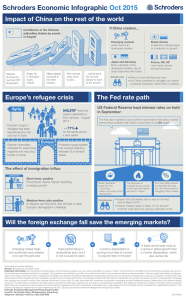

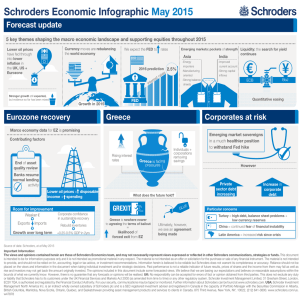

Global Market Perspective Schroders Economic and Asset Allocation Views Q4 2015

advertisement