27-Sep-11 PRELIMINARY RESULTS; UPDATED

advertisement

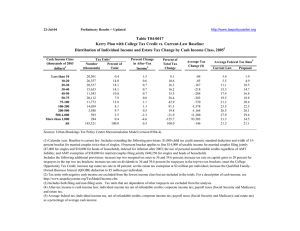

27-Sep-11 PRELIMINARY RESULTS; UPDATED http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T11-0363 President Obama's Proposals for the Joint Committee Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2013 1 Summary Table Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units with Tax Increase or Cut 3 With Tax Cut Pct of Tax Avg Tax Cut Units 20.3 44.0 69.4 85.5 89.9 95.7 98.3 98.9 93.4 53.9 30.2 72.4 -595 -711 -1,005 -1,052 -1,141 -1,484 -2,280 -4,243 -7,348 -9,638 -44,925 -2,175 With Tax Increase Pct of Tax Avg Tax Units Increase 8.3 10.0 12.8 8.1 6.0 3.0 1.2 0.9 6.5 46.1 69.8 7.1 34 42 59 89 116 192 408 939 2,913 7,005 59,427 2,343 Percent Change in After-Tax Income 4 2.2 2.1 3.0 2.9 2.6 2.7 3.2 3.9 3.0 0.3 -1.5 2.5 Share of Total Federal Tax Change 1.1 3.7 6.2 6.6 5.9 13.8 14.2 37.7 16.8 0.6 -6.7 100.0 Average Federal Tax Change ($) -118 -309 -693 -891 -1,016 -1,386 -2,211 -4,122 -6,319 -1,222 28,509 -1,373 Average Federal Tax Rate5 Change (% Points) Under the Proposal -2.1 -2.0 -2.7 -2.5 -2.2 -2.2 -2.5 -3.0 -2.2 -0.2 0.9 -1.9 2.7 1.8 7.0 11.4 14.2 16.9 19.0 21.7 25.3 29.5 38.0 21.7 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). Number of AMT Taxpayers (millions). Baseline: 21.0 Proposal: 5.3 * Less than 0.05 ** Insufficient data (1) Calendar year. Baseline is current law. Proposal: extends 2001 and 2003 individual income tax cuts but limits them for married taxpayers with incomes greater than $250,000 ($200,000 for singles), indexed for inflation after 2009, as proposed in Administration's FY2012 budget; reinstates 2009 estate tax rate and exemption, unindexed; limits the value of all itemized deductions and certain other tax expenditures to 28 percent for married taxpayers with AGI greater than $250,000 ($200,000 for singles), indexed for inflation after 2009; taxes carried interest in investment partnerships as ordinary income; closes loopholes for corporate jet depreciation; repeals oil and gas subsidies; broadens business tax base; and makes certain changes to international taxation. Estimates assume that taxpayers would adjust their investment portfolio and optimally pay down their mortgage balance if their tax benefit from mortgage interest were reduced. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 27-Sep-11 PRELIMINARY RESULTS; UPDATED http://www.taxpolicycenter.org Table T11-0363 President Obama's Proposals for the Joint Committee Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 20.3 44.0 69.4 85.5 89.9 95.7 98.3 98.9 93.4 53.9 30.2 72.4 8.3 10.0 12.8 8.1 6.0 3.0 1.2 0.9 6.5 46.1 69.8 7.1 Percent Change in After-Tax Income 4 2.2 2.1 3.0 2.9 2.6 2.7 3.2 3.9 3.0 0.3 -1.5 2.5 Share of Total Federal Tax Change 1.1 3.7 6.2 6.6 5.9 13.8 14.2 37.7 16.8 0.6 -6.7 100.0 Average Federal Tax Change Dollars -118 -309 -693 -891 -1,016 -1,386 -2,211 -4,122 -6,319 -1,222 28,509 -1,373 Percent -43.4 -52.4 -28.1 -17.9 -13.4 -11.5 -11.6 -12.0 -7.9 -0.6 2.5 -8.0 Share of Federal Taxes Change (% Points) -0.1 -0.3 -0.4 -0.3 -0.2 -0.4 -0.4 -1.1 0.0 0.6 2.4 0.0 Under the Proposal 0.1 0.3 1.4 2.7 3.3 9.3 9.5 24.2 17.2 8.3 23.6 100.0 Average Federal Tax Rate5 Change (% Points) -2.1 -2.0 -2.7 -2.5 -2.2 -2.2 -2.5 -3.0 -2.2 -0.2 0.9 -1.9 Under the Proposal 2.7 1.8 7.0 11.4 14.2 16.9 19.0 21.7 25.3 29.5 38.0 21.