CIS March 2011 Exam Diet Examination Paper 1.2: Corporate Finance

advertisement

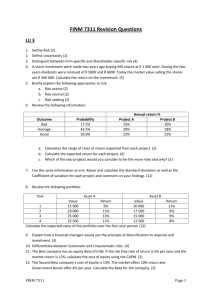

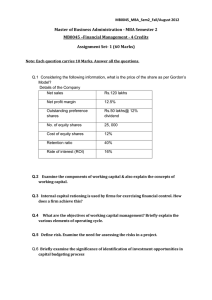

CIS March 2011 Exam Diet Examination Paper 1.2: Corporate Finance Equity Valuation and Analysis Fixed Income Valuation and Analysis Corporate Finance (1 - 20) 1. Beta is a measure of: A. The total risk of an asset or portfolio. B. Unsystematic risk. C. Unique risk. D. Systematic risk. 2. Which of the following is a characteristic of equity finance in a company? A. Ordinary shareholders have voting rights. B. Equity finance is not part of the permanent capital of the company. C. Ordinary shareholders have unlimited liability. D. Ordinary shareholders are entitled to a fixed dividend. 3. A company plans to pay its first dividend of 10k in two years’ time with dividends expected to grow thereafter at a rate of 10% per annum. If the relevant cost of equity capital is 15%, what should be the current market value of the share to the nearest penny? A. 100k B. 174k C. 182k D. 200k 4. Which of the following cannot be an objective of a firm? A. To maximize profit. B. To maximize sales. C. To maximize shareholder’s wealth. D. None of the above. 5. Which of the following is the most likely source of financing a small business? A. Bank loan. B. Leasing. C. Bonds. D. Proprietor’s personal savings. 6. If a company does not have any part of its capital in form of preference shares or loan stock, it is said to be: A. Geared. B. Ungeared. C. Relatively ungeared. D. Highly geared. 7. Identify which of the following statements is incorrect: A. If stock is too low; there is a risk of interruption in production. B. If stock is too low; there could be frequent ordering cost. C. If stock is too low; there could be high stock out cost. D. If stock is too low; there could be high carrying cost. 8. Which of the following instruments is not currently traded on the Nigerian Stock Exchange? A. Ordinary shares. B. Bonds. C. Rights. D. Warrants. 9. Which of the following should be taken into consideration in analyzing relevant cash flows for capital budgeting? A. Opportunity cost. B. Sunk cost. C. Non-incremental cost. D. Interest cost. 10. What is agency relationship? A. The relationship between B. The relationship between C. The relationship between D. The relationship between shareholders and professional managers. executive managers and staff. the firm and its clients. the firm and the society. 11. Effective credit control policy requires careful consideration of which of the following? I. II. III. IV. Credit period. Cost of cash discounts. Collection policy. Assessment of credit worthiness. A. B. C. D. II, III and IV only I, III and IV only I, II and III only I, II, III and IV 12. If the beta of Leo is 0.6, the risk-free rate is 3% and the market rate of return is 10%, what is the expected rate of return on Leo? A. 4.2% B. 7.2% C. 9.0% D. 10.8% 13. Which of the following statements is true with respect to financial leverage? A. As variable costs increase as a proportion of total costs, financial leverage will increase. B. As equity increases as a proportion of total capital, financial leverage will increase. C. The existence of any fixed costs will cause EBIT to become more volatile than sales. D. Fixed interest costs will cause net income to become more volatile than EBIT. 14. Which of the following statements is true in respect of the issuance of dividend by a company? A. It could be paid in stock. B. It could be paid in rights. C. It could be paid in cash. D. Both A and C are correct 15. MM Proposition II implies that: A. The expected return on equity for a firm is negatively related to its debt to equity ratio. B. The expected return on equity for a firm is positively related to its debt to equity ratio. C. The value of a levered firm is equal to the value of an equivalent unlevered firm. D. The riskiness of equity increases with leverage. 16. A firm may impose on itself internal capital rationing for which of the following reasons? A. To expand the shareholding base of the firm. B. As a strategy to grow organically. C. To maximally utilize expansion potentials. D. To increase gearing. 17. Which of the following statements is correct about participating preferred stock? A. It allows owners to participate in the company’s profit. B. It guarantees a dividend payment. C. It never allows payment of a fixed dividend. D. It may be called by the company. 18. Retained earnings of a company represent the total of earnings held since the company was formed less any dividends paid out to stockholders. A. The earnings are also called earned surplus. B. Operating losses in any year reduce retained earnings from previous years. C. Both statements A and B are true. D. None of the above is correct. 