12-May-09 PRELIMINARY RESULTS

advertisement

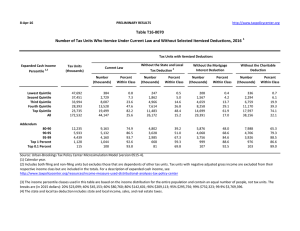

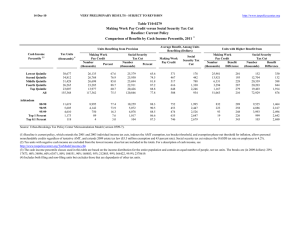

12-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T09-0261 Replace ESI Exclusion and Self-Employment Health Insurance Deduction With Voucher to Purchase Private Insurance Impose Comprehensive VAT at Tax Exclusive Rate of 8.4% With $500 Individual Cash Subsidy Distribution of Federal Tax Change by Cash Income Percentile, 2009 1 Summary Table Percent of Tax Units 4 Cash Income Percentile 2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change ($) Average Federal Tax Rate 6 Change (% Points) Under the Proposal 90.5 71.2 56.0 45.2 19.6 60.7 9.5 28.8 44.0 54.8 80.4 39.2 27.8 8.1 2.5 -0.1 -5.4 0.0 -8,032.1 -4,863.0 -2,310.2 133.0 15,400.8 100.0 -3,106 -2,087 -1,099 74 9,801 10 -27.9 -7.4 -2.2 0.1 4.2 0.0 -28.1 0.5 12.3 17.3 26.7 18.0 28.3 14.5 7.4 5.2 2.5 71.7 85.6 92.6 94.8 97.5 -2.9 -4.3 -6.7 -7.4 -7.4 2,265.2 2,270.6 4,841.2 6,023.7 2,483.1 2,847 5,950 15,403 75,488 309,804 2.3 3.4 5.2 5.5 5.3 21.6 24.3 27.9 31.5 33.5 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-2). Number of AMT Taxpayers (millions). Baseline: 3.8 Proposal: 4.1 (1) Calendar year. Baseline is current law. Proposal replaces the employer sponsored insurance deduction and self-employment health insurance deduction with a voucher to purchase private insurance. Individual voucher value depends on age and gender; the total voucher for each tax unit is the sum of each individual's voucher. Only individuals not on public insurance receive a voucher. The proposal imposes a revenue neutral comprehensive VAT at tax exclusive rate of 8.4% to finance the voucher and $500 individual cash subsidy. The VAT is distributed to labor earnings plus all capital. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $19,792, 40% $38,213, 60% $65,692, 80% $104,318, 90% $150,433, 95% $203,190, 99% $522,025, 99.9% $2,131,606. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0261 Replace ESI Exclusion and Self-Employment Health Insurance Deduction With Voucher to Purchase Private Insurance Impose Comprehensive VAT at Tax Exclusive Rate of 8.4% With $500 Individual Cash Subsidy Distribution of Federal Tax Change by Cash Income Percentile, 2009 1 Detail Table 4 Percent of Tax Units 2,3 Cash Income Percentile With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) 6 Average Federal Tax Rate Under the Proposal Change (% Points) Under the Proposal 90.5 71.2 56.0 45.2 19.6 60.7 9.5 28.8 44.0 54.8 80.4 39.2 27.8 8.1 2.5 -0.1 -5.4 0.0 -8,032.1 -4,863.0 -2,310.2 133.0 15,400.8 100.0 -3,106 -2,087 -1,099 74 9,801 10 12,097.6 -93.8 -14.9 0.5 18.6 0.1 -6.2 -3.8 -1.8 0.1 11.9 0.0 -6.3 0.3 10.2 20.0 75.9 100.0 -27.9 -7.4 -2.2 0.1 4.2 0.0 -28.1 0.5 12.3 17.3 26.7 18.0 28.3 14.5 7.4 5.2 2.5 71.7 85.6 92.6 94.8 97.5 -2.9 -4.3 -6.7 -7.4 -7.4 2,265.2 2,270.6 4,841.2 6,023.7 2,483.1 2,847 5,950 15,403 75,488 309,804 12.1 16.4 22.7 21.0 18.8 1.7 1.8 3.7 4.7 1.9 16.3 12.5 20.2 26.9 12.2 2.3 3.4 5.2 5.5 5.3 21.6 24.3 27.9 31.5 33.5 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2009 1 4 Tax Units Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 37,398 33,701 30,402 25,999 22,729 150,979 24.8 22.3 20.1 17.2 15.1 100.0 11,139 28,130 50,928 83,030 234,071 68,631 -26 2,225 7,377 14,288 52,570 12,367 11,165 25,905 43,551 68,742 181,502 56,264 -0.2 7.9 14.5 17.2 22.5 18.0 4.0 9.2 14.9 20.8 51.3 100.0 4.9 10.3 15.6 21.0 48.6 100.0 -0.1 4.0 12.0 19.9 64.0 100.0 11,510 5,519 4,546 1,154 116 7.6 