1-Aug-11 PRELIMINARY RESULTS Less than 10 10-20

advertisement

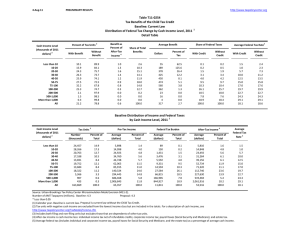

1-Aug-11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T11-0245 Limit Benefit of Specified Tax Expenditures to 2 Percent of AGI for High-Income Taxpayers Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2013 1 Summary Table Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units with Tax Increase or Cut With Tax Cut Pct of Tax Avg Tax Cut Units 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0 0 0 0 0 0 0 0 0 0 0 0 3 With Tax Increase Pct of Tax Avg Tax Units Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 27.8 64.5 69.6 1.7 0 0 0 0 0 0 0 999 3,029 13,668 84,230 16,521 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.4 -1.7 -2.9 -0.5 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 11.2 20.3 68.5 100.0 Average Federal Tax Change ($) 0 0 0 0 0 0 0 1 843 8,820 58,583 275 Average Federal Tax Rate Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.3 1.3 1.9 0.4 5 Under the Proposal 2.6 1.9 7.0 11.5 14.3 16.9 18.9 21.6 24.7 27.9 34.8 21.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). Number of AMT Taxpayers (millions). Baseline: 4.5 Proposal: 3.9 * Less than 0.05 ** Insufficient data (1) Calendar year. Baseline is current policy, which makes 2001 tax law permanent with the exception of the temporary 2 percent reduction in Social Security payroll taxes. Proposal would limit the value of itemized deductions, the exclusion for employer-sponsored health insurance premiums, and the child and dependent care and general business tax credits to two percent of a taxpayer's adjusted gross income. The cap would phase in for married couples with AGI between $250,000 and $500,000 and for singles and heads of household with AGI between $200,000 and $400,000, indexed for inflation after 2009. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 1-Aug-11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11-0245 Limit Benefit of Specified Tax Expenditures to 2 Percent of AGI for High-Income Taxpayers Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 27.8 64.5 69.6 1.7 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.4 -1.7 -2.9 -0.5 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 11.2 20.3 68.5 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 1 843 8,820 58,583 275 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 1.2 4.8 5.9 1.8 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 -0.1 -0.1 -0.2 -0.2 -0.5 -0.1 0.2 0.9 0.0 Under the Proposal 0.1 0.3 1.4 2.8 3.5 9.6 9.8 24.8 17.3 8.1 22.3 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.3 1.3 1.9 0.4 Under the Proposal 2.6 1.9 7.0 11.5 14.3 16.9 18.9 21.6 24.7 27.9 34.8 21.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 21,065 27,359 20,377 16,959 13,305 22,765 14,636 20,881 6,084 1,051 534 166,272 12.7 16.5 12.3 10.2 8.0 13.7 8.8 12.6 3.7 0.6 0.3 100.0 Pre-Tax Income Average (dollars) 5,766 15,205 25,480 35,896 46,141 63,142 89,268 139,817 292,655 696,116 3,032,367 72,381 Percent of Total 1.0 3.5 4.3 5.1 5.1 11.9 10.9 24.3 14.8 6.1 13.5 100.0 Federal Tax Burden Average (dollars) 151 285 1,789 4,119 6,574 10,674 16,900 30,150 71,406 185,705 997,919 14,984 Percent of Total 0.1 0.3 1.5 2.8 3.5 9.8 9.9 25.3 17.4 7.8 21.4 100.0 After-Tax Income 4 Average (dollars) 5,615 14,919 23,691 31,777 39,567 52,468 72,368 109,667 221,249 510,411 2,034,448 57,397 Percent of Total 1.2 4.3 5.1 5.7 5.5 12.5 11.1 24.0 14.1 5.6 11.4 100.0 Average Federal Tax Rate 5 2.6 1.9 7.0 11.5 14.3 16.9 18.9 21.6 24.4 26.7 32.9 20.7 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). Number of AMT Taxpayers (millions). Baseline: 4.5 Proposal: 3.9 * Less than 0.05 (1) Calendar year. Baseline is current policy, which makes 2001 tax law permanent with the exception of the temporary 2 percent reduction in Social Security payroll taxes. Proposal would limit the value of itemized deductions, the exclusion for employer-sponsored health insurance premiums, and the child and dependent care and general business tax credits to two percent of a taxpayer's adjusted gross income. The cap would phase in for married couples with AGI between $250,000 and $500,000 and for singles and heads of household with AGI between $200,000 and $400,000, indexed for inflation after 2009. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 1-Aug-11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11-0245 Limit Benefit of Specified Tax Expenditures to 2 Percent of AGI for High-Income Taxpayers Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 36.2 60.1 61.2 0.5 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.6 -2.1 -3.2 -0.3 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 15.1 19.8 65.1 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 0 1,296 10,314 60,342 85 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 1.7 5.1 5.6 1.1 Share of Federal Taxes Change (% Points) 0.0 0.0 -0.1 -0.1 -0.1 -0.2 -0.1 -0.2 0.1 0.2 0.6 0.0 Under the Proposal 0.9 2.6 5.6 7.7 8.2 18.0 11.8 17.7 9.8 4.4 13.2 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.4 1.5 2.0 0.2 Under the Proposal 5.7 5.7 11.3 14.7 18.7 20.9 23.5 24.3 26.1 30.4 38.3 20.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,722 19,121 12,334 9,158 5,981 8,668 3,570 3,358 794 131 74 80,622 Percent of Total 20.7 23.7 15.3 11.4 7.4 10.8 4.4 4.2 1.0 0.2 0.1 100.0 Pre-Tax Income Average (dollars) 5,678 15,084 25,339 35,802 45,980 62,437 88,424 136,678 298,894 696,170 2,952,272 39,043 Percent of Total 3.0 9.2 9.9 10.4 8.7 17.2 10.0 14.6 7.5 2.9 6.9 100.0 Federal Tax Burden Average (dollars) 326 854 2,857 5,261 8,582 13,077 20,740 33,240 76,630 201,558 1,071,091 7,723 Percent of Total 0.9 2.6 5.7 7.7 8.2 18.2 11.9 17.9 9.8 4.3 12.7 100.0 After-Tax Income 4 Average (dollars) 5,352 14,229 22,482 30,541 37,398 49,360 67,684 103,438 222,264 494,612 1,881,181 31,320 Percent of Total 3.5 10.8 11.0 11.1 8.9 16.9 9.6 13.8 7.0 2.6 5.5 100.0 Average Federal Tax Rate 5 5.7 5.7 11.3 14.7 18.7 20.9 23.5 24.3 25.6 29.0 36.3 19.8 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). * Less than 0.05 (1) Calendar year. Baseline is current policy, which makes 2001 tax law permanent with the exception of the temporary 2 percent reduction in Social Security payroll taxes. Proposal would limit the value of itemized deductions, the exclusion for employer-sponsored health insurance premiums, and the child and dependent care and general business tax credits to two percent of a taxpayer's adjusted gross income. The cap would phase in for married couples with AGI between $250,000 and $500,000 and for singles and heads of household with AGI between $200,000 and $400,000, indexed for inflation after 2009. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 1-Aug-11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11-0245 Limit Benefit of Specified Tax Expenditures to 2 Percent of AGI for High-Income Taxpayers Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 25.9 65.2 71.2 3.8 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.3 -1.7 -2.8 -0.6 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 10.2 21.0 68.8 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 0 726 8,621 56,668 627 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 1.0 4.7 5.9 2.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 -0.1 -0.2 -0.6 -0.2 0.2 0.9 0.0 Under the Proposal 0.0 -0.1 0.0 0.5 1.0 5.1 8.4 28.1 21.0 9.8 26.0 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.3 1.2 1.9 0.5 Under the Proposal -1.1 -2.3 0.9 6.1 8.7 13.5 17.0 20.9 24.4 27.6 34.2 22.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 1,291 2,559 2,875 3,624 4,468 10,281 9,429 16,457 5,091 885 440 57,802 Percent of Total 2.2 4.4 5.0 6.3 7.7 17.8 16.3 28.5 8.8 1.5 0.8 100.0 Pre-Tax Income Average (dollars) 5,093 15,850 25,634 36,207 46,489 63,998 89,794 140,888 291,809 696,396 2,988,320 132,789 Percent of Total 0.1 0.5 1.0 1.7 2.7 8.6 11.0 30.2 19.4 8.0 17.1 100.0 Federal Tax Burden Average (dollars) -56 -367 242 2,224 4,029 8,609 15,305 29,464 70,527 183,268 964,061 29,259 Percent of Total 0.0 -0.1 0.0 0.5 1.1 5.2 8.5 28.7 21.2 9.6 25.1 100.0 After-Tax Income 4 Average (dollars) 5,150 16,217 25,392 33,982 42,461 55,389 74,489 111,424 221,282 513,128 2,024,260 103,530 Percent of Total 0.1 0.7 1.2 2.1 3.2 9.5 11.7 30.6 18.8 7.6 14.9 100.0 Average Federal Tax Rate 5 -1.1 -2.3 0.9 6.1 8.7 13.5 17.0 20.9 24.2 26.3 32.3 22.