GLOBAL MARKET FORECAST (team B) Success Key Factors: Taxi Market:

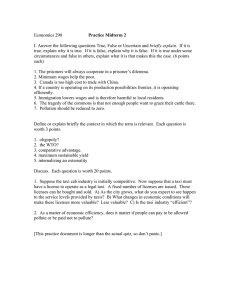

advertisement

GLOBAL MARKET FORECAST (team B) Success Key Factors: Taxi Market: Focus strategy Technical Efficiency Satisfying buyer needs is a prerequisite to the viability of the joint venture. Cab companies would be using the cars in the most technically difficult conditions (mean number of driving hours: 10 hrs; need to find fuelling facilities frequently and all over L.A.; need of luggage space crucial: space taken by the methanol reformer). Fuel cell cars would affect the quality/performance of cab services. Price Sensitivity The cab companies will be willing to pay for fuel cell cabs only if fuel cell cabs satisfy their needs and are cost-competitive. The big threat of substitution (any car) will influence the prices we can charge. Presence in all market segments In USA: Mono-brand taxi companies Each company has its own car brand, with different models within the same brand. For example, Yellow Cab Cie is using only Ford vehicles. Taxi companies are many and constituted locally of 1 to 300 taxis. We would need to persuade taxi companies to change their car brand and supply them with more than one model. Brand identity is an additional problem. In EU: Multi-brand taxi companies Each cab company gets many car brands and models. We must cover all segments to satisfy our customers. Conclusion: If a focuser's target segment is not different from other segments, then the focus strategy will not succeed. If we focus on taxis while Ford and all other automakers have broad product lines with many models, our segment (taxis) can be well served by Ford and others at the same time they are serving other segments. Hence Ford and others will enjoy competitive advantage over us in the taxi segment due to the economics of having a broader line. Success Key Factors of the Fuel Cell Market: Volume strategy Level of added-value Specialization (market niche) high fragmentation J.V. volume impossible low Strong + Defensible possibly Strong but not Defensible To get a volume strategy, we need : Low added value of the product Low price Mass distribution Mass communication Economy of scale : Fuel-cells are still a young technology. The biggest problem is that fuel-cells are still too expensive. One key reason is that not enough fuel-cells are being made to allow economies of scale. Company position In agreement with the competition (i .e. : Ballard & Daimler & Ford), the return on equities (R.O.E.), would be significant only with a minimum production of 10 000 cars a year, in 2006. With minivans, we would not have to develop a new car entirely. Just an adaptation of the existent would be necessary. Moreover, minivans have the best market share of our commercialised vehicles in U.S. International range : Our market would begin by L.A and would then be extended to Massachusetts and NewYork. If the JV is successful, globalisation would involve the rest of America and Europe. In E.U. the market would arrive 5 years later, because Europe will apply laws against pollution later than California. Presence in all market segments : In L.A. and California, we would target a market niche, proposing only one segment of car (mini-vans). That segment is the best way to enter the U.S. market. Of course, to enter a global market, we would have a global segment presence. Financial strategic analysis : Taxi strategy LAFCC = LAFCC ownership JV $ ?? debt NO EXPANSION HIGH RISK LAFCC would control LAFCC, but would not get the financial resources necessary to diversify the fuel-cell technology towards others applications. High risk is involved: the rates of return on investments would probably not exceed the capital. A third partner would eventually take over. Global car strategy LAFCC JV $$$$ LOOSING CONTROL WITH US AUTOMAKER In this case, the big american automaker would invest heavily in both companies. The JV and LAFCC would make money but the automaker would control both the JV and LAFCC. Minivan strategy LAFCC JV $$$ EXPANSION & CONTROL WITH RENO AUTOMAKER With Reno strategy, the rates of Return On Investment would be in excess of the capital. LAFCC would keep the control of its company, with the majority of shares, other shares being divided between Reno (30-40%), the Government (subventions: 10-20%), and others shareholders (5-10 %). The expansion of LAFCC technology would be steady. LAFCC would not control the JV but would keep enough shares to gain a good part of the JV dividend. This solution would be the best compromise for both partners between the taxi, and the global car market. The joint venture would also create many jobs. The employment program is the following : Employment Program 1000 1000 900 800 700 600 Number of Employees 600 500 400 300 300 200 200 100 0 50 0 2000 2001 2002 2003 2004 Years 2005 2006 2007 2008 S1 2009 2010 50 fuel cell minivans could be placed on the road free of charge to demonstrate the technology (marketing plan). We thought that it could be shuttle buses going from the airport to hotels. Fuelling facilities should not be a problem.