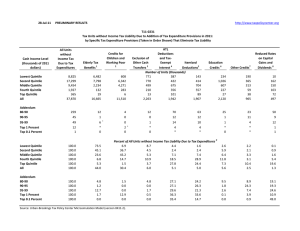

Table T09-0168

advertisement

17-Mar-09 http://www.taxpolicycenter.org PRELIMINARY RESULTS Table T09-0168 Distribution of Tax Units with Small Business Income, by Cash Income Percentile, 2009 1 All Tax Units Cash Income Percentile Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Tax Units with Small Business Income2 Number Percent of Total (thousands) Percent of Tax Units with Small Business Income 3 Greater than 0 Greater than 10% of AGI Greater than Greater than 25% of AGI 50% of AGI Small Business Income as Percent of AGI 37,410 33,710 30,411 26,011 22,659 150,979 24.8 22.3 20.1 17.2 15.0 100.0 6,312 5,218 6,238 7,376 10,243 36,064 17.5 14.5 17.3 20.5 28.4 100.0 16.9 15.5 20.5 28.4 45.2 23.9 15.3 11.4 12.5 13.8 22.6 15.1 13.9 9.0 8.3 7.9 14.8 11.2 12.1 6.6 5.1 4.2 9.2 8.1 18.1 8.3 6.6 6.1 18.4 13.8 11,475 5,519 4,524 1,142 114 7.6 3.7 3.0 0.8 0.1 4,340 2,416 2,622 865 98 12.0 6.7 7.3 2.4 0.3 37.8 43.8 58.0 75.7 85.7 18.0 19.3 32.4 45.7 50.2 10.6 12.2 23.7 34.6 39.2 6.0 7.3 15.7 24.9 28.6 8.5 10.2 20.6 31.6 32.0 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Tax units that are dependents of other tax units are excluded from the analysis. Tax units with negative cash income are not included in the lowest income category but are included in the totals. The breaks are (in 2009 dollars): 20% $19,957, 40% $37,919, 60% $65,635, 80% $111,847, 90% $160,851, 95% $224,521, 99% $590,626, 99.9% $2,706,133. (2) Includes all tax units reporting a net gain or loss on Schedules C, E, or F. (3) Small business income is defined as the sum of the absolute values of the gains or losses reported on Schedules C, E, and F.