7-Jul-08 PRELIMINARY RESULTS

advertisement

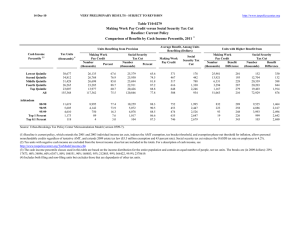

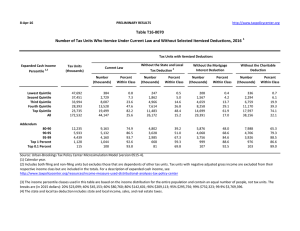

7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T08-0161 2001-06 Tax Cuts with AMT Patch Extended: Financing Proportional to Cash Income Distribution of Federal Tax Change by Cash Income Percentile, 2010 1 Summary Table Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change ($) Average Federal Tax Rate 6 Change (% Points) Under the Proposal 2.4 22.9 17.5 23.3 38.8 19.3 93.6 77.1 82.4 76.6 61.2 79.7 -2.6 -1.1 -1.3 -0.6 1.0 0.0 n/a n/a n/a n/a n/a n/a 278 276 554 413 -2,054 0 2.5 1.0 1.0 0.5 -0.7 0.0 7.8 13.9 20.1 22.6 27.9 24.0 35.6 38.9 38.9 68.8 86.7 64.3 61.1 61.1 31.2 13.4 0.1 0.1 0.4 2.6 3.3 n/a n/a n/a n/a n/a -94 -131 -1,092 -34,684 -204,845 -0.1 -0.1 -0.3 -1.7 -2.2 24.9 26.0 27.8 31.0 32.5 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 (1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a 3.2 percent levy on the cash income of all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2008 dollars): 20% $19,264, 40% $38,201, 60% $67,715, 80% $114,258, 90% $165,007, 95% $232,495, 99% $620,442, 99.9% $2,957,751. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0161 2001-06 Tax Cuts with AMT Patch Extended: Financing Proportional to Cash Income Distribution of Federal Tax Change by Cash Income Percentile, 2010 1 Detail Table 4 Percent of Tax Units Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal 6 Average Federal Tax Rate Change (% Points) Under the Proposal 2.4 22.9 17.5 23.3 38.8 19.3 93.6 77.1 82.4 76.6 61.2 79.7 -2.6 -1.1 -1.3 -0.6 1.0 0.0 n/a n/a n/a n/a n/a n/a 278 276 554 413 -2,054 0 47.2 7.3 5.4 2.0 -2.5 0.0 0.4 0.3 0.6 0.4 -1.6 0.0 1.2 4.7 11.5 18.4 64.1 100.0 2.5 1.0 1.0 0.5 -0.7 0.0 7.8 13.9 20.1 22.6 27.9 24.0 35.6 38.9 38.9 68.8 86.7 64.3 61.1 61.1 31.2 13.4 0.1 0.1 0.4 2.6 3.3 n/a n/a n/a n/a n/a -94 -131 -1,092 -34,684 -204,845 -0.3 -0.3 -1.1 -5.3 -6.3 0.0 0.0 -0.2 -1.4 -0.8 14.0 10.0 15.6 24.6 12.3 -0.1 -0.1 -0.3 -1.7 -2.2 24.9 26.0 27.8 31.0 32.5 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2010 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 39,491 33,367 30,543 25,544 22,575 152,206 26.0 21.9 20.1 16.8 14.8 100.0 11,166 29,131 54,009 91,878 292,812 78,753 589 3,784 10,308 20,342 83,747 18,905 10,577 25,348 43,701 71,536 209,065 59,848 5.3 13.0 19.1 22.1 28.6 24.0 3.7 8.1 13.8 19.6 55.2 100.0 4.6 9.3 14.7 20.1 51.8 100.0 0.8 4.4 10.9 18.1 65.7 100.0 11,415 5,515 4,501 1,143 116 7.5 3.6 3.0 0.8 0.1 141,464 201,383 357,460 1,990,331 9,409,657 35,260 52,444 100,600 652,471 3,257,912 106,204 148,939 256,860 1,337,859 6,151,745 24.9 26.0 28.1 32.8 34.6 13.5 9.3 13.4 19.0 9.1 13.3 9.0 12.7 16.8 7.8 14.0 10.1 15.7 25.9 13.1 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a 3.2 percent levy on the cash income of all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2008 dollars): 20% $19,264, 40% $38,201, 60% $67,715, 80% $114,258, 90% $165,007, 95% $232,495, 99% $620,442, 99.9% $2,957,751. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0161 2001-06 Tax Cuts with AMT Patch Extended: Financing Proportional to Cash Income Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2010 1 Detail Table 4 Percent of Tax Units Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Share of Federal Taxes Change (% Points) Percent Under the Proposal 6 Average Federal Tax Rate Change (% Points) Under the Proposal 6.9 26.0 15.1 20.2 27.3 19.3 88.2 73.9 84.9 79.8 72.7 79.7 -2.0 -0.7 -1.1 -0.8 0.8 0.0 n/a n/a n/a n/a n/a n/a 209 168 428 507 -1,325 0 86.4 5.7 5.0 2.9 -1.9 0.0 0.2 0.2 0.4 0.5 -1.3 0.0 0.5 3.4 9.3 17.9 68.8 100.0 2.0 0.6 0.9 0.6 -0.5 0.0 4.3 11.9 18.9 22.2 27.8 24.0 22.0 26.0 34.2 62.0 84.3 77.9 74.0 65.8 38.0 15.7 -0.4 -0.2 0.3 2.6 3.4 n/a n/a n/a n/a n/a 400 238 -605 -30,717 -185,681 1.3 0.5 -0.7 -5.5 -6.5 0.2 0.1 -0.1 -1.5 -0.9 15.3 11.3 16.7 25.5 12.7 0.3 0.1 -0.2 -1.8 -2.2 25.0 26.2 27.7 30.9 32.3 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2010 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 32,821 31,406 29,601 28,883 28,810 152,206 21.6 20.6 19.5 19.0 18.9 100.0 10,461 26,284 47,962 80,213 246,942 78,753 242 2,971 8,629 17,276 70,076 18,905 10,219 23,312 39,333 62,937 176,867 59,848 2.3 11.3 18.0 21.5 28.4 24.0 2.9 6.9 11.8 19.3 59.4 100.0 3.7 8.0 12.8 20.0 55.9 100.0 0.3 3.2 8.9 17.3 70.2 100.0 14,500 7,269 5,664 1,377 136 9.5 4.8 3.7 0.9 0.1 120,998 171,358 306,359 1,728,054 8,294,256 29,894 44,659 85,495 564,039 2,865,534 91,104 126,699 220,864 1,164,015 5,428,722 24.7 26.1 27.9 32.6 34.6 14.6 10.4 14.5 19.9 9.4 14.5 10.1 13.7 17.6 8.1 15.1 11.3 16.8 27.0 13.6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a 3.2 percent levy on the cash income of all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by divi by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2008 dollars): 20% $13,175, 40% $24,896, 60% $42,910, 80% $69,481, 90% $99,405, 95% $140,767, 99% $369,601, 99.9% $1,787,257. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0161 2001-06 Tax Cuts with AMT Patch Extended: Financing Proportional to Cash Income Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2010 1 Detail Table - Single Tax Units 4 Percent of Tax Units Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Share of Federal Taxes Change (% Points) Percent Under the Proposal 6 Average Federal Tax Rate Change (% Points) Under the Proposal 0.7 4.2 2.5 3.4 11.3 4.2 93.2 95.8 97.5 96.6 88.7 94.1 -3.1 -2.2 -2.2 -1.9 2.0 -0.3 61.1 82.1 115.8 132.9 -286.0 100.0 230 376 620 849 -2,230 104 42.6 15.6 9.2 6.5 -4.8 1.0 0.6 0.8 1.0 1.1 -3.4 0.0 2.0 6.1 13.6 21.6 56.6 100.0 2.9 1.9 1.8 1.5 -1.4 0.2 9.7 14.0 21.0 24.2 27.9 23.8 6.0 10.6 19.0 51.9 82.5 94.0 89.4 81.0 48.1 17.5 -1.0 -0.2 2.0 7.1 8.6 41.1 5.7 -70.3 -262.5 -138.7 605 178 -3,025 -53,125 -315,996 2.7 0.5 -5.0 -13.3 -14.3 0.3 -0.1 -0.8 -2.8 -1.5 15.6 10.7 13.3 17.1 8.3 0.7 0.2 -1.4 -4.6 -5.4 26.7 27.4 27.2 30.2 32.3 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2010 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 