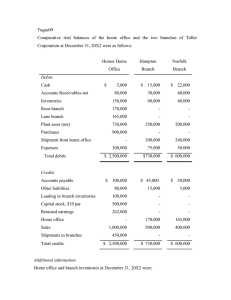

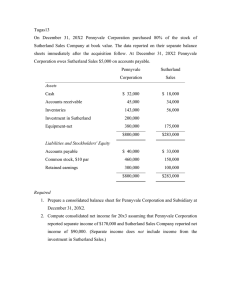

Tugas19 Comparative separate company and consolidated ... and its 80%-owned subsidiary, Silky Corporation, at year end 20X2...

advertisement

Tugas19 Comparative separate company and consolidated balance sheets for Pharm Corporation and its 80%-owned subsidiary, Silky Corporation, at year end 20X2 are as follows : Pharm Silky Consolidated $ 180,000 $ 40,000 $ 220,000 200,000 160,000 360,000 70,000 150,000 170,000 Plant assets-net 500,000 350,000 850,000 Investment in Silky 630,000 - - - - 150,000 $1,580,000 $700,000 $1,750,000 $ 80,000 $ 50,000 $ 120,000 100,000 50,000 110,000 1,000,000 500,000 1,000,000 400,000 100,000 400,000 - - 120,000 $1,580,000 $700,000 Assets Cash Inventories Other current assets Goodwill Equities Accounts payable Dividends payable Capital stock, $10 par Retained earnings Minority interest $1,750,000 Investigation reveals that the consolidated balance sheet is in error because Pharm Corporation has not amortized goodwill and it has not eliminated unrealized inventory profits. The investment in silky was acquired on January 1, 20X1at a price $150,000 in excess of the book value and fair value. The original plan was to amortize goodwill over 20 years. Unrealized profits in silky’s December 31, 20X1 and 20X2 inventories of merchandise acquired from Pharm were $30,000 and $50,000, respectively. Intercompany receivables of $10,000 are included in other current assets. Required : Prepare consolidated balance sheet working papers on December 31, 20X2 for Pharm Corporation and Subsidiary.