19. Rights issues are used to allow current shareholders to: A. To maintain their present percentage of ownership. B. Buy additional stock at a price lower than current market price. C. Subscribe to future issues of new stock. D. Both A and B. 20. Stock dividends are frequently paid by companies that are: A. Well established. B. Considered to be growth companies. C. In a turnaround situation. D. Cash rich. Equity Valuation and Analysis (21 - 40) 21. Stock market indexes are used for the following purposes except: A. To measure the general performance of the market. B. To perform fundamental analysis. C. To predict future price movement. D. To analyze factors underlying stock price market. 22. Which of the following factors can affect stock prices? A. The national economy. B. The political situation in the country. C. Global macroeconomic factors. D. All of the above. 23. Suppose that the average P/E multiple in the oil industry is 20. Dominion Oil is expected to have an EPS of N3.00 in the coming year. What would the intrinsic value of Dominion Oil stock be? A. N28.12 B. N35.55 C. N60.00 D. N72.00 24. The rights of equity shareholders include which of the following? I. II. III. IV. Right to exercise control through voting. Residual right to earnings. Pre-emptive right to maintain proportion of ownership through rights issue. Right of residual claim on the assets of the company. A. B. C. D. I and III only II and III only I, II and III only I, II, III and IV 25. An increase in which of the following variables is most likely to increase the value of a company? A. Long term sustainable growth rate. B. Investors’ required return. C. Dividend yield. D. Interest rate. 26. When computing free cash flow to the firm (FCFF) from earnings before interest and tax (EBIT), how would you treat net borrowings? A. It should be added to gross cash flow. B. It should be deducted before accounting for tax and interest. C. It is irrelevant to the calculation and should be ignored. D. It should be treated just like interest expenses. 27. Which of the following types of mutual funds concentrate heavily on high-interest and high-dividend-yielding securities? A. Industry-specialized fund. B. Income fund. C. Balance fund. D. Growth fund. 28. Which of the following best describes capital gains? A. Taxable profit that occurs when a company decides to capitalize some of its accumulated reserves. B. When a company decides on an upward revaluation its fixed assets. C. Total dividends shareholders receive in the duration of his share holding. D. Profit resulting between the purchase and sale of securities. 29. Which of the following is the most likely implication of a high P/E ratio, all other things being equal? The firm is: A. Growing quickly. B. Growing at the same speed as the average company. C. Growing slowly. D. Not grow. 30. A fraction of earnings reinvested in the firm is referred to as: A. Dividend payout ratio. B. Retention rate. C. Plowback ratio. D. B and C. 31. Which of the following statements is true about the Gordon’s model? A. It is valid only when g is less than k. B. It is valid only when k is less than g. C. It assumes zero growth of dividends. D. Its variables can easily be derived with accuracy. 32. Low Tech Company has an expected ROE of 10%. If the firm follows a policy of paying 40% of earnings in the form of dividends, what will the firm’s growth rate be? A. 3.0% B. 4.8% C. 6.0% D. 7.2% 33. A preferred stock will pay a dividend of N3.00 in the upcoming year, and every year thereafter, dividends are not expected to grow. You require a return of 9% on this stock. Use the constant growth dividend discount model to calculate the intrinsic value of this preferred stock. A. N33.33 B. N0.27 C. N31.82 D. N56.25 34. What is the most appropriate discount rate to use when applying a Free Cash flow to Equity (FCFE) valuation model? A. Required rate of return on equity. B. WACC. C. Risk-free rate. D. A or C depending on the debt level of the firm. 35. Analysts commonly consider all of the following to be indicators that the market is overvalued except: A. High average dividend yield. B. High average ratio of stock prices to corporate sales. C. High average P/E ratio. D. High average price-to-book ratio. 36. Richie Global Limited has total ordinary shares in issue of 60 million with a par value of N1.00 each. The company has recently declared gross dividend amounting to N1.5 million. Its shares are currently trading at N5.20 each. Based on the information above, calculate the dividend per share of Richie Global Limited. A. 1.5k B. 2.5k C. N1.5 D. N3.0 37. Which of the following statements best characterizes defensive stocks? A. Defensive stocks are conservative with respect to how much dividends they pay out to shareholders. B. Defensive stocks makes reference to how conservative a company is within an industry, therefore, there is a conservative stock from every industry. C. Defensive stocks generally consist of companies that supply goods and services to the military. D. Defensive stocks exhibit a low correlation with respect to movements in the market. 38. Which of the following is not a characteristic of an investment company? A. It allows investors’ holdings to remain liquid. B. It allows investors to make their own specific investment choices. C. It allows investors to diversify their holdings, regardless of size. D. It gives investors professional management of their holdings. 