3.7 3.0 0.8 0.1 122,728 173,553 298,384 1,380,494 5,859,810 23,629 36,256 67,728 359,484 1,650,034 99,099 137,298 230,656 1,021,011 4,209,776 19.3 20.9 22.7 26.0 28.2 13.6 9.2 13.1 15.4 6.6 13.4 8.9 12.3 13.9 5.8 14.6 10.7 16.5 22.2 10.2 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version0309-2). Number of AMT Taxpayers (millions). Baseline: 3.8 Proposal: 4.1 (1) Calendar year. Baseline is current law. Proposal replaces the employer sponsored insurance deduction and self-employment health insurance deduction with a voucher to purchase private insurance. Individual voucher value depends on age and gender; the total voucher for each tax unit is the sum of each individual's voucher. Only individuals not on public insurance receive a voucher. The proposal imposes a revenue neutral comprehensive VAT at tax exclusive rate of 6.7% to finance the voucher and $500 individual cash subsidy. The VAT is distributed to labor earnings plus all capital. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $19,792, 40% $38,213, 60% $65,692, 80% $104,318, 90% $150,433, 95% $203,190, 99% $522,025, 99.9% $2,131,606. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0261 Replace ESI Exclusion and Self-Employment Health Insurance Deduction With Voucher to Purchase Private Insurance Impose Comprehensive VAT at Tax Exclusive Rate of 8.4% With $500 Individual Cash Subsidy Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2009 1 Detail Table Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Average Federal Tax Rate 6 Under the Proposal Change (% Points) Under the Proposal 92.1 79.4 65.1 45.5 18.9 60.7 7.9 20.5 34.8 54.5 81.1 39.2 33.7 10.3 4.3 -0.2 -5.4 0.0 -7,913.2 -5,258.0 -3,466.4 215.2 16,750.8 100.0 -3,715 -2,469 -1,692 107 8,115 10 624.0 -167.1 -28.4 0.9 18.5 0.1 -6.1 -4.1 -2.7 0.2 12.9 0.0 -7.1 -1.6 6.8 19.1 83.0 100.0 -35.6 -9.7 -3.8 0.2 4.2 0.0 -41.3 -3.9 9.5 16.8 26.6 18.0 27.1 13.5 7.8 5.5 2.6 72.8 86.5 92.2 94.5 97.4 -2.9 -4.5 -6.5 -7.3 -7.3 2,576.1 2,667.0 5,198.7 6,309.0 2,585.3 2,468 5,131 12,863 65,409 271,015 12.1 16.7 22.5 21.0 18.7 2.0 2.1 4.0 4.9 2.0 18.5 14.5 21.9 28.2 12.7 2.4 3.5 5.1 5.4 5.3 21.9 24.8 27.5 31.3 33.3 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2009 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 30,811 30,805 29,640 29,116 29,857 150,979 20.4 20.4 19.6 19.3 19.8 100.0 10,429 25,498 45,048 72,752 195,312 68,631 -595 1,478 5,962 12,123 43,800 12,367 11,024 24,020 39,087 60,629 151,512 56,264 -5.7 5.8 13.2 16.7 22.4 18.0 3.1 7.6 12.9 20.4 56.3 100.0 4.0 8.7 13.6 20.8 53.3 100.0 -1.0 2.4 9.5 18.9 70.0 100.0 15,099 7,518 5,846 1,395 138 10.0 5.0 3.9 0.9 0.1 104,284 145,101 254,000 1,205,141 5,155,011 20,372 30,792 57,073 311,845 1,447,331 83,913 114,309 196,927 893,296 3,707,680 19.5 21.2 22.5 25.9 28.1 15.2 10.5 14.3 16.2 6.9 14.9 10.1 13.6 14.7 6.0 16.5 12.4 17.9 23.3 10.7 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version0309-2). Number of AMT Taxpayers (millions). Baseline: 3.8 Proposal: 4.1 (1) Calendar year. Baseline is current law. Proposal replaces the employer sponsored insurance deduction and self-employment health insurance deduction with a voucher to purchase private insurance. Individual voucher value depends on age and gender; the total voucher for each tax unit is the sum of each individual's voucher. Only individuals not on public insurance receive a voucher. The proposal imposes a revenue neutral comprehensive VAT at tax exclusive rate of 6.7% to finance the voucher and $500 individual cash subsidy. The VAT is distributed to labor earnings plus all capital. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,452, 40% $24,939, 60% $41,565, 80% $64,974, 90% $90,586, 95% $126,051, 99% $321,606, 99.9% $1,307,820. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0261 Replace ESI Exclusion and Self-Employment Health Insurance Deduction With Voucher to Purchase Private Insurance Impose Comprehensive VAT at Tax Exclusive Rate of 8.4% With $500 Individual Cash Subsidy Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2009 1 Detail Table - Single Tax Units 4 Percent of Tax Units 2,3 Cash Income Percentile With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Share of Federal Taxes Change (% Points) Percent 6 Average Federal Tax Rate Under the Proposal Change (% Points) Under the Proposal 91.3 79.2 55.6 34.4 12.8 59.7 8.6 20.7 44.3 65.6 87.1 40.3 31.3 6.9 1.5 -2.6 -5.2 -0.1 -1,685.9 -816.2 -251.8 542.2 2,366.2 100.0 -2,343 -1,225 -425 1,102 5,148 34 -1,193.5 -71.7 -8.7 11.2 17.4 0.4 -7.4 -3.6 -1.2 2.3 10.2 0.0 -6.8 1.4 11.7 23.6 70.2 100.0 -30.5 -6.3 -1.3 2.1 4.0 0.1 -27.9 2.5 13.6 20.8 27.2 18.6 16.5 9.4 7.7 8.4 3.1 83.4 90.6 92.4 91.6 96.9 -4.2 -5.3 -5.7 -6.3 -7.0 615.8 505.3 640.8 604.4 250.5 2,531 4,259 7,864 37,266 170,078 15.6 18.0 20.1 16.7 15.3 2.6 2.2 2.8 2.6 1.1 20.1 14.6 16.9 18.6 8.3 3.3 4.1 4.4 4.6 4.8 24.6 26.7 26.5 31.9 36.0 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2009 1 4 Tax Units Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total 15,928 14,749 13,104 10,889 10,176 65,239 24.4 22.6 20.1 16.7 15.6 100.0 5,386 2,627 1,804 359 33 8.3 4.0 2.8 0.6 0.1 Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) 7,691 19,388 32,811 52,452 127,722 41,404 196 1,708 4,896 9,807 29,556 7,673 7,495 17,679 27,914 42,645 98,166 33,731 76,418 104,693 177,218 817,131 3,560,360 16,272 23,672 39,134 223,765 1,111,510 60,147 81,021 138,085 593,365 2,448,850 Average Income (Dollars) Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.6 8.8 14.9 18.7 23.1 18.5 4.5 10.6 15.9 21.1 48.1 100.0 5.4 11.9 16.6 21.1 45.4 100.0 0.6 5.0 12.8 21.3 60.1 100.0 21.3 22.6 22.1 27.4 31.2 15.2 10.2 11.8 10.9 4.3 14.7 9.7 11.3 9.7 3.6 17.5 12.4 14.1 16.1 7.2 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version0309-2). (1) Calendar year. Baseline is current law. Proposal replaces the employer sponsored insurance deduction and self-employment health insurance deduction with a voucher to purchase private insurance. Individual voucher value depends on age and gender; the total voucher for each tax unit is the sum of each individual's voucher. Only individuals not on public insurance receive a voucher. The proposal imposes a revenue neutral comprehensive VAT at tax exclusive rate of 6.7% to finance the voucher and $500 individual cash subsidy. The VAT is distributed to labor earnings plus all capital. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by divi by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,452, 40% $24,939, 60% $41,565, 80% $64,974, 90% $90,586, 95% $126,051, 99% $321,606, 99.9% $1,307,820. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0261 Replace ESI Exclusion and Self-Employment Health Insurance Deduction With Voucher to Purchase Private Insurance Impose Comprehensive VAT at Tax Exclusive Rate of 8.4% With $500 Individual Cash Subsidy Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2009 1 Detail Table - Married Tax Units Filing Jointly 4 Percent of Tax Units 2,3 Cash Income Percentile With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) 6 Average Federal Tax Rate Under the Proposal Change (% Points) Under the Proposal 92.8 82.7 75.7 53.7 21.8 56.8 7.2 17.3 24.2 46.3 78.2 43.2 43.8 13.7 6.2 0.9 -5.4 -1.0 -81.0 -68.3 -66.6 -18.4 337.5 100.0 -6,435 -4,294 -3,174 -647 9,963 890 687.1 -284.6 -46.0 -4.7 19.1 4.3 -3.3 -2.9 -3.0 -1.5 10.8 0.0 -3.8 -1.8 3.2 15.4 87.1 100.0 -46.8 -13.0 -5.4 -0.7 4.2 0.8 -53.6 -8.5 6.4 14.8 26.4 19.6 33.3 15.6 7.7 4.3 2.4 66.7 84.4 92.3 95.6 97.6 -2.5 -4.2 -6.8 -7.5 -7.4 40.3 49.0 110.5 137.7 54.7 2,478 5,693 15,420 74,791 299,092 10.8 16.3 23.4 22.1 19.5 1.0 1.5 3.7 4.6 1.8 17.1 14.5 24.1 31.5 13.8 2.0 3.4 5.3 5.6 5.3 20.7 24.0 27.9 31.1 32.7 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2009 1 4 Tax Units Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 6,690 8,457 11,153 15,150 18,010 59,744 11.2 14.2 18.7 25.4 30.2 100.0 13,760 32,925 58,474 88,068 236,078 110,299 -937 1,509 6,901 13,718 52,297 20,672 14,697 31,417 51,572 74,350 183,780 89,627 8,649 4,572 3,811 979 97 14.5 7.7 6.4 1.6 0.2 122,710 169,474 292,035 1,330,820 5,602,474 22,913 35,026 66,026 339,102 1,534,754 99,797 134,448 226,009 991,717 4,067,720 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -6.8 4.6 11.8 15.6 22.2 18.7 1.4 4.2 9.9 20.3 64.5 100.0 1.8 5.0 10.7 21.0 61.8 100.0 -0.5 1.0 6.2 16.8 76.3 100.0 18.7 20.7 22.6 25.5 27.4 16.1 11.8 16.9 19.8 8.3 16.1 11.5 16.1 18.1 7.4 16.1 13.0 20.4 26.9 12.1 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version0309-2). (1) Calendar year. Baseline is current law. Proposal replaces the employer sponsored insurance deduction and self-employment health insurance deduction with a voucher to purchase private insurance. Individual voucher value depends on age and gender; the total voucher for each tax unit is the sum of each individual's voucher. Only individuals not on public insurance receive a voucher. The proposal imposes a revenue neutral comprehensive VAT at tax exclusive rate of 6.7% to finance the voucher and $500 individual cash subsidy. The VAT is distributed to labor earnings plus all capital. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by divi by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,452, 40% $24,939, 60% $41,565, 80% $64,974, 90% $90,586, 95% $126,051, 99% $321,606, 99.9% $1,307,820. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0261 Replace ESI Exclusion and Self-Employment Health Insurance Deduction With Voucher to Purchase Private Insurance Impose Comprehensive VAT at Tax Exclusive Rate of 8.4% With $500 Individual Cash Subsidy Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2009 1 Detail Table - Head of Household Tax Units 4 Percent of Tax Units 2,3 Cash Income Percentile With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Share of Federal Taxes Dollars Percent Change (% Points) 6 Average Federal Tax Rate Under the Proposal Change (% Points) Under the Proposal 93.0 75.6 65.4 40.8 19.4 72.9 7.0 24.3 34.6 59.2 80.6 27.1 26.9 9.5 3.5 -1.3 -4.9 6.1 64.9 39.0 13.6 -4.0 -14.0 100.0 -4,076 -2,710 -1,442 777 5,849 -2,113 208.4 -314.1 -21.8 6.1 17.0 -52.4 -89.3 -35.7 21.0 41.7 62.9 0.0 -105.6 -29.2 53.6 75.6 106.0 100.0 -30.9 -9.2 -3.0 1.1 3.8 -5.5 -45.8 -6.3 10.7 18.8 26.3 5.0 24.0 9.9 12.1 7.9 4.8 76.0 90.1 87.9 92.1 95.2 -3.5 -4.9 -5.7 -7.7 -8.8 -4.4 -2.4 -3.1 -4.1 -1.9 2,782 5,132 10,761 63,559 310,667 12.9 16.9 20.4 21.6 22.4 24.4 10.7 12.3 15.5 6.8 42.2 18.1 20.3 25.5 11.1 2.7 3.8 4.4 5.7 6.3 24.0 26.2 26.1 31.9 34.6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2009 