Document 14463371

advertisement

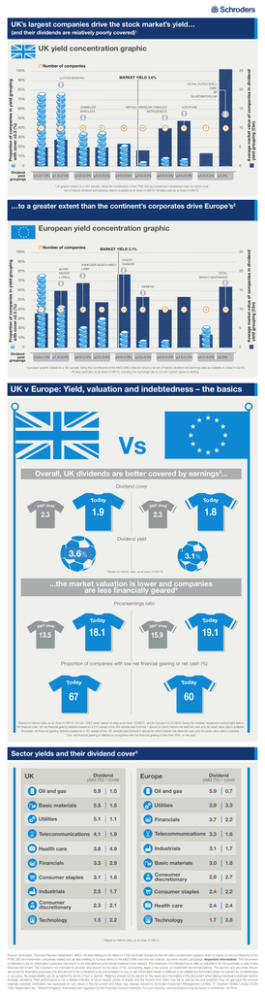

UK’s largest companies drive the stock market’s yield… (and their dividends are relatively poorly covered)1 Number of companies 100% 25 MARKET YIELD 3.6% LLOYDS BANKING Proportion of companies in yield grouping with cover >2.5 (%) 90% ROYAL DUTCH SHELL HSBC BP GLAXOSMITHKLINE 80% 70% BRITISH AMERICAN TOBACCO ASTRAZENECA SABMILLER BARCLAYS 60% 20 VODAFONE 15 50% 40% 37 30 53 35 30 20 21 13 7 18 10 30% 20% 5 10% 0 Average market value of companies in dividend yield grouping (£bn) UK yield concentration graphic 0 Dividend yield groupings >0.0<1.5% >1.5<2.0% 1 >2.0<2.5% >2.5<3.0% >3.0<3.5% >3.5<4.0% >4.0<4.5% >4.5<5.0% >5.0<5.5% >5.5% UK graphic based on a 264 sample, being the constituents of the FTSE 350 (ex investment companies) index for which a full set of historic dividend and earnings data is available as at close 31/08/15. All data used as at close 31/08/15. …to a greater extent than the continent’s corporates drive Europe’s2 Number of companies 100% Proportion of companies in yield grouping with cover >2.5 (%) 90% 70% 25 SANOFI DAIMLER ANHEUSER-BUSCH INBEV LVMH BAYER INDITEX L'OREAL 80% MARKET YIELD 3.1% TOTAL BANCO SANTANDER SIEMENS 60% 20 15 50% 40% 21 30 27 22 24 12 12 9 4 20 10 30% 20% 5 10% 0 Average market value of companies in dividend yield grouping (£bn) European yield concentration graphic 0 Dividend yield groupings >0.0<1.5% >1.5<2.0% 2 >2.0<2.5% >2.5<3.0% >3.0<3.5% >3.5<4.0% >4.0<4.5% >4.5<5.0% >5.0<5.5% >5.5% European graphic based on a 181 sample, being the constituents of the MSCI EMU index for which a full set of historic dividend and earnings data as available at close 31/08/15. All data used also as at close 31/08/15, including the exchange rate to convert market values to sterling. UK v Europe: Yield, valuation and indebtedness – the basics Vs Overall, UK dividends are better covered by earnings3... Dividend cover Today 2007 peak 1.9 2.3 Today 2007 peak 1.8 2.3 Dividend yield 3.6% 3.1% 3 Based on historic data, as at close 31/08/15. ...the market valuation is lower and companies are less financially geared4 Price/earnings ratio Today 2007 peak 18.1 13.5 Today 2007 peak 19.1 15.9 Proportion of companies with low net financial gearing or net cash (%) Today Today 67 60 4 Based on historic data, as at close 31/08/15. For UK, ‘2007 peak’ based on data as at close 15/06/07, and for Europe it is 31/05/07 being the markets’ respective closing highs before the financial crisis. UK net financial gearing statistics based on a 219 subset of the 264 sample (see footnote 1 above) for which historic net debt/net cash and net asset value data is available. European net financial gearing statistics based on a 151 subset of the 181 sample (see footnote 2 above) for which historic net debt/net cash and net asset value data is available. ‘Low’ net financial gearing is defined as companies with net financial gearing of less than 50%, or net cash. Sector yields and their dividend cover5 UK Dividend yield (%) / cover Europe Dividend yield (%) / cover Oil and gas 5.9 1.0 Oil and gas 5.9 0.7 Basic materials 5.5 1.5 Utilities 3.9 3.3 Utilities 5.1 1.1 Financials 3.7 2.2 Telecommunications 4.1 1.9 Telecommunications 3.3 1.6 Health care 3.8 4.9 Industrials 3.1 1.7 Financials 3.3 2.9 Basic materials 3.0 1.8 Consumer staples 3.1 1.6 Consumer discretionary 2.8 2.7 Industrials 2.5 1.7 Consumer staples 2.4 2.2 Consumer discretionary 2.3 2.1 Health care 2.4 2.4 Technology 1.5 2.2 Technology 1.7 2.8 5 Based on historic data, as at close 31/08/15. Source: Schroders, Thomson Reuters Datastream, MSCI. All data relating to UK refers to FTSE All-Share (except for the UK yield concentration graphic which is based on the constituents of the FTSE 350 (ex investment companies index)) and all data relating to Europe refers to the MSCI EMU and the two indices’ top-level industry groupings. Important Information: This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. No responsibility can be accepted for errors of fact or opinion. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results, prices of shares and the income from them may fall as well as rise and investors may not get back the amount originally invested. Schroders has expressed its own views in this document and these may change. Issued by Schroder Investment Management Limited, 31 Gresham Street, London EC2V 7QA. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority. For your security, communications may be taped or monitored. w47616