Medicaid and CHIP Risk-Based Managed Care in 20 States

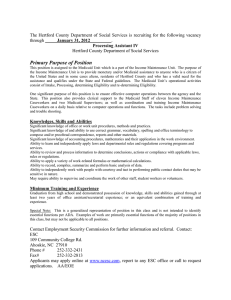

advertisement