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 21,065 27,359 20,377 16,959 13,305 22,765 14,636 20,881 6,084 1,051 534 166,272 12.7 16.5 12.3 10.2 8.0 13.7 8.8 12.6 3.7 0.6 0.3 100.0 Pre-Tax Income Average (dollars) 5,766 15,205 25,480 35,896 46,141 63,142 89,268 139,817 292,655 696,116 3,032,367 72,381 Percent of Total 1.0 3.5 4.3 5.1 5.1 11.9 10.9 24.3 14.8 6.1 13.5 100.0 Federal Tax Burden Average (dollars) 272 589 2,466 4,988 7,566 12,061 19,150 34,450 80,279 206,531 1,123,823 17,091 Percent of Total 0.2 0.6 1.8 3.0 3.5 9.7 9.9 25.3 17.2 7.6 21.1 100.0 After-Tax Income 4 Average (dollars) 5,493 14,616 23,015 30,908 38,575 51,081 70,119 105,367 212,377 489,585 1,908,544 55,290 Percent of Total 1.3 4.4 5.1 5.7 5.6 12.7 11.2 23.9 14.1 5.6 11.1 100.0 Average Federal Tax Rate 5 4.7 3.9 9.7 13.9 16.4 19.1 21.5 24.6 27.4 29.7 37.1 23.6 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). Number of AMT Taxpayers (millions). Baseline: 21.0 Proposal: 5.3 * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal: extends 2001 and 2003 individual income tax cuts but limits them for married taxpayers with incomes greater than $250,000 ($200,000 for singles), indexed for inflation after 2009, as proposed in Administration's FY2012 budget; reinstates 2009 estate tax rate and exemption, unindexed; limits the value of all itemized deductions and certain other tax expenditures to 28 percent for married taxpayers with AGI greater than $250,000 ($200,000 for singles), indexed for inflation after 2009; taxes carried interest in investment partnerships as ordinary income; closes loopholes for corporate jet depreciation; repeals oil and gas subsidies; broadens business tax base; and makes certain changes to international taxation. Estimates assume that taxpayers would adjust their investment portfolio and optimally pay down their mortgage balance if their tax benefit from mortgage interest were reduced. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 27-Sep-11 PRELIMINARY RESULTS; UPDATED http://www.taxpolicycenter.org Table T11-0363 President Obama's Proposals for the Joint Committee Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2013 Detail Table - Single Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 14.3 36.5 61.4 86.3 95.6 96.1 97.4 97.5 82.4 44.7 24.9 57.6 8.4 11.9 17.4 8.7 2.9 2.8 1.8 2.0 17.5 55.2 75.1 9.4 Percent Change in After-Tax Income 4 1.4 1.0 1.5 1.6 1.6 2.2 2.9 3.6 3.9 1.5 -1.7 2.0 Share of Total Federal Tax Change 2.5 5.7 8.4 9.0 7.0 18.4 13.8 24.5 13.1 1.9 -4.3 100.0 Average Federal Tax Change Dollars Percent -74 -147 -337 -488 -583 -1,052 -1,911 -3,612 -8,156 -7,014 28,856 -615 -18.4 -14.8 -10.6 -8.5 -6.4 -7.4 -8.4 -9.7 -9.0 -2.9 2.4 -7.1 Share of Federal Taxes Change (% Points) -0.1 -0.2 -0.2 -0.1 0.1 -0.1 -0.2 -0.5 -0.2 0.2 1.3 0.0 Under the Proposal 0.9 2.5 5.4 7.5 7.9 17.6 11.5 17.5 10.1 4.7 14.3 100.0 Average Federal Tax Rate Change (% Points) -1.3 -1.0 -1.3 -1.4 -1.3 -1.7 -2.2 -2.6 -2.7 -1.0 1.0 -1.6 5 Under the Proposal 5.8 5.6 11.3 14.7 18.7 21.0 23.6 24.6 27.5 33.4 42.5 20.6 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,722 19,121 12,334 9,158 5,981 8,668 3,570 3,358 794 131 74 80,622 Percent of Total 20.7 23.7 15.3 11.4 7.4 10.8 4.4 4.2 1.0 0.2 0.1 100.0 Pre-Tax Income Average (dollars) 5,678 15,084 