11-Dec-09 PRELIMINARY RESULTS

advertisement

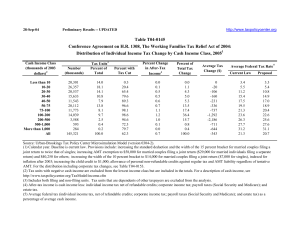

11-Dec-09 PRELIMINARY RESULTS CLICK ON PDF OR EXCEL FILE FOR ADDITIONAL TABLES THAT SHOW DISTRIBUTION BY AGE http://www.taxpolicycenter.org Table T09-0501 Certain Individual Income and Estate Tax Provisions in Administration's FY2010 Budget Proposals Distribution of Federal Tax Change by Cash Income Percentile, 2011 1 All Tax Units Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 72.0 84.5 94.7 99.3 99.4 87.3 0.1 0.1 0.1 0.0 0.2 0.1 5.0 4.6 3.7 3.8 3.4 3.7 5.8 11.6 14.7 21.0 46.7 100.0 -496 -1,059 -1,484 -2,553 -6,483 -2,051 -101.8 -36.0 -17.8 -14.3 -8.8 -12.5 -0.7 -1.1 -0.6 -0.4 2.8 0.0 0.0 2.9 9.6 17.9 69.4 100.0 -4.7 -4.0 -3.1 -3.0 -2.4 -2.9 -0.1 7.2 14.1 18.2 25.3 20.1 99.5 99.8 99.4 96.3 87.3 0.0 0.1 0.2 3.4 12.3 4.5 4.2 3.5 1.7 1.3 17.1 10.3 12.4 6.9 2.5 -4,690 -5,900 -8,579 -18,755 -65,942 -14.3 -12.0 -9.4 -3.5 -2.4 -0.3 0.1 0.6 2.5 1.4 14.6 10.8 17.0 27.1 14.0 -3.4 -3.1 -2.6 -1.1 -0.9 20.5 22.7 24.8 31.1 34.5 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2011 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 37,292 34,806 31,498 26,231 22,974 155,368 24.0 22.4 20.3 16.9 14.8 100.0 10,481 26,186 48,373 84,329 267,017 71,667 487 2,943 8,323 17,855 74,081 16,458 9,993 23,243 40,050 66,474 192,936 55,208 4.7 11.2 17.2 21.2 27.7 23.0 3.5 8.2 13.7 19.9 55.1 100.0 4.3 9.4 14.7 20.3 51.7 100.0 0.7 4.0 10.3 18.3 66.6 100.0 11,625 5,563 4,611 1,175 119 7.5 3.6 3.0 0.8 0.1 136,507 191,223 333,276 1,657,137 7,672,765 32,702 49,296 91,094 534,071 2,714,593 103,805 141,927 242,182 1,123,066 4,958,172 24.0 25.8 27.3 32.2 35.4 14.3 9.6 13.8 17.5 8.2 14.1 9.2 13.0 15.4 6.9 14.9 10.7 16.4 24.5 12.6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 17.0 Proposal: 3.8 (1) Calendar year. Baseline is current law. Proposal would: (a) extend the 2009 AMT exemption levels and index them for inflation after 2009; (b) index the AMT tax bracket threshold and exemption phaseout threshold for inflation; (c) allow personal nonrefundable credits (other than the child tax credit) regardless of AMT liability; (d) extend the 0 and 15 percent rates on capital gains and qualified dividends and add a 20 percent rate for taxpayers otherwise in the 36 or 39.6 percent tax bracket; (e) extend the 10, 25, and 28 percent statutory marginal tax rates; (f) retain the 36 and 39.6 percent tax rates; (g) increase the threshold for the 36 percent tax rate to $231,300 for married couples filing a joint return, $190,650 for singles, and $210,950 for heads of households (expressed in 2009 dollars); (h) set the standard deduction for married couples filing jointly equal to twice that for singles; (i) increase the EITC plateau for married couples filing jointly by $5,000 (indexed for inflation after 2009); (j) set the threshold for the 15-percent bracket for married couples filing jointly equal to twice that for singles; (k) extend the Making Work Pay credit currently scheduled to sunset on 12/31/10; (l) reduce the phaseout rate from 2 to 1.6 percent; (m) index the phaseout thresholds for inflation after 2010; (n) repeal personal exemption phaseout (PEP) and limitation on itemized deductions (Pease) but only for taxpayers with AGI less than $200,000 (in 2009$), $250,000 for married couples filing jointly; (o) extend education incentives including American Opportunity Tax Credit; (p) extend $1,000 child tax credit and CTC refundability provisions and AMT treatment; (q) extend expansion of the child and dependent care tax credit; (r) extend EITC measures including additional tier for three or more children; and (s) extend 2009 estate tax law including: (i) maximum rate of 45 percent; (ii) $3.5 million effective exemption, not indexed for inflation; (iii) replace credit for state-level wealth transfer taxes with a deduction; (iv) effective repeal of Qualified Family Owned Business Interest (QFOBI) deduction; and (v) repeal of the 5-percent surtax. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $17,709, 40% $34,668, 60% $63,846, 80% $104,388, 90% $167,146, 95% $210,251, 99% $555,037, 99.9% $2,351,648. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 11-Dec-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0501 Certain Individual Income and Estate Tax Provisions in Administration's FY2010 Budget Proposals Distribution of Federal Tax Change by Cash Income Percentile, 2011 1 Tax Units with Head Under Age 50 Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 90.6 98.2 99.5 99.9 99.7 95.9 0.0 0.1 0.0 0.0 0.2 0.1 7.0 6.2 4.4 4.2 3.4 4.2 8.1 15.5 17.1 21.9 37.1 100.0 -669 -1,417 -1,703 -2,779 -5,949 -2,080 -130.3 -42.5 -18.7 -14.9 -8.8 -14.2 -1.2 -1.7 -0.7 -0.2 3.8 0.0 -0.3 3.5 12.3 20.7 63.7 100.0 -6.7 -5.4 -3.6 -3.3 -2.4 -3.3 -1.6 7.3 15.4 18.8 25.1 19.6 99.8 100.0 99.7 96.3 87.0 0.0 0.0 0.1 3.4 12.7 4.7 4.1 3.1 1.4 1.3 16.1 8.7 8.5 3.8 1.5 -4,813 -5,817 -7,408 -15,213 -63,155 -14.6 -11.7 -8.1 -2.9 -2.3 -0.1 0.3 1.1 2.5 1.3 15.6 10.9 15.9 21.3 10.8 -3.5 -3.1 -2.2 -0.9 -0.8 20.6 23.0 25.2 31.5 34.9 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2011 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 22,363 20,162 18,432 14,480 11,472 88,402 25.3 22.8 20.9 16.4 13.0 100.0 10,047 26,323 48,020 84,402 245,362 63,985 513 3,337 9,117 18,650 67,537 14,635 9,533 22,987 38,903 65,752 177,825 49,350 6,159 2,744 2,105 464 43 7.0 3.1 2.4 0.5 0.1 136,363 190,783 332,790 1,619,647 7,884,376 32,891 49,777 91,105 525,972 2,813,027 103,472 141,006 241,686 1,093,675 5,071,349 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 5.1 12.7 19.0 22.1 27.5 22.9 4.0 9.4 15.7 21.6 49.8 100.0 4.9 10.6 16.4 21.8 46.8 100.0 0.9 5.2 13.0 20.9 59.9 100.0 24.1 26.1 27.4 32.5 35.7 14.9 9.3 12.4 13.3 6.1 14.6 8.9 11.7 11.6 5.1 15.7 10.6 14.8 18.9 9.5 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. Proposal would: (a) extend the 2009 AMT exemption levels and index them for inflation after 2009; (b) index the AMT tax bracket threshold and exemption phaseout threshold for inflation; (c) allow personal nonrefundable credits (other than the child tax credit) regardless of AMT liability; (d) extend the 0 and 15 percent rates on capital gains and qualified dividends and add a 20 percent rate for taxpayers otherwise in the 36 or 39.6 percent tax bracket; (e) extend the 10, 25, and 28 percent statutory marginal tax rates; (f) retain the 36 and 39.6 percent tax rates; (g) increase the threshold for the 36 percent tax rate to $231,300 for married couples filing a joint return, $190,650 for singles, and $210,950 for heads of households (expressed in 2009 dollars); (h) set the standard deduction for married couples filing jointly equal to twice that for singles; (i) increase the EITC plateau for married couples filing jointly by $5,000 (indexed for inflation after 2009); (j) set the threshold for the 15-percent bracket for married couples filing jointly equal to twice that for singles; (k) extend the Making Work Pay credit currently scheduled to sunset on 12/31/10; (l) reduce the phaseout rate from 2 to 1.6 percent; (m) index the phaseout thresholds for inflation after 2010; (n) repeal personal exemption phaseout (PEP) and limitation on itemized deductions (Pease) but only for taxpayers with AGI less than $200,000 (in 2009$), $250,000 for married couples filing jointly; (o) extend education incentives including American Opportunity Tax Credit; (p) extend $1,000 child tax credit and CTC refundability provisions and AMT treatment; (q) extend expansion of the child and dependent care tax credit; (r) extend EITC measures including additional tier for three or more children; and (s) extend 2009 estate tax law including: (i) maximum rate of 45 percent; (ii) $3.5 million effective exemption, not indexed for inflation; (iii) replace credit for state-level wealth transfer taxes with a deduction; (iv) effective repeal of Qualified Family Owned Business Interest (QFOBI) deduction; and (v) repeal of the 5-percent surtax. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $17,709, 40% $34,668, 60% $63,846, 80% $104,388, 90% $167,146, 95% $210,251, 99% $555,037, 99.9% $2,351,648. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 11-Dec-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0501 Certain Individual Income and Estate Tax Provisions in Administration's FY2010 Budget Proposals Distribution of Federal Tax Change by Cash Income Percentile, 2011 1 Tax Units with Head Age 50-64 Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 67.0 86.3 96.1 99.5 99.5 88.5 0.2 0.3 0.2 0.0 0.2 0.2 4.0 3.8 3.3 3.4 3.0 3.2 3.5 7.1 11.7 21.0 56.5 100.0 -388 -858 -1,308 -2,264 -5,968 -2,178 -66.1 -24.2 -14.3 -11.9 -7.7 -9.7 -0.3 -0.5 -0.4 -0.4 1.6 0.0 0.2 2.4 7.6 16.7 73.0 100.0 -3.8 -3.3 -2.7 -2.7 -2.1 -2.4 1.9 10.2 16.1 19.7 25.8 22.5 99.5 99.9 99.6 96.5 88.4 0.0 0.0 0.1 3.1 11.2 4.2 4.0 3.2 1.3 1.0 19.4 13.8 15.1 8.2 2.7 -4,307 -5,615 -7,664 -15,378 -47,266 -12.6 -11.1 -8.4 -2.9 -1.8 -0.5 -0.2 0.2 2.0 1.2 14.4 11.9 17.6 29.2 15.3 -3.2 -2.9 -2.3 -0.9 -0.6 21.8 23.5 25.1 30.4 33.7 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2011 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 7,428 6,852 7,447 7,716 7,864 38,128 19.5 18.0 19.5 20.2 20.6 100.0 10,314 26,304 48,649 84,770 278,512 90,475 587 3,545 9,155 18,999 77,897 22,490 9,728 22,759 39,494 65,771 200,615 67,985 3,741 2,044 1,637 441 47 9.8 5.4 4.3 1.2 0.1 136,627 191,453 331,880 1,686,150 7,480,216 34,076 50,603 90,972 527,158 2,566,648 102,551 140,850 240,909 1,158,993 4,913,568 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 5.7 13.5 18.8 22.4 28.0 24.9 2.2 5.2 10.5 19.0 63.5 100.0 2.8 6.0 11.4 19.6 60.9 100.0 0.5 2.8 8.0 17.1 71.4 100.0 24.9 26.4 27.4 31.3 34.3 14.8 11.4 15.8 21.6 10.2 14.8 11.1 15.2 19.7 8.9 14.9 12.1 17.4 27.1 14.1 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. Proposal would: (a) extend the 2009 AMT exemption levels and index them for inflation after 2009; (b) index the AMT tax bracket threshold and exemption phaseout threshold for inflation; (c) allow personal nonrefundable credits (other than the child tax credit) regardless of AMT liability; (d) extend the 0 and 15 percent rates on capital gains and qualified dividends and add a 20 percent rate for taxpayers otherwise in the 36 or 39.6 percent tax bracket; (e) extend the 10, 25, and 28 percent statutory marginal tax rates; (f) retain the 36 and 39.6 percent tax rates; (g) increase the threshold for the 36 percent tax rate to $231,300 for married couples filing a joint return, $190,650 for singles, and $210,950 for heads of households (expressed in 2009 dollars); (h) set the standard deduction for married couples filing jointly equal to twice that for singles; (i) increase the EITC plateau for married couples filing jointly by $5,000 (indexed for inflation after 2009); (j) set the threshold for the 15-percent bracket for married couples filing jointly equal to twice that for singles; (k) extend the Making Work Pay credit currently scheduled to sunset on 12/31/10; (l) reduce the phaseout rate from 2 to 1.6 percent; (m) index the phaseout thresholds for inflation after 2010; (n) repeal personal exemption phaseout (PEP) and limitation on itemized deductions (Pease) but only for taxpayers with AGI less than $200,000 (in 2009$), $250,000 for married couples filing jointly; (o) extend education incentives including American Opportunity Tax Credit; (p) extend $1,000 child tax credit and CTC refundability provisions and AMT treatment; (q) extend expansion of the child and dependent care tax credit; (r) extend EITC measures including additional tier for three or more children; and (s) extend 2009 estate tax law including: (i) maximum rate of 45 percent; (ii) $3.5 million effective exemption, not indexed for inflation; (iii) replace credit for state-level wealth transfer taxes with a deduction; (iv) effective repeal of Qualified Family Owned Business Interest (QFOBI) deduction; and (v) repeal of the 5-percent surtax. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $17,709, 40% $34,668, 60% $63,846, 80% $104,388, 90% $167,146, 95% $210,251, 99% $555,037, 99.9% $2,351,648. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 11-Dec-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0501 Certain Individual Income and Estate Tax Provisions in Administration's FY2010 Budget Proposals Distribution of Federal Tax Change by Cash Income Percentile, 2011 1 Tax Units with Head Age 65 or Over Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 21.3 47.5 77.2 96.9 98.1 59.4 0.0 0.1 0.1 0.0 0.5 0.1 0.8 1.3 2.2 3.3 4.1 3.2 1.3 4.7 10.8 17.9 65.2 100.0 -89 -310 -999 -2,298 -9,280 -1,796 -28.7 -22.2 -21.7 -17.9 -10.7 -12.8 -0.1 -0.3 -0.7 -0.8 1.8 0.0 0.5 2.4 5.7 12.0 79.3 100.0 -0.8 -1.2 -2.0 -2.8 -3.0 -2.6 1.9 4.2 7.4 12.6 24.9 17.5 98.0 98.9 98.2 95.8 86.1 0.0 0.4 0.4 3.8 13.5 4.7 4.7 5.4 2.7 2.1 16.9 10.4 22.1 15.8 5.5 -5,085 -6,944 -13,141 -30,364 -101,929 -17.5 -15.7 -14.4 -5.4 -3.6 -0.7 -0.3 -0.4 3.1 2.0 11.7 8.1 19.2 40.3 21.3 -3.7 -3.6 -3.9 -1.8 -1.3 17.5 19.4 23.2 31.6 35.3 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2011 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 7,501 7,793 5,620 4,035 3,638 28,838 26.0 27.0 19.5 14.0 12.6 100.0 11,939 25,726 49,167 83,224 310,453 70,347 311 1,396 4,614 12,814 86,465 14,072 11,627 24,330 44,553 70,409 223,988 56,275 1,725 774 869 270 28 6.0 2.7 3.0 0.9 0.1 136,764 192,173 337,081 1,674,080 7,668,294 29,050 44,132 91,297 559,292 2,811,389 107,715 148,041 245,784 1,114,788 4,856,904 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.6 5.4 9.4 15.4 27.9 20.0 4.4 9.9 13.6 16.6 55.7 100.0 5.4 11.7 15.4 17.5 50.2 100.0 0.6 2.7 6.4 12.7 77.5 100.0 21.2 23.0 27.1 33.4 36.7 11.6 7.3 14.4 22.3 10.5 11.5 7.1 13.2 18.5 8.3 12.4 8.4 19.6 37.2 19.3 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. Proposal would: (a) extend the 2009 AMT exemption levels and index them for inflation after 2009; (b) index the AMT tax bracket threshold and exemption phaseout threshold for inflation; (c) allow personal nonrefundable credits (other than the child tax credit) regardless of AMT liability; (d) extend the 0 and 15 percent rates on capital gains and qualified dividends and add a 20 percent rate for taxpayers otherwise in the 36 or 39.6 percent tax bracket; (e) extend the 10, 25, and 28 percent statutory marginal tax rates; (f) retain the 36 and 39.6 percent tax rates; (g) increase the threshold for the 36 percent tax rate to $231,300 for married couples filing a joint return, $190,650 for singles, and $210,950 for heads of households (expressed in 2009 dollars); (h) set the standard deduction for married couples filing jointly equal to twice that for singles; (i) increase the EITC plateau for married couples filing jointly by $5,000 (indexed for inflation after 2009); (j) set the threshold for the 15-percent bracket for married couples filing jointly equal to twice that for singles; (k) extend the Making Work Pay credit currently scheduled to sunset on 12/31/10; (l) reduce the phaseout rate from 2 to 1.6 percent; (m) index the phaseout thresholds for inflation after 2010; (n) repeal personal exemption phaseout (PEP) and limitation on itemized deductions (Pease) but only for taxpayers with AGI less than $200,000 (in 2009$), $250,000 for married couples filing jointly; (o) extend education incentives including American Opportunity Tax Credit; (p) extend $1,000 child tax credit and CTC refundability provisions and AMT treatment; (q) extend expansion of the child and dependent care tax credit; (r) extend EITC measures including additional tier for three or more children; and (s) extend 2009 estate tax law including: (i) maximum rate of 45 percent; (ii) $3.5 million effective exemption, not indexed for inflation; (iii) replace credit for state-level wealth transfer taxes with a deduction; (iv) effective repeal of Qualified Family Owned Business Interest (QFOBI) deduction; and (v) repeal of the 5-percent surtax. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $17,709, 40% $34,668, 60% $63,846, 80% $104,388, 90% $167,146, 95% $210,251, 99% $555,037, 99.9% $2,351,648. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.