18,210 14,995 12,823 10,747 8,802 65,926 27.6 22.8 19.5 16.3 13.4 100.0 7,983 19,871 34,970 57,411 158,831 43,953 541 2,411 6,710 13,015 46,592 10,357 7,442 17,460 28,260 44,396 112,239 33,597 4,662 2,207 1,594 339 30 7.1 3.4 2.4 0.5 0.1 86,159 121,836 211,955 1,148,722 5,865,339 22,412 33,194 60,625 400,171 2,209,465 63,747 88,643 151,331 748,552 3,655,873 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 6.8 12.1 19.2 22.7 29.3 23.6 5.0 10.3 15.5 21.3 48.3 100.0 6.1 11.8 16.4 21.5 44.6 100.0 1.4 5.3 12.6 20.5 60.1 100.0 26.0 27.2 28.6 34.8 37.7 13.9 9.3 11.7 13.5 6.1 13.4 8.8 10.9 11.5 5.0 15.3 10.7 14.2 19.9 9.8 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a 3.2 percent levy on the cash income of all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by divi by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2008 dollars): 20% $13,175, 40% $24,896, 60% $42,910, 80% $69,481, 90% $99,405, 95% $140,767, 99% $369,601, 99.9% $1,787,257. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0161 2001-06 Tax Cuts with AMT Patch Extended: Financing Proportional to Cash Income Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2010 1 Detail Table - Married Tax Units Filing Jointly 4 Percent of Tax Units Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Share of Federal Taxes Change (% Points) Percent Under the Proposal 6 Average Federal Tax Rate Change (% Points) Under the Proposal 16.1 40.2 26.6 32.8 36.1 32.1 78.1 59.8 73.4 67.2 63.9 67.2 -0.9 0.0 -0.5 -0.3 0.5 0.2 -6.5 -0.4 -24.4 -27.3 152.2 100.0 119 5 273 226 -1,025 -206 25.6 0.1 2.6 1.1 -1.3 -0.6 0.0 0.0 0.2 0.3 -0.5 0.0 0.2 1.7 6.1 15.7 76.2 100.0 0.9 0.0 0.4 0.2 -0.4 -0.2 4.2 11.5 17.5 21.2 27.8 24.9 31.6 34.0 41.3 65.8 84.9 68.3 66.0 58.7 34.2 15.1 -0.2 -0.1 -0.1 1.8 2.5 -15.5 -7.7 -8.5 183.9 118.3 218 200 276 -23,310 -148,937 0.6 0.4 0.3 -3.8 -4.9 0.2 0.1 0.2 -1.0 -0.7 15.5 12.3 18.9 29.5 14.5 0.2 0.1 0.1 -1.2 -1.7 24.4 25.8 27.9 31.0 32.3 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2010 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 6,695 8,633 11,078 14,945 18,390 60,003 11.2 14.4 18.5 24.9 30.7 100.0 13,865 33,676 61,922 97,550 292,129 131,312 468 3,853 10,542 20,416 82,188 32,861 13,397 29,823 51,381 77,134 209,941 98,451 8,823 4,764 3,826 978 98 14.7 7.9 6.4 1.6 0.2 140,866 195,719 348,056 1,908,327 8,920,566 34,166 50,335 96,672 614,165 3,030,661 106,700 145,384 251,384 1,294,162 5,889,905 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 3.4 11.4 17.0 20.9 28.1 25.0 1.2 3.7 8.7 18.5 68.2 100.0 1.5 4.4 9.6 19.5 65.4 100.0 0.2 1.7 5.9 15.5 76.7 100.0 24.3 25.7 27.8 32.2 34.0 15.8 11.8 16.9 23.7 11.1 15.9 11.7 16.3 21.4 9.8 15.3 12.2 18.8 30.5 15.1 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a 3.2 percent levy on the cash income of all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by divi by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2008 dollars): 20% $13,175, 40% $24,896, 60% $42,910, 80% $69,481, 90% $99,405, 95% $140,767, 99% $369,601, 99.9% $1,787,257. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0161 2001-06 Tax Cuts with AMT Patch Extended: Financing Proportional to Cash Income Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2010 1 Detail Table - Head of Household Tax Units 4 Percent of Tax Units Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Share of Federal Taxes Change (% Points) Percent Under the Proposal 6 Average Federal Tax Rate Change (% Points) Under the Proposal 14.0 54.2 21.2 17.3 11.1 28.4 84.8 45.7 78.6 82.7 88.9 71.2 -1.7 0.2 -0.7 -1.2 -0.6 -0.7 31.4 -6.8 26.7 33.7 16.0 100.0 237 -53 309 758 811 243 -33.8 -1.8 3.3 4.4 1.6 3.5 1.2 -0.7 0.0 0.2 -0.6 0.0 -2.1 12.7 27.9 27.1 34.4 100.0 1.8 -0.2 0.6 1.0 0.4 0.6 -3.5 9.6 18.7 22.9 27.4 17.1 9.5 6.0 16.1 58.2 87.5 90.5 94.0 83.9 41.8 12.6 -1.5 -1.4 -0.9 1.9 2.8 16.4 5.9 5.1 -11.4 -7.3 1,280 1,640 1,817 -20,804 -150,999 4.5 4.1 2.4 -4.1 -5.4 0.1 0.0 -0.1 -0.7 -0.4 12.9 5.1 7.4 9.0 4.3 1.1 1.0 0.6 -1.3 -1.9 25.9 26.7 27.0 30.9 32.3 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2010 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 7,646 7,371 4,983 2,562 1,139 23,751 32.2 31.0 21.0 10.8 4.8 100.0 13,428 30,812 51,446 79,109 189,015 42,212 -700 2,996 9,295 17,392 50,994 6,981 14,129 27,816 42,151 61,716 138,021 35,231 739 208 161 32 3 3.1 0.9 0.7 0.1 0.0 115,628 157,848 291,009 1,592,859 8,179,514 28,607 40,488 76,830 512,823 2,790,609 87,021 117,360 214,179 1,080,036 5,388,905 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -5.2 9.7 18.1 22.0 27.0 16.5 10.2 22.7 25.6 20.2 21.5 100.0 12.9 24.5 25.1 18.9 18.8 100.0 -3.2 13.3 27.9 26.9 35.0 100.0 24.7 25.7 26.4 32.2 34.1 8.5 3.3 4.7 5.0 2.3 7.7 2.9 4.1 4.1 1.8 12.8 5.1 7.5 9.8 4.7 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a 3.2 percent levy on the cash income of all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by divi by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2008 dollars): 20% $13,175, 40% $24,896, 60% $42,910, 80% $69,481, 90% $99,405, 95% $140,767, 99% $369,601, 99.9% $1,787,257. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0161 2001-06 Tax Cuts with AMT Patch Extended: Financing Proportional to Cash Income Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2010 Detail Table - Tax Units with Children Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent 1 Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 22.4 70.3 35.6 48.9 40.9 44.0 75.7 29.6 64.3 51.1 59.1 55.6 -0.7 1.1 0.0 0.4 0.5 0.4 -6.7 22.1 -1.1 18.4 64.0 100.0 105 -333 16 -296 -1,202 -318 -12.3 -8.9 0.1 -1.2 -1.3 -1.3 0.1 -0.3 0.2 0.0 0.0 0.0 -0.6 3.1 11.0 20.0 66.6 100.0 0.7 -1.0 0.0 -0.3 -0.4 -0.3 -5.1 9.7 18.7 22.5 28.8 23.7 38.6 41.4 37.0 79.2 90.5 61.4 58.5 63.0 20.8 9.5 -0.1 0.0 -0.3 2.1 2.4 -3.5 -0.5 -8.1 76.0 40.1 125 36 785 -30,866 -167,310 0.3 0.1 0.7 -4.1 -4.5 0.3 0.2 0.3 -0.7 -0.4 15.4 10.5 16.6 24.2 11.6 0.1 0.0 0.2 -1.4 -1.5 25.5 26.7 29.1 32.2 32.9 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2010 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 9,706 10,212 10,505 9,595 8,188 48,340 20.1 21.1 21.7 19.9 16.9 100.0 14,702 34,956 63,732 105,871 322,351 99,549 -859 3,733 11,881 24,067 93,885 23,900 15,561 31,222 51,851 81,804 228,467 75,649 4,282 1,952 1,576 379 37 8.9 4.0 3.3 0.8 0.1 160,580 229,132 411,928 2,259,920 10,858,536 40,804 61,052 119,198 758,191 3,742,481 119,776 168,079 292,730 1,501,729 7,116,055 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -5.8 10.7 18.6 22.7 29.1 24.0 3.0 7.4 13.9 21.1 54.9 100.0 4.1 8.7 14.9 21.5 51.2 100.0 -0.7 3.3 10.8 20.0 66.5 100.0 25.4 26.7 28.9 33.6 34.5 14.3 9.3 13.5 17.8 8.3 14.0 9.0 12.6 15.6 7.2 15.1 10.3 16.3 24.8 12.0 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 Note: Tax units with children are those claiming an exemption for children at home or away from home. 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a 3.2 percent levy on the cash income of all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2008 dollars): 20% $13,175, 40% $24,896, 60% $42,910, 80% $69,481, 90% $99,405, 95% $140,767, 99% $369,601, 99.9% $1,787,257. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0161 2001-06 Tax Cuts with AMT Patch Extended: Financing Proportional to Cash Income Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2010 Detail Table - Elderly Tax Units Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent 1 Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 0.4 1.6 3.1 7.5 26.5 7.7 96.3 98.4 96.9 92.4 73.5 91.6 -3.0 -2.6 -2.0 -1.0 2.7 0.9 -10.5 -25.0 -20.5 -20.3 175.4 100.0 307 545 777 631 -5,124 -578 124.3 52.5 22.4 5.9 -7.3 -3.4 0.4 1.0 0.8 1.1 -3.3 0.0 0.7 2.6 4.0 12.9 79.9 100.0 3.0 2.5 1.8 0.9 -2.0 -0.7 5.3 7.1 9.9 15.4 25.3 20.5 17.6 23.0 39.5 53.6 77.5 82.4 77.0 60.5 46.4 22.5 0.4 0.8 2.4 5.1 6.1 5.1 8.8 38.9 122.6 67.9 -337 -1,008 -4,892 -51,992 -282,976 -1.5 -2.9 -6.6 -10.3 -11.2 0.2 0.1 -0.7 -2.9 -1.7 11.8 10.6 19.5 38.0 19.1 -0.3 -0.7 -1.8 -3.4 -4.0 19.6 21.9 24.7 29.6 31.3 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2010 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 5,775 7,717 4,454 5,413 5,771 29,149 19.8 26.5 15.3 18.6 19.8 100.0 10,390 22,198 42,782 73,004 259,004 79,238 247 1,038 3,461 10,622 70,604 16,813 10,143 21,160 39,322 62,382 188,400 62,425 2,562 1,471 1,340 397 40 8.8 5.1 4.6 1.4 0.1 110,558 155,282 279,444 1,530,982 7,145,995 22,039 35,006 73,763 504,801 2,520,342 88,519 120,275 205,681 1,026,181 4,625,653 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.4 4.7 8.1 14.6 27.3 21.2 2.6 7.4 8.3 17.1 64.7 100.0 3.2 9.0 9.6 18.6 59.8 100.0 0.3 1.6 3.2 11.7 83.1 100.0 19.9 22.5 26.4 33.0 35.3 12.3 9.9 16.2 26.3 12.5 12.5 9.7 15.2 22.4 10.3 11.5 10.5 20.2 40.9 20.8 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a 3.2 percent levy on the cash income of all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2008 dollars): 20% $13,175, 40% $24,896, 60% $42,910, 80% $69,481, 90% $99,405, 95% $140,767, 99% $369,601, 99.9% $1,787,257. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.