4‐Aug‐11 PRELIMINARY RESULTS Lowest Quintile Second Quintile

advertisement

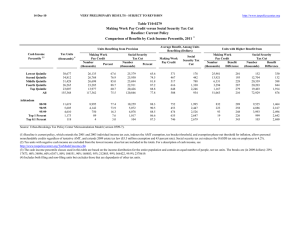

4‐Aug‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0261 Tax Benefits of the American Opportunity Tax Credit, Lifetime Learning Credit, Tuition and Fees Deduction and the Student Loan Interest Deduction Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile, 2011 1 Detail Table Percent of Tax Units4 Cash Income Percentile 2,3 Without Benefit With Benefit Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Benefit as Percent of After‐Tax Income5 Average Benefit Share of Total Benefits Dollars Share of Federal Taxes Percent of Tax With Credits and Deductions Without Credits and Deductions Average Federal Tax Rate6 With Credits and Deductions Without Credits and Deductions 6.8 10.6 14.5 18.1 14.7 12.1 93.2 89.4 85.6 81.9 85.3 87.9 0.6 0.4 0.4 0.3 0.1 0.2 11.3 17.6 22.8 26.4 21.7 100.0 54 100 148 207 196 128 71.0 7.0 2.6 1.6 0.3 1.1 0.2 2.7 9.3 18.2 69.5 100.0 0.3 2.9 9.5 18.3 69.0 100.0 0.8 5.8 12.5 16.6 23.1 18.1 1.4 6.2 12.9 16.8 23.1 18.3 21.7 13.3 2.3 1.0 0.1 78.4 86.7 97.7 99.1 99.9 0.3 0.1 0.0 0.0 0.0 15.7 5.3 0.7 0.1 0.0 280 196 31 9 1 1.1 0.5 0.0 0.0 0.0 15.1 11.3 17.5 25.6 13.1 15.2 11.3 17.3 25.3 13.0 19.2 21.1 23.0 27.6 30.8 19.4 21.2 23.0 27.6 30.8 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2011 1 Tax Units4 Cash Income Percentile 2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Pre‐Tax Income Percent of Total Average (dollars) 43,661 36,819 32,344 26,761 23,243 163,869 26.6 22.5 19.7 16.3 14.2 100.0 9,187 24,603 44,639 79,524 251,746 65,357 11,775 5,676 4,619 1,173 120 7.2 3.5 2.8 0.7 0.1 130,276 183,757 320,086 1,530,773 6,859,873 Federal Tax Burden Percent of Total After‐Tax Income 5 Average Federal Tax Rate 6 Average (dollars) Percent of Total Average (dollars) 3.8 8.5 13.5 19.9 54.6 100.0 77 1,420 5,592 13,168 58,040 11,841 0.2 2.7 9.3 18.2 69.5 100.0 9,111 23,183 39,047 66,356 193,707 53,516 4.5 9.7 14.4 20.3 51.3 100.0 0.8 5.8 12.5 16.6 23.1 18.1 14.3 9.7 13.8 16.8 7.7 24,948 38,713 73,520 422,727 2,113,515 15.1 11.3 17.5 25.6 13.1 105,329 145,044 246,566 1,108,046 4,746,357 14.1 9.4 13.0 14.8 6.5 19.2 21.1 23.0 27.6 30.8 Percent of Total Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). Number of AMT Taxpayers (millions). Baseline: 4.3 Proposal: 4.3 * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal is current law without the American Opportunity Tax Credit, Lifetime Learning Credit, tuition and fees deduction and the student loan interest deduction. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2011 dollars): 20% $16,812; 40% $33,542; 60% $59,486; 80% $103,465; 90% $163,173; 95% $210,998; 99% $532,613; 99.9% $2,178,886. (4) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (5) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.