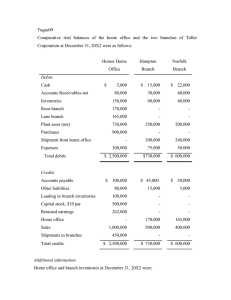

Consolidated Financial Statements Problem

advertisement

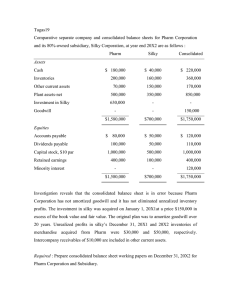

Tugas13 On December 31, 20X2 Pennyvale Corporation purchased 80% of the stock of Sutherland Sales Company at book value. The data reported on their separate balance sheets immediately after the acquisition follow. At December 31, 20X2 Pennyvale Corporation owes Sutherland Sales $5,000 on accounts payable. Pennyvale Sutherland Corporation Sales $ 32,000 $ 18,000 45,000 34,000 Inventories 143,000 56,000 Investment in Sutherland 200,000 Equipment-net 380,000 175,000 $800,000 $283,000 $ 40,000 $ 33,000 Common stock, $10 par 460,000 150,000 Retained earnings 300,000 100,000 $800,000 $283,000 Assets Cash Accounts receivable Liabilities and Stockholders' Equity Accounts payable Required 1. Prepare a consolidated balance sheet for Pennyvale Corporation and Subsidiary at December 31, 20X2. 2. Compute consolidated net income for 20x3 assuming that Pennyvale Corporation reported separate income of $170,000 and Sutherland Sales Company reported net income of $90,000. (Separate income does not include income from the investment in Sutherland Sales.)