Entries for Uncollectible Accounts

advertisement

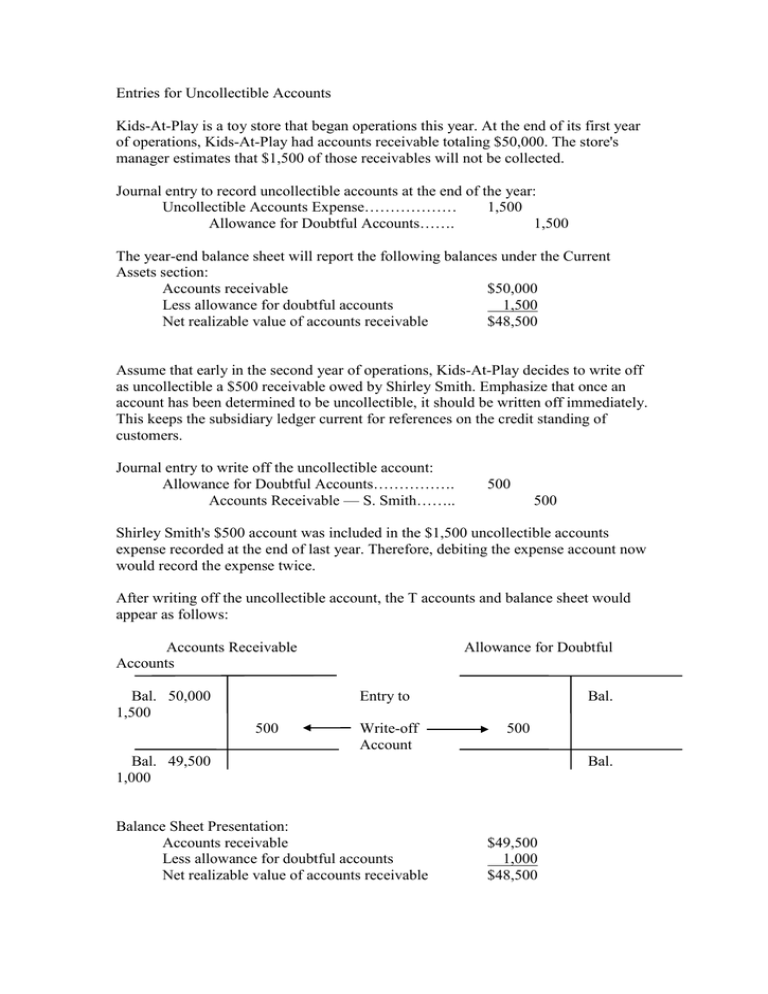

Entries for Uncollectible Accounts Kids-At-Play is a toy store that began operations this year. At the end of its first year of operations, Kids-At-Play had accounts receivable totaling $50,000. The store's manager estimates that $1,500 of those receivables will not be collected. Journal entry to record uncollectible accounts at the end of the year: Uncollectible Accounts Expense……………… 1,500 Allowance for Doubtful Accounts……. 1,500 The year-end balance sheet will report the following balances under the Current Assets section: Accounts receivable $50,000 Less allowance for doubtful accounts 1,500 Net realizable value of accounts receivable $48,500 Assume that early in the second year of operations, Kids-At-Play decides to write off as uncollectible a $500 receivable owed by Shirley Smith. Emphasize that once an account has been determined to be uncollectible, it should be written off immediately. This keeps the subsidiary ledger current for references on the credit standing of customers. Journal entry to write off the uncollectible account: Allowance for Doubtful Accounts……………. Accounts Receivable — S. Smith…….. 500 500 Shirley Smith's $500 account was included in the $1,500 uncollectible accounts expense recorded at the end of last year. Therefore, debiting the expense account now would record the expense twice. After writing off the uncollectible account, the T accounts and balance sheet would appear as follows: Accounts Receivable Accounts Bal. 50,000 1,500 Allowance for Doubtful Entry to 500 Write-off Account Bal. 500 Bal. 49,500 1,000 Balance Sheet Presentation: Accounts receivable Less allowance for doubtful accounts Net realizable value of accounts receivable Bal. $49,500 1,000 $48,500 Point out that the net realizable value of accounts receivable did not change. Kids-AtPlay still expects to collect $48,500 of its receivables. All that has changed is that the company now knows that Shirley Smith, who owes $500, is one credit customer who will probably not pay. There still is approximately $1,000 in bad debts left to be discovered. If George Jackson, will not be able to pay his $100 account receivable. Allowance for Doubtful Accounts…………….. Accounts Receivable—G. Jackson……. 100 100 Assume that after Kids-At-Play has written off George Jackson's account, he does pay the $100 he owes. Step 1: The account must be reinstated. Accounts Receivable—G. Jackson…………… Allowance for Doubtful Accounts……. 100 Step 2: The cash received is recorded. Cash…………………………………………… Accounts Receivable—G. Jackson…… 100 100 100