January, 2015 Quali…cation Exam: Inter…eld Microeconomics

advertisement

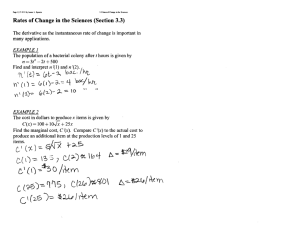

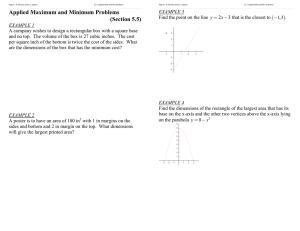

Quali…cation Exam: Inter…eld Microeconomics Dr. Fadlon, January 2015 January, 2015 Quali…cation Exam: Inter…eld Microeconomics Answer all of the following 6 questions. Write your answers in the space provided following each question. Before you write your answer, read the question carefully. Show enough of your work so that your reasoning can be followed. Student Name: 2 1. [20 pt] Janice Doe consumes two goods, X and Y. Janice has a utility function given by the expression: U = 4X 0:5 Y 0:5 : The current prices of X and Y are $25 and $50, respectively. Janice currently has an income of $750 per time period. (a) Write an expression for Janice’s budget constraint. (b) Calculate the optimal quantities of X and Y that Janice should choose, given her budget constraint. Graph your answer. (c) Suppose that the government rations purchases of good X such that Janice is limited to 10 units of X per time period. Assuming that Janice chooses to spend her entire income, how much Y will Janice consume? Construct a diagram that shows the impact of the limited availability of X. Is Janice satisfying the usual conditions of consumer equilibrium while the restriction is in e¤ect? (d) Calculate the impact of the ration restriction on Janice’s utility. 3 4 2. [15 pt] Joe’s Pig Palace sells barbecue plates for $4.5 each, and serves an average of 525 customers per week. During a recent promotion, Joe cut his price to $3.5 and observed an increase in sales to 600 plates per week. (a) Calculate Joe’s arc price elasticity of demand. (b) Joe is considering permanently lowering his price to $4 to increase revenue. How many plates should Joe expect to sell at the new price? Does the move make sense in the light of Joe’s desire to increase revenue? 5 6 3. [20 pt] A paper company dumps nondegradable waste into a river that ‡ows by the …rm’s plant. The …rm estimates its production function to be: Q = 6KW; where Q = annual paper production measured in pounds, K = machine hours of capital, and W = gallons of polluted water dumped into the river per year. The …rm currently faces no environmental regulation in dumping waste into the river. Without regulation, it costs the …rm $7.5 per gallon dumped. The …rm estimates a $30 per hour rental rate on capital. The operating budget for capital and waste water is $300,000 per year. (a) Determine the …rm’s optimal ratio of waste water to capital. (b) Given the …rm’s $300,000 budget, how much capital and waste water should the …rm employ? How much output will the …rm produce? (c) The state environmental protection agency plans to impose a $7.5 e- uent fee for each gallon that is dumped. Assuming that the …rm intends to maintain its pre-fee output, how much capital and waste water should the …rm employ? How much will the …rm pay in e- uent fees? What happens to the …rm’s cost as a result of the e- uent fee? 7 8 4. [12 pt] In the local cotton market, there are 1,000 producers that have identical short-run cost functions. They are: C(q) = 0:025q 2 + 200; where q is the number of bales produced each period. If the local cotton market is perfectly competitive, what is each cotton producer’s short-run supply curve? Derive the local market supply curve of cotton. 9 10 5. [13 pt] Hale’s One Stop and Auto Service competes with Murray’s Gas Mart. The local demand is: Qd = 25 10P Both …rms sell exactly the same quality of gasoline. Thus, if the …rms charge a di¤erent price, the lower price …rm will capture the entire market share. If the …rms charge the same price, they will split the market share. The marginal cost functions are both constant at $1.25. If the …rms compete by setting price, what is the market output level? What is the market price level? 11 12 6. [20 pt] In a small town, two fast food restaurants A and B are engaged in a price competition. Each restaurant sell a hamburger that is a bit di¤erent than their competitor. The two restaurants compete by choosing price. Their demand functions are: Restaurant A’s demand: QA = 14 PA 0:4PB Restaurant B’s demand: QB = 14 PB 0:4PA where QA and QB are quantities demanded of hamburgers (in thousands). Both restaurants have the same marginal costs of $4, but zero …xed costs. (a) What is the relationship between the two goods (i.e., complement, substitute)? Explain (b) For each restaurant, …nd the best response functions. (c) Find equilibrium prices, quantities and pro…ts. (d) Now suppose that the two restaurants decided to cooperate and charge a uniform price that will maximize their pro…ts. Find the cooperation price, quantities produced by each restaurant and pro…ts. (e) What is the e¤ect of the cooperation on consumer surplus? Explain intuitively the result. (f) If restaurant B charges the price you found in part d, what is the optimal price for restaurant A? Do you think the cooperation would last? 13 14 15