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). * Less than 0.05 (1) Calendar year. Baseline is current policy, which makes 2001 tax law permanent with the exception of the temporary 2 percent reduction in Social Security payroll taxes. Proposal would limit the value of itemized deductions, the exclusion for employer-sponsored health insurance premiums, and the child and dependent care and general business tax credits to two percent of a taxpayer's adjusted gross income. The cap would phase in for married couples with AGI between $250,000 and $500,000 and for singles and heads of household with AGI between $200,000 and $400,000, indexed for inflation after 2009. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 1-Aug-11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11-0245 Limit Benefit of Specified Tax Expenditures to 2 Percent of AGI for High-Income Taxpayers Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 40.1 63.0 63.9 0.3 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.6 -1.4 -2.6 -0.1 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 20.7 19.3 60.0 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 0 1,226 7,197 49,069 35 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 1.7 4.1 5.1 0.7 Share of Federal Taxes Change (% Points) 0.0 0.1 0.0 -0.1 -0.1 -0.2 -0.1 -0.2 0.1 0.1 0.4 0.0 Under the Proposal -1.8 -6.5 -0.6 8.5 12.0 27.4 18.5 21.8 8.5 3.4 8.7 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.4 1.1 1.7 0.1 Under the Proposal -11.9 -9.9 -0.6 8.0 13.1 16.8 19.7 23.0 25.0 27.0 35.5 12.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 2,911 5,398 4,846 3,748 2,505 3,317 1,353 905 149 24 11 25,256 Percent of Total 11.5 21.4 19.2 14.8 9.9 13.1 5.4 3.6 0.6 0.1 0.0 100.0 Pre-Tax Income Average (dollars) 6,577 15,312 25,728 35,771 45,998 62,381 88,201 132,511 287,163 675,227 2,859,898 39,986 Percent of Total 1.9 8.2 12.4 13.3 11.4 20.5 11.8 11.9 4.3 1.6 3.1 100.0 Federal Tax Burden Average (dollars) -784 -1,512 -158 2,875 6,045 10,461 17,327 30,429 70,604 175,368 965,301 4,975 Percent of Total -1.8 -6.5 -0.6 8.6 12.1 27.6 18.7 21.9 8.4 3.3 8.3 100.0 After-Tax Income 4 Average (dollars) 7,360 16,823 25,886 32,895 39,953 51,920 70,873 102,082 216,560 499,858 1,894,597 35,011 Percent of Total 2.4 10.3 14.2 13.9 11.3 19.5 10.9 10.4 3.7 1.3 2.3 100.0 Average Federal Tax Rate 5 -11.9 -9.9 -0.6 8.0 13.1 16.8 19.7 23.0 24.6 26.0 33.8 12.4 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). * Less than 0.05 (1) Calendar year. Baseline is current policy, which makes 2001 tax law permanent with the exception of the temporary 2 percent reduction in Social Security payroll taxes. Proposal would limit the value of itemized deductions, the exclusion for employer-sponsored health insurance premiums, and the child and dependent care and general business tax credits to two percent of a taxpayer's adjusted gross income. The cap would phase in for married couples with AGI between $250,000 and $500,000 and for singles and heads of household with AGI between $200,000 and $400,000, indexed for inflation after 2009. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 1-Aug-11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11-0245 Limit Benefit of Specified Tax Expenditures to 2 Percent of AGI for High-Income Taxpayers Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 * 31.5 77.9 78.6 2.8 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.4 -2.0 -3.0 -0.5 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 13.4 23.6 63.0 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 0 945 10,159 59,076 392 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 1.3 5.3 6.0 2.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 -0.2 -0.2 -0.6 -0.2 0.3 0.8 0.0 Under the Proposal -0.4 -1.4 -0.6 1.0 2.1 7.5 9.9 28.8 21.0 9.6 22.5 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.3 1.5 2.0 0.4 Under the Proposal -17.5 -15.6 -4.2 5.7 10.9 15.3 17.9 21.2 25.1 29.1 35.3 20.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,361 5,658 5,534 4,844 3,945 7,372 5,840 9,226 2,749 450 206 49,418 Percent of Total 6.8 11.5 11.2 9.8 8.0 14.9 11.8 18.7 5.6 0.9 0.4 100.0 Pre-Tax Income Average (dollars) 5,988 15,525 25,702 35,836 46,072 63,539 89,617 140,522 290,144 695,662 2,943,211 93,026 Percent of Total 0.4 1.9 3.1 3.8 4.0 10.2 11.4 28.2 17.4 6.8 13.2 100.0 Federal Tax Burden Average (dollars) -1,046 -2,415 -1,078 2,028 5,002 9,701 16,073 29,725 71,962 192,521 980,000 18,899 Percent of Total -0.4 -1.5 -0.6 1.1 2.1 7.7 10.1 29.4 21.2 9.3 21.7 100.0 After-Tax Income 4 Average (dollars) 7,034 17,941 26,780 33,808 41,070 53,838 73,544 110,797 218,182 503,141 1,963,211 74,127 Percent of Total 0.7 2.8 4.1 4.5 4.4 10.8 11.7 27.9 16.4 6.2 11.1 100.0 Average Federal Tax Rate 5 -17.5 -15.6 -4.2 5.7 10.9 15.3 17.9 21.2 24.8 27.7 33.3 20.3 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). * Less than 0.05 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current policy, which makes 2001 tax law permanent with the exception of the temporary 2 percent reduction in Social Security payroll taxes. Proposal would limit the value of itemized deductions, the exclusion for employer-sponsored health insurance premiums, and the child and dependent care and general business tax credits to two percent of a taxpayer's adjusted gross income. The cap would phase in for married couples with AGI between $250,000 and $500,000 and for singles and heads of household with AGI between $200,000 and $400,000, indexed for inflation after 2009. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 1-Aug-11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11-0245 Limit Benefit of Specified Tax Expenditures to 2 Percent of AGI for High-Income Taxpayers Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 17.6 43.9 61.2 1.1 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.3 -1.2 -3.1 -0.5 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 7.2 14.0 78.9 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 0 589 6,127 63,860 284 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.9 3.3 6.1 2.3 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 -0.2 -0.2 -0.5 -0.3 0.1 1.1 0.0 Under the Proposal 0.0 0.3 0.7 1.4 1.7 7.0 7.9 20.8 18.8 9.9 31.4 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.2 0.9 2.1 0.4 Under the Proposal 0.9 0.9 2.7 4.8 5.9 9.9 13.4 17.8 22.6 27.4 36.2 17.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,030 8,603 4,956 3,838 2,823 5,216 3,053 3,858 1,285 239 130 37,068 Percent of Total 8.2 23.2 13.4 10.4 7.6 14.1 8.2 10.4 3.5 0.7 0.4 100.0 Pre-Tax Income Average (dollars) 6,762 15,150 25,187 35,853 46,514 63,113 88,974 139,885 298,833 698,342 3,081,067 71,055 Percent of Total 0.8 5.0 4.7 5.2 5.0 12.5 10.3 20.5 14.6 6.4 15.2 100.0 Federal Tax Burden Average (dollars) 59 142 678 1,731 2,749 6,222 11,881 24,883 66,834 184,856 1,050,097 12,158 Percent of Total 0.0 0.3 0.8 1.5 1.7 7.2 8.1 21.3 19.1 9.8 30.3 100.0 After-Tax Income 4 Average (dollars) 6,703 15,008 24,509 34,122 43,765 56,891 77,093 115,002 231,999 513,486 2,030,970 58,897 Percent of Total 0.9 5.9 5.6 6.0 5.7 13.6 10.8 20.3 13.7 5.6 12.1 100.0 Average Federal Tax Rate 5 0.9 0.9 2.7 4.8 5.9 9.9 13.4 17.8 22.4 26.5 34.1 17.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). * Less than 0.05 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current policy, which makes 2001 tax law permanent with the exception of the temporary 2 percent reduction in Social Security payroll taxes. Proposal would limit the value of itemized deductions, the exclusion for employer-sponsored health insurance premiums, and the child and dependent care and general business tax credits to two percent of a taxpayer's adjusted gross income. The cap would phase in for married couples with AGI between $250,000 and $500,000 and for singles and heads of household with AGI between $200,000 and $400,000, indexed for inflation after 2009. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.