . to [meet] a 10% REPS requirement.” The Bill also included a solar “carve-out” requiring that at least 0.2% of North Carolina’s electricity needs in 2018 must be supplied through a combination of new solar electric and solar thermal facilities. Further, Session Law 2007-397 requires that at least 0.2% of North Carolina’s total electricity needs in 2018 must be supplied by swine waste resources and at least 900,000 megawatt hours of electric power must come from poultry waste resources. Senate Bill 3 is detailed visually in the linked YouTube video. The below chart represents the impact that Senate Bill 3 is projected to have on North Carolina. [wonder how fracking has changed his?] Generally speaking, Senate Bill Three allows electric suppliers and utilities to comply with its REPS program in any of following ways: (i) using renewable fuels in existing electric generating facilities, (ii) facilitating the generation of power at new renewable energy facilities, (iii) purchasing power from renewable energy facilities, (iv) purchasing renewable energy certificates, or (v) implementing energy efficiency measures. According to the Bill, “[r]enewable energy facilities include facilities that generate electric power by the use of a renewable energy resource, combined heat and power systems, and solar thermal energy facilities. Renewable energy resources include solar electric, solar thermal, wind, hydropower, geothermal, ocean current, wave energy resources, biomass resources, including agricultural waste, animal waste, wood waste, spent pulping liquors, combustible residues, combustible liquids, combustible gases, energy crops, or landfill methane.” On February 29, 2008, the North Carolina Utilities Commission adopted an order implementing the methods of compliance with the North Carolina REPS program. The North Carolina Utilities Commission characterized North Carolina’s REPS program in the following manner: “beginning in 2012 at 3% of retail electricity sales, the REPS requirement ultimately increases to . . . 12.5% of retail sales beginning in 2021 for the State’s electric public utilities ―Duke Energy Carolinas, Progress Energy 5 Carolinas, and Dominion North Carolina Power. Utilities are required to submit an annual REPS compliance plan to the Commission outlining each utility’s electric growth forecast and its comprehensive plans for meeting customers’ needs via both traditional power and renewable energy resources. The annual report must detail the steps that the utility has taken to comply with Senate Bill 3. Interestingly, the Commission has not adopted specific penalties for non-compliance with Senate Bill 3. Rather, the Commission has indicated that it will remedy non-compliance by relying on its existing authority as detailed in Chapter 62 of the North Carolina General Code. The Rules established by the Commission also indicate that utilities are permitted to recover the additional costs that they incur to generate energy utilizing renewable energy resources. However, the Commission has limited the REPS cost recovery to $10 per customer account through 2011, $12 each year through 2014, and $34 each year starting in 2015. Annual and commercial and industrial per-account customer charges are initially capped at $50 and $500. [was this authorized in law?] Like other states, North Carolina elected to ensure compliance with its REPS requirement via renewable energy certificates (“RECs”). Under its system, the Commission awards RECs to facilities that generate energy by using renewable energy resources. In order to earn a REC, the facility must be registered with the Commission. As explained in the Rule, energy facilities generating excess renewable energy certificates are permitted to sell those credits to other utilities and electric suppliers. However, unlike in other states, the North Carolina Utilities Commission elected not to create or require participation in a formal REC trading platform. Mechanically, the process has been described in the following manner: “[t]o comply with the REPS law, utilities acquire RECs from renewable energy resources either by generating their own renewable energy, implementing energy efficiency measures or purchasing RECs from a renewable energy generator. Then the utilities “retire” the RECs for compliance. The NCUC tracks each utility’s purchase of RECs to verify their compliance with the REPS law. By the letter of the law, the utility must purchase at least 75% of these RECs from renewable energy generated inside North Carolina or energy efficiency, to ensure intended job creation and economic and environmental benefits occur in our State.” [oops, isn’t this a dormant commerce clause violation?] The following are the estimated economic benefits that will accrue to North Carolina as a result of Senate Bill 3. First, it will help the state avoid nearly $500mm in investments in new nuclear, natural gas, and coal plants. Second, it will eliminate the need for 1,800 megawatts of coal and nuclear power plants. Third, it should encourage at least $2.5bn in investments in new renewable energy resources by 2018. Fourth, it will help achieve the over-arching goal of connecting renewable energy systems to the electric grid. Fifth, it will create jobs for 4,000 North Carolinians in the renewable resources field. Sixth, the Bill is projected to reduce cumulative greenhouse emissions by approximately 125 million metric tons between 2007 and 2020. Seventh, it is projected to spur the creation of 300 megawatts of new solar power installations by 2018. Furthermore, since the passage of the Bill, the number of renewable energy and energy efficient companies in the state has increased by 125%. The below chart graphically represents the renewable energy projects that are currently registered in North Carolina. 6 Despite the positive externalities created by the Bill, critics contend that Senate Bill 3 is merely a disguised tax. Given that the project is estimated to cost an estimate $310 million per year and that utilities will be permitted to pass-along those costs to consumers, some consumer advocates have argued against the program. Critics, including many North Carolina House Republicans, contend that Senate Bill 3 is merely a concession to the state’s public utilities that will ultimately hurt the citizens of the state. Ironically, despite initially opposing the Bill, Progress Energy and Duke Energy both currently support the Bill largely because of the 12,500 green energy jobs created by the Bill. While critics are attempting to repeal the bill, the challenge is unlikely to be successful without the support of large utilities and in the face of the Bill’s apparent success in reducing reliance on traditional fossil fuels and creating jobs in the clean energy sector. [why do the same Republicans favor giving businesses tax breaks to locate in NC?] In conclusion, other states in the Southeast should follow the lead of North Carolina and implement RPS initiatives in their own states. In adopting Senate Bill 3, North Carolina outlined a roadmap for its transition from traditional fossil fuels to more renewable sources of energy. By creating a 7 RPS program, North Carolina developed a system that (i) created jobs in North Carolina, (ii) fostered the development of renewable energy resources, (iii) reduced the State’s reliance on coal and other fossil fuels, and (iv) allowed the private market to efficiently accomplish those changes. Unlike some critics warned, Senate Bill 3 has done very little to raise rates for users of energy in North Carolina. By passing Senate Bill 3, North Carolina developed a model for a cost-effective transition to renewable energy that other states in the Southeast should emulate. [who, what were the forces behind the law?] 8