Medicaid and CHIP Managed Care Payment Methods and Spending in 20 States

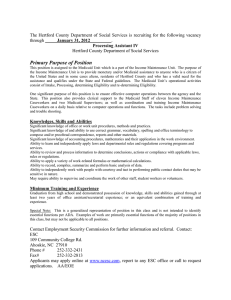

advertisement