U.S. TREAS Form treas-irs-851-2003

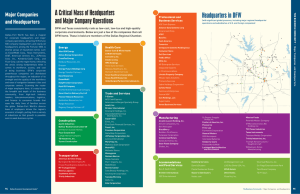

advertisement

U.S. TREAS Form treas-irs-851-2003 Form 851 Affiliations Schedule (Rev. December 2003) 䊳 Department of the Treasury Internal Revenue Service Tax year ending OMB No. 1545-0025 File with each consolidated income tax return. , Employer identification number Name of common parent corporation Number, street, and room or suite no. (If a P.O. box, see instructions.) City or town, state, and ZIP code Part I Corp. No. 1 Overpayment Credits, Estimated Tax Payments, and Tax Deposits (See instructions.) Name and address of corporation Portion of overpayment credits and estimated tax payments Employer identification number Portion of tax deposited with Form 7004 Common parent corporation Subsidiary corporations: 2 3 4 5 6 7 8 9 10 䊳 Totals (Must equal amounts shown on the consolidated tax return.) Part II Corp. No. Principal Business Activity, Voting Stock Information, Etc. (See instructions.) Principal business activity (PBA) PBA Code No. Did the subsidiary make any nondividend distributions? Yes No Stock holdings at beginning of year Number of shares Percent of Percent of Owned by voting corporation value power no. Common parent corporation: 1 Subsidiary corporations: 2 % % 3 % % 4 % % 5 % % 6 % % 7 % % 8 % % 9 % % 10 For Paperwork Reduction Act Notice, see instructions. % Cat. No. 16880G Form % 851 (Rev. 12-2003)