Schroder Global Emerging Markets Fund Fund Summary Overview

advertisement

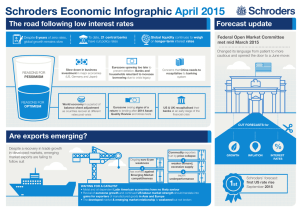

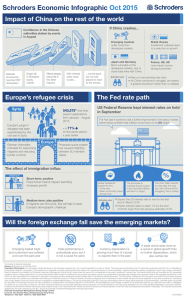

Fund Summary Schroder Global Emerging Markets Fund Overview The Schroder Global Emerging Markets Fund provides exposure to a range of developing countries around the world characterised by a stronger growth potential than mature economies. These emerging countries provide the opportunity for premium returns although with higher risks relative to developed countries. The investable universe is commonly defined by the MSCI Emerging Markets Index which covers 21 countries and over 800 stocks.* Key features –– Opportunities in developing countries around the world which are typically characterised by a stronger growth potential than mature economies, offering the opportunity for premium returns but with higher risk attached. –– Experienced team consisting of 40 investment professionals with an average of 14 years investment experience.* –– Disciplined investment process targeting to add value from both country allocation and stock selection. –– Strong proprietary stock research database which provides investment professionals with instant access by intranet to both internal and external research. * As at 31 Dec 2014 Portfolio summary Performance objective o outperform the MSCI Emerging Markets Index (net dividends reinvested) T after fees over 3 year rolling periods Country weights^ +/– 5% of country weight in the MSCI Emerging Markets Index Sector weights No formal guidelines Tracking error 2 – 8% pa. Target 5% pa No. securities Typically 90 – 130 ^ Investment process Investment guidelines are as at time of investment and subject to change without notice. Inputs Portfolio construction Country analysis – Quantitative model with judgemental overlay Country allocation (50%) Risk management and implementation Model portfolio Stock analysis – Fundamental Portfolio implementation Portfolio execution and monitoring Stock selection (50%) We believe that emerging stock markets are inefficient and provide strong potential for adding value through active fund management. This value can be extracted through both country and stock selection. We believe that it is inappropriate to apply a systematic style bias across so many countries at such different stages of development. However, given our strong analytical resources we would expect to generally have a bias towards medium capitalisation stocks which should provide extra return potential. Our aim is to achieve returns with the minimum level of risk through a pro-active approach to risk control. We believe that applying a systematic, disciplined approach, with a strong team culture increases our ability to add value. Fund Summary Schroder Global Emerging Markets Fund Investment process (cont.) Schroders has a balanced approach to investing in Emerging Market equities. We use a mix of top down analysis and bottom up stock selection and look to derive 50% of our added value from country selection and 50% from stock selection. Our investment process begins with gathering and analysing of information on both countries and stocks which is then used to decide allocations for the portfolio. Country allocation is driven by our proprietary quantitative model to which the team applies judgmental overlay in a controlled manner. Fundamental research from our team of locally based analysts forms the basis of the stock selection process and portfolios are constructed by our three global Emerging Market fund managers focusing on their highest conviction ideas. We believe that risk management is important in Emerging Markets and have active risk control processes in place at the portfolio construction stage, including a sophisticated proprietary risk system and a comprehensive set of portfolio reviews. What are the risks? Fund features Risks associated with investments in emerging markets include but are not limited to significantly greater price volatility than in developed markets; substantially less liquidity and significantly smaller market capitalisation of securities markets; more substantial government intervention in the economy; higher rates of inflation; less government supervision and regulation of securities markets and participants in those markets and a higher degree of political uncertainty. Schroders actively reassesses and manages risk at every stage of the investment process. For further details about the risks of investing in this Fund please refer to the Product Disclosure Statement. Inception date 25 October 2006 Valuation Normally every business day Minimum investment $25,000 Management costs (ICR) 1.40% pa Buy/sell spread^ 0.40% on application; 0.40% on redemption Entry/exit fees Nil Distributions Usually the last business day of June and December mFund code SCH41 ^ Refer to website. Subject to change. Contact Us Please call Client Services on 1300 136 471 or email us at info.au@schroders.com Or visit us at www.schroders.com.au Investment in the Schroder Global Emerging Markets Fund may be made on an application form in the current Product Disclosure Statement (PDS) which is available from Schroder Investment Management Australia Limited (ABN 22 000 443 274, AFS Licence 226274) website www.schroders.com.au. The information contained in this flyer is general information only. It does not contain and should not be taken as containing any financial product advice or financial product recommendations. Before acting on the information contained in this flyer you should obtain a copy of the PDS and consider the appropriateness of the information in regard to your objective, financial situation and needs before making any decision about whether to invest, or continue to hold. The repayment of capital and performance of the Fund is not guaranteed by Schroders or any company in the Schroders Group. Opinions constitute our judgement at the time of issue and are subject to change. Past performance is not an indicator of future performance. Investment guidelines represented are internal only and are subject to change without notice. For security reasons telephone calls may be recorded. April 2015 SC991