1 4 Tax Units Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Number (thousands) Percent of Total 7,886 7,129 4,664 2,524 1,185 23,435 33.7 30.4 19.9 10.8 5.1 100.0 13,176 29,467 48,386 71,741 153,000 38,440 -1,956 863 6,623 12,710 34,439 4,035 781 229 144 32 3 3.3 1.0 0.6 0.1 0.0 101,698 135,764 243,422 1,118,475 4,909,652 21,578 30,371 52,846 293,737 1,389,447 Average Federal Tax Rate6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 15,132 28,604 41,764 59,030 118,561 34,405 -14.8 2.9 13.7 17.7 22.5 10.5 11.5 23.3 25.1 20.1 20.1 100.0 14.8 25.3 24.2 18.5 17.4 100.0 -16.3 6.5 32.7 33.9 43.2 100.0 80,120 105,393 190,576 824,737 3,520,205 21.2 22.4 21.7 26.3 28.3 8.8 3.5 3.9 4.0 1.6 7.8 3.0 3.4 3.3 1.3 17.8 7.4 8.0 10.0 4.3 Average AfterTax Income5 (Dollars) Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version0309-2). (1) Calendar year. Baseline is current law. Proposal replaces the employer sponsored insurance deduction and self-employment health insurance deduction with a voucher to purchase private insurance. Individual voucher value depends on age and gender; the total voucher for each tax unit is the sum of each individual's voucher. Only individuals not on public insurance receive a voucher. The proposal imposes a revenue neutral comprehensive VAT at tax exclusive rate of 6.7% to finance the voucher and $500 individual cash subsidy. The VAT is distributed to labor earnings plus all capital. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by divi by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,452, 40% $24,939, 60% $41,565, 80% $64,974, 90% $90,586, 95% $126,051, 99% $321,606, 99.9% $1,307,820. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0261 Replace ESI Exclusion and Self-Employment Health Insurance Deduction With Voucher to Purchase Private Insurance Impose Comprehensive VAT at Tax Exclusive Rate of 8.4% With $500 Individual Cash Subsidy Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2009 1 Detail Table - Tax Units with Children Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Average Federal Tax Rate 6 Under the Proposal Change (% Points) Under the Proposal 93.6 76.7 72.0 45.9 14.3 63.7 6.4 23.3 27.9 54.1 85.7 36.3 30.2 10.3 5.1 -0.2 -6.1 0.6 250.3 165.5 129.4 -7.7 -442.2 100.0 -5,022 -3,393 -2,667 175 12,304 -439 202.8 -393.9 -33.3 1.1 19.7 -3.1 -8.0 -5.2 -3.7 0.9 16.1 0.0 -11.8 -3.9 8.2 22.8 84.7 100.0 -35.5 -10.0 -4.4 0.2 4.7 -0.5 -53.1 -7.5 8.8 17.3 28.3 16.8 20.6 10.3 5.3 3.2 1.9 79.4 89.8 94.7 96.8 98.1 -3.7 -5.0 -7.7 -8.1 -7.6 -76.8 -69.0 -138.5 -158.0 -61.6 4,187 7,559 20,447 92,473 367,846 14.5 17.7 23.7 21.2 18.6 2.9 2.6 4.9 5.7 2.3 19.1 14.4 22.8 28.4 12.4 2.9 3.9 5.8 5.8 5.4 23.2 25.7 30.2 33.3 34.2 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2009 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Number (thousands) Percent of Total 10,679 10,452 10,394 9,395 7,700 48,765 21.9 21.4 21.3 19.3 15.8 100.0 14,136 33,788 60,328 95,703 264,258 83,132 -2,477 861 8,002 16,360 62,529 14,393 3,928 1,955 1,451 366 36 8.1 4.0 3.0 0.8 0.1 142,540 195,504 353,516 1,583,826 6,844,819 28,894 42,658 86,291 435,407 1,973,610 1 Average Federal Tax Rate6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 16,613 32,927 52,326 79,343 201,729 68,738 -17.5 2.6 13.3 17.1 23.7 17.3 3.7 8.7 15.5 22.2 50.2 100.0 5.3 10.3 16.2 22.2 46.3 100.0 -3.8 1.3 11.9 21.9 68.6 100.0 113,646 152,846 267,226 1,148,419 4,871,209 20.3 21.8 24.4 27.5 28.8 13.8 9.4 12.7 14.3 6.1 13.3 8.9 11.6 12.5 5.2 16.2 11.9 17.8 22.7 10.1 Average AfterTax Income5 (Dollars) Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version0309-2). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal replaces the employer sponsored insurance deduction and self-employment health insurance deduction with a voucher to purchase private insurance. Individual voucher value depends on age and gender; the total voucher for each tax unit is the sum of each individual's voucher. Only individuals not on public insurance receive a voucher. The proposal imposes a revenue neutral comprehensive VAT at tax exclusive rate of 6.7% to finance the voucher and $500 individual cash subsidy. The VAT is distributed to labor earnings plus all capital. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,452, 40% $24,939, 60% $41,565, 80% $64,974, 90% $90,586, 95% $126,051, 99% $321,606, 99.9% $1,307,820. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0261 Replace ESI Exclusion and Self-Employment Health Insurance Deduction With Voucher to Purchase Private Insurance Impose Comprehensive VAT at Tax Exclusive Rate of 8.4% With $500 Individual Cash Subsidy Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2009 1 Detail Table - Elderly Tax Units Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Share of Federal Taxes Change (% Points) Percent Average Federal Tax Rate 6 Under the Proposal Change (% Points) Under the Proposal 90.9 85.4 67.6 44.0 20.9 60.1 9.0 14.5 32.3 55.9 79.0 39.8 17.3 3.9 1.6 -0.1 -4.4 -1.7 -26.5 -18.9 -9.4 1.6 153.2 100.0 -1,769 -824 -600 85 6,974 1,062 -10,625.3 -210.1 -46.1 1.4 18.5 10.3 -2.5 -1.9 -1.1 -0.9 6.3 0.0 -2.5 -0.9 1.0 10.4 91.9 100.0 -17.3 -3.9 -1.5 0.1 3.5 1.5 -17.1 -2.0 1.8 8.9 22.6 15.6 29.4 18.7 11.2 4.1 1.3 70.4 81.3 88.8 95.9 98.7 -1.9 -3.0 -5.1 -6.4 -7.0 15.3 18.6 48.9 70.4 30.2 1,531 3,408 9,487 50,743 225,148 12.5 15.9 22.1 19.2 17.8 0.2 0.6 2.4 3.1 1.2 12.9 12.7 25.4 40.9 18.7 1.6 2.6 4.1 4.8 5.0 14.6 18.5 22.8 29.7 33.2 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2009 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 4,518 6,908 4,712 5,606 6,619 28,390 15.9 24.3 16.6 19.8 23.3 100.0 10,241 21,365 39,436 67,390 197,494 72,658 17 392 1,301 5,886 37,681 10,270 10,225 20,973 38,135 61,504 159,814 62,388 3,007 1,640 1,554 418 40 10.6 5.8 5.5 1.5 0.1 95,095 133,885 230,630 1,059,787 4,494,318 12,301 21,417 43,028 263,997 1,265,869 82,795 112,469 187,602 795,790 3,228,449 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.2 1.8 3.3 8.7 19.1 14.1 2.2 7.2 9.0 18.3 63.4 100.0 2.6 8.2 10.2 19.5 59.7 100.0 0.0 0.9 2.1 11.3 85.5 100.0 12.9 16.0 18.7 24.9 28.2 13.9 10.7 17.4 21.5 8.8 14.1 10.4 16.5 18.8 7.4 12.7 12.1 22.9 37.9 17.6 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version0309-2). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal replaces the employer sponsored insurance deduction and self-employment health insurance deduction with a voucher to purchase private insurance. Individual voucher value depends on age and gender; the total voucher for each tax unit is the sum of each individual's voucher. Only individuals not on public insurance receive a voucher. The proposal imposes a revenue neutral comprehensive VAT at tax exclusive rate of 6.7% to finance the voucher and $500 individual cash subsidy. The VAT is distributed to labor earnings plus all capital. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,452, 40% $24,939, 60% $41,565, 80% $64,974, 90% $90,586, 95% $126,051, 99% $321,606, 99.9% $1,307,820. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.