25,339 35,802 45,980 62,437 88,424 136,678 298,894 696,170 2,952,272 39,043 Percent of Total 3.0 9.2 9.9 10.4 8.7 17.2 10.0 14.6 7.5 2.9 6.9 100.0 Federal Tax Burden Average (dollars) 402 993 3,188 5,751 9,164 14,174 22,778 37,252 90,423 239,164 1,226,221 8,637 Percent of Total 1.0 2.7 5.7 7.6 7.9 17.6 11.7 18.0 10.3 4.5 13.0 100.0 After-Tax Income 4 Average (dollars) 5,276 14,090 22,151 30,051 36,816 48,263 65,646 99,426 208,471 457,007 1,726,051 30,407 Percent of Total 3.6 11.0 11.2 11.2 9.0 17.1 9.6 13.6 6.8 2.5 5.2 100.0 Average Federal Tax Rate 5 7.1 6.6 12.6 16.1 19.9 22.7 25.8 27.3 30.3 34.4 41.5 22.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal: extends 2001 and 2003 individual income tax cuts but limits them for married taxpayers with incomes greater than $250,000 ($200,000 for singles), indexed for inflation after 2009, as proposed in Administration's FY2012 budget; reinstates 2009 estate tax rate and exemption, unindexed; limits the value of all itemized deductions and certain other tax expenditures to 28 percent for married taxpayers with AGI greater than $250,000 ($200,000 for singles), indexed for inflation after 2009; taxes carried interest in investment partnerships as ordinary income; closes loopholes for corporate jet depreciation; repeals oil and gas subsidies; broadens business tax base; and makes certain changes to international taxation. Estimates assume that taxpayers would adjust their investment portfolio and optimally pay down their mortgage balance if their tax benefit from mortgage interest were reduced. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 27-Sep-11 PRELIMINARY RESULTS; UPDATED http://www.taxpolicycenter.org Table T11-0363 President Obama's Proposals for the Joint Committee Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2013 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 26.0 49.1 66.1 71.5 78.1 94.4 98.7 99.3 95.6 55.5 31.3 87.4 14.0 11.1 11.9 14.9 13.2 3.9 1.0 0.6 4.3 44.4 68.7 6.2 Percent Change in After-Tax Income 4 4.0 3.7 5.4 4.4 3.2 2.8 3.1 4.0 2.9 0.1 -1.4 2.5 Share of Total Federal Tax Change 0.2 1.0 2.6 3.6 4.1 10.6 14.8 49.2 21.8 0.3 -8.3 100.0 Average Federal Tax Change Dollars -198 -572 -1,303 -1,419 -1,324 -1,486 -2,253 -4,298 -6,161 -472 26,990 -2,487 Percent -129.4 -266.4 -84.5 -39.2 -24.8 -14.7 -12.8 -12.7 -7.8 -0.2 2.5 -7.5 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.2 -0.2 -0.2 -0.4 -0.5 -1.6 -0.1 0.7 2.7 0.0 Under the Proposal 0.0 -0.1 0.0 0.5 1.0 5.0 8.1 27.3 20.7 10.0 27.4 100.0 Average Federal Tax Rate Change (% Points) -3.9 -3.6 -5.1 -3.9 -2.9 -2.3 -2.5 -3.1 -2.1 -0.1 0.9 -1.9 5 Under the Proposal -0.9 -2.3 0.9 6.1 8.6 13.4 17.1 21.0 24.9 28.9 37.2 23.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 1,291 2,559 2,875 3,624 4,468 10,281 9,429 16,457 5,091 885 440 57,802 Percent of Total 2.2 4.4 5.0 6.3 7.7 17.8 16.3 28.5 8.8 1.5 0.8 100.0 Pre-Tax Income Average (dollars) 5,093 15,850 25,634 36,207 46,489 63,998 89,794 140,888 291,809 696,396 2,988,320 132,789 Percent of Total 0.1 0.5 1.0 1.7 2.7 8.6 11.0 30.2 19.4 8.0 17.1 100.0 Federal Tax Burden Average (dollars) 153 215 1,541 3,625 5,342 10,088 17,579 33,901 78,740 201,725 1,083,481 33,359 Percent of Total 0.0 0.0 0.2 0.7 1.2 5.4 8.6 28.9 20.8 9.3 24.7 100.0 After-Tax Income 4 Average (dollars) 4,940 15,635 24,093 32,582 41,148 53,910 72,215 106,987 213,069 494,671 1,904,839 99,430 Percent of Total 0.1 0.7 1.2 2.1 3.2 9.6 11.9 30.6 18.9 7.6 14.6 100.0 Average Federal Tax Rate 5 3.0 1.4 6.0 10.0 11.5 15.8 19.6 24.1 27.0 29.0 36.3 25.