39. Limited liability is often discussed as a reason to own ordinary shares. This means: A. Stock value is guaranteed. B. Loss is limited to the amount of stock purchase price. C. Ordinary shares have less risk than a bond held to maturity. D. Ordinary shares always pay dividend. 40. A stock split, such as 2 for 1, means: A. An investor will have twice as many shares. B. The value of each share is reduced by one-half. C. Total par value of stock is not affected. D. All of the above. Fixed Income Valuation and Analysis (41 - 60) 41. Zero coupon bonds have which of the following characteristics: A. Interest is paid every six months. B. They have very stable resale price. C. They have no reinvestment risk. D. They should not be purchased. 42. Which of the following is a characteristic of revenue bonds? A. It is backed by the full faith and credit of the issuer. B. It is paid from the income generated by a specific project. C. It involves competitive underwriting. D. All of the above. 43. A speculative bond issue, sometimes called junk bond, will have a Standard and Poor’s rating of: A. BBB or lower. B. C or lower. C. BB or lower. D. NR. 44. Which of the following is not a limitation of current yield? A. It only considers the coupon flows. B. It ignores the timing of cash flows. C. It assumes the coupon can be reinvested at the current yield till maturity. D. None of the above. 45. The price of a fixed income security moves: A. In the opposite direction of a change in interest rate. B. Along the direction of a change in interest rate. C. Based on other factors apart from change in interest rate. D. Only based on changes in the credit rating of the issuer. 46. The term inverted yield means: A. Long term bonds have a higher yield. B. Long term bonds have a lower yield. C. The situation never occurs. D. Rating of bonds may be improving. 47. Which of the following best describe the strategy referred to as ‘riding the yield curve’? A. Switching from bonds to stocks. B. Switching over from long term bonds to short term bonds to get more yield. C. Switching over from short term bonds to long term when the latter yields better. D. Switching over to short term bonds from long term bonds when yield curve is downward sloping. 48. Sinking funds are most likely to: A. Reduce default risk. B. Increase liquidity risk. C. Negatively affect bond rating. D. Increase prepayment risk. 49. The present value of a N1,000 par value, zero-coupon bond with a three-year maturity, assuming an annual discount rate of 6 percent compounded semiannually is closest to: A. N837.48 B. N839.62 C. N943.40 D. N955.50 50. A bond’s indenture: A. Pledges it as collateral. B. Is the same as a debenture. C. Relates only to its interest and principal payments. D. Contains its covenants. 51. The coupon yield of a bond is: A. The present value of all future cash flow of the bond. B. Coupon payments discounted and time weighted. C. Coupon payment stated as a percentage of bonds features. D. Coupon payment stated as a percentage of bond’s present price. 52. A coupon bond: A. Pays interest on a regular basis (typically semi-annually). B. Does not pay interest on a regular basis, but pays a lump sum at maturity. C. Can always be converted into a specific number of shares of common stock in the issuing company. D. Always sells at par. 53. Which of the following is TRUE about the call feature of a bond? It: A. Stipulates whether and under what circumstances the bond holders can request an earlier repayment of the principal amount prior to maturity. B. Describes the credit risk of the bond. C. Describes the maturity date of the bond. D. Stipulates whether and under what circumstances the issuer can redeem the bond prior to maturity. 54. The interest rate risk of a bond is the: A. Risk related to the possibility of bankruptcy of the bond's issuer. B. Risk that arises from the uncertainty about the bond's return caused by changes in interest rates over time. C. Unsystematic risk caused by factors unique in the bond. D. Risks related to the possibility of bankruptcy of the bond's issuer and that arises from the uncertainty of the bond's return caused by the change in interest rates. 55. If the market rate of interest is greater than the coupon rate, the bond will be valued: A. Less than par. B. At par. C. Greater than par. D. Cannot be determined. 56. What is the present value of a three-year security that pays a fixed annual coupon of 6 percent using a discount rate of 7 percent? A. 92.48 B. 100.00 C. 101.75 D. 97.38 57. Which of the following equations is correct in respect of bond pricing? A. Full bond price = Quoted price + Accrued interest B. Full bond price = Quoted price - Accrued interest C. Full bond price = Quoted price D. Full bond price = Clean price 58. Which of the following statement about warrants is not correct? A. A warrant could be used as sweetener to a bond issue. B. When warrants are exercised the balance sheet of the issuer is affected. C. Warrants are similