The copyright to this article is held by the Econometric Society, . It may be downloaded, printed and

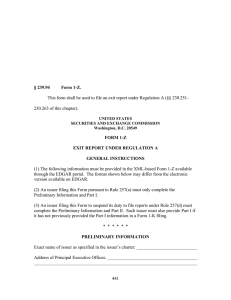

advertisement