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal: extends 2001 and 2003 individual income tax cuts but limits them for married taxpayers with incomes greater than $250,000 ($200,000 for singles), indexed for inflation after 2009, as proposed in Administration's FY2012 budget; reinstates 2009 estate tax rate and exemption, unindexed; limits the value of all itemized deductions and certain other tax expenditures to 28 percent for married taxpayers with AGI greater than $250,000 ($200,000 for singles), indexed for inflation after 2009; taxes carried interest in investment partnerships as ordinary income; closes loopholes for corporate jet depreciation; repeals oil and gas subsidies; broadens business tax base; and makes certain changes to international taxation. Estimates assume that taxpayers would adjust their investment portfolio and optimally pay down their mortgage balance if their tax benefit from mortgage interest were reduced. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 27-Sep-11 PRELIMINARY RESULTS; UPDATED http://www.taxpolicycenter.org Table T11-0363 President Obama's Proposals for the Joint Committee Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2013 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 52.9 65.5 90.0 95.8 96.8 98.3 98.7 99.1 84.2 51.6 28.5 83.6 4.8 2.9 2.3 0.9 1.2 0.7 0.6 0.5 15.8 48.5 71.5 2.2 Percent Change in After-Tax Income 4 4.9 4.7 5.0 4.4 3.8 3.7 3.9 3.0 1.6 0.0 -1.6 3.9 Share of Total Federal Tax Change 3.0 12.5 18.4 15.9 11.4 18.9 11.1 8.2 1.5 0.0 -1.0 100.0 Average Federal Tax Change Dollars -341 -755 -1,242 -1,387 -1,481 -1,861 -2,688 -2,956 -3,380 36 28,658 -1,295 Percent 78.2 99.4 -120.4 -33.2 -20.0 -15.2 -13.5 -8.9 -4.5 0.0 2.7 -20.5 Share of Federal Taxes Change (% Points) -1.0 -3.9 -3.9 -1.6 0.1 1.7 1.5 2.8 1.4 0.7 2.1 0.0 Under the Proposal -1.8 -6.5 -0.8 8.3 11.8 27.2 18.4 21.7 8.6 3.6 9.5 100.0 Average Federal Tax Rate Change (% Points) -5.2 -4.9 -4.8 -3.9 -3.2 -3.0 -3.1 -2.2 -1.2 0.0 1.0 -3.2 5 Under the Proposal -11.8 -9.9 -0.8 7.8 12.9 16.6 19.6 23.0 25.3 28.4 38.8 12.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 2,911 5,398 4,846 3,748 2,505 3,317 1,353 905 149 24 11 25,256 Percent of Total 11.5 21.4 19.2 14.8 9.9 13.1 5.4 3.6 0.6 0.1 0.0 100.0 Pre-Tax Income Average (dollars) 6,577 15,312 25,728 35,771 45,998 62,381 88,201 132,511 287,163 675,227 2,859,898 39,986 Percent of Total 1.9 8.2 12.4 13.3 11.4 20.5 11.8 11.9 4.3 1.6 3.1 100.0 Federal Tax Burden Average (dollars) -436 -760 1,032 4,179 7,422 12,232 19,936 33,396 76,042 191,872 1,080,094 6,311 Percent of Total -0.8 -2.6 3.1 9.8 11.7 25.5 16.9 19.0 7.1 2.9 7.3 100.0 After-Tax Income 4 Average (dollars) 7,013 16,071 24,696 31,592 38,576 50,149 68,264 99,115 211,121 483,355 1,779,804 33,675 Percent of Total 2.4 10.2 14.1 13.9 11.4 19.6 10.9 10.5 3.7 1.4 2.3 100.0 Average Federal Tax Rate 5 -6.6 -5.0 4.0 11.7 16.1 19.6 22.6 25.2 26.5 28.4 37.8 15.8 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal: extends 2001 and 2003 individual income tax cuts but limits them for married taxpayers with incomes greater than $250,000 ($200,000 for singles), indexed for inflation after 2009, as proposed in Administration's FY2012 budget; reinstates 2009 estate tax rate and exemption, unindexed; limits the value of all itemized deductions and certain other tax expenditures to 28 percent for married taxpayers with AGI greater than $250,000 ($200,000 for singles), indexed for inflation after 2009; taxes carried interest in investment partnerships as ordinary income; closes loopholes for corporate jet depreciation; repeals oil and gas subsidies; broadens business tax base; and makes certain changes to international taxation. Estimates assume that taxpayers would adjust their investment portfolio and optimally pay down their mortgage balance if their tax benefit from mortgage interest were reduced. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 27-Sep-11 PRELIMINARY RESULTS; UPDATED http://www.taxpolicycenter.org Table T11-0363 President Obama's Proposals for the Joint Committee Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 56.4 77.3 94.3 97.6 97.8 99.1 99.6 99.7 94.5 50.3 25.1 91.9 2.4 2.1 1.2 0.8 0.7 0.5 0.2 0.2 5.5 49.6 74.9 2.0 Percent Change in After-Tax Income 4 5.8 5.8 6.6 6.0 5.3 4.2 4.3 4.7 2.9 -0.1 -1.6 3.5 Share of Total Federal Tax Change 1.1 4.5 7.5 7.5 6.6 12.9 14.3 37.3 13.4 -0.2 -5.0 100.0 Average Federal Tax Change Dollars -386 -988 -1,666 -1,906 -2,059 -2,160 -3,035 -5,003 -6,044 471 29,667 -2,503 Percent 59.2 69.2 -307.0 -49.4 -29.5 -18.3 -15.9 -14.4 -7.5 0.2 2.7 -11.2 Share of Federal Taxes Change (% Points) -0.2 -0.7 -0.9 -0.7 -0.5 -0.6 -0.5 -1.0 0.8 1.1 3.2 0.0 Under the Proposal -0.4 -1.4 -0.6 1.0 2.0 7.3 9.6 28.1 20.8 9.7 23.8 100.0 Average Federal Tax Rate5 Change (% Points) -6.5 -6.4 -6.5 -5.3 -4.5 -3.4 -3.4 -3.6 -2.1 0.1 1.0 -2.7 Under the Proposal -17.4 -15.6 -4.4 5.4 10.7 15.1 17.9 21.2 25.5 30.4 38.4 21.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,361 5,658 5,534 4,844 3,945 7,372 5,840 9,226 2,749 450 206 49,418 Percent of Total 6.8 11.5 11.2 9.8 8.0 14.9 11.8 18.7 5.6 0.9 0.4 100.0 Pre-Tax Income Average (dollars) 5,988 15,525 25,702 35,836 46,072 63,539 89,617 140,522 290,144 695,662 2,943,211 93,026 Percent of Total 0.4 1.9 3.1 3.8 4.0 10.2 11.4 28.2 17.4 6.8 13.2 100.0 Federal Tax Burden Average (dollars) -653 -1,427 543 3,855 6,969 11,781 19,060 34,805 80,122 211,294 1,101,072 22,303 Percent of Total -0.2 -0.7 0.3 1.7 2.5 7.9 10.1 29.1 20.0 8.6 20.6 100.0 After-Tax Income 4 Average (dollars) 6,640 16,953 25,160 31,981 39,103 51,758 70,557 105,717 210,021 484,368 1,842,139 70,723 Percent of Total 0.6 2.7 4.0 4.4 4.4 10.9 11.8 27.9 16.5 6.2 10.9 100.0 Average Federal Tax Rate 5 -10.9 -9.2 2.1 10.8 15.1 18.5 21.3 24.8 27.6 30.4 37.4 24.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). * Less than 0.05 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal: extends 2001 and 2003 individual income tax cuts but limits them for married taxpayers with incomes greater than $250,000 ($200,000 for singles), indexed for inflation after 2009, as proposed in Administration's FY2012 budget; reinstates 2009 estate tax rate and exemption, unindexed; limits the value of all itemized deductions and certain other tax expenditures to 28 percent for married taxpayers with AGI greater than $250,000 ($200,000 for singles), indexed for inflation after 2009; taxes carried interest in investment partnerships as ordinary income; closes loopholes for corporate jet depreciation; repeals oil and gas subsidies; broadens business tax base; and makes certain changes to international taxation. Estimates assume that taxpayers would adjust their investment portfolio and optimally pay down their mortgage balance if their tax benefit from mortgage interest were reduced. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 27-Sep-11 PRELIMINARY RESULTS; UPDATED http://www.taxpolicycenter.org Table T11-0363 President Obama's Proposals for the Joint Committee Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 0.1 1.4 12.9 55.2 65.9 88.0 96.0 97.8 93.0 55.1 33.7 47.0 12.6 20.9 43.1 28.0 21.9 9.5 3.4 2.0 7.0 44.8 66.4 18.8 Percent Change in After-Tax Income 4 0.0 0.0 0.2 0.9 1.1 2.1 2.7 3.8 4.1 1.1 -1.4 1.9 Share of Total Federal Tax Change 0.0 0.0 0.7 3.0 3.4 15.2 15.0 40.0 28.1 3.3 -8.6 100.0 Average Federal Tax Change Dollars 1 -2 -57 -313 -485 -1,184 -1,990 -4,210 -8,899 -5,514 26,935 -1,096 Percent 2.1 -1.4 -7.5 -15.0 -14.7 -15.7 -14.1 -14.2 -11.2 -2.6 2.3 -7.7 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 -0.1 -0.1 -0.7 -0.6 -1.5 -0.7 0.5 3.2 0.0 Under the Proposal 0.0 0.3 0.7 1.4 1.6 6.8 7.6 20.1 18.7 10.2 32.5 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 -0.2 -0.9 -1.0 -1.9 -2.2 -3.0 -3.0 -0.8 0.9 -1.5 Under the Proposal 0.9 1.0 2.8 5.0 6.1 10.1 13.6 18.2 23.7 29.9 39.7 18.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,030 8,603 4,956 3,838 2,823 5,216 3,053 3,858 1,285 239 130 37,068 Percent of Total 8.2 23.2 13.4 10.4 7.6 14.1 8.2 10.4 3.5 0.7 0.4 100.0 Pre-Tax Income Average (dollars) 6,762 15,150 25,187 35,853 46,514 63,113 88,974 139,885 298,833 698,342 3,081,067 71,055 Percent of Total 0.8 5.0 4.7 5.2 5.0 12.5 10.3 20.5 14.6 6.4 15.2 100.0 Federal Tax Burden Average (dollars) 60 150 762 2,093 3,301 7,541 14,117 29,636 79,843 213,998 1,195,078 14,265 Percent of Total 0.0 0.2 0.7 1.5 1.8 7.4 8.2 21.6 19.4 9.7 29.3 100.0 After-Tax Income 4 Average (dollars) 6,702 14,999 24,425 33,760 43,213 55,571 74,857 110,249 218,990 484,344 1,885,989 56,790 Percent of Total 1.0 6.1 5.8 6.2 5.8 13.8 10.9 20.2 13.4 5.5 11.6 100.0 Average Federal Tax Rate 5 0.9 1.0 3.0 5.8 7.1 12.0 15.9 21.2 26.7 30.6 38.8 20.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). * Less than 0.05 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal: extends 2001 and 2003 individual income tax cuts but limits them for married taxpayers with incomes greater than $250,000 ($200,000 for singles), indexed for inflation after 2009, as proposed in Administration's FY2012 budget; reinstates 2009 estate tax rate and exemption, unindexed; limits the value of all itemized deductions and certain other tax expenditures to 28 percent for married taxpayers with AGI greater than $250,000 ($200,000 for singles), indexed for inflation after 2009; taxes carried interest in investment partnerships as ordinary income; closes loopholes for corporate jet depreciation; repeals oil and gas subsidies; broadens business tax base; and makes certain changes to international taxation. Estimates assume that taxpayers would adjust their investment portfolio and optimally pay down their mortgage balance if their tax benefit from mortgage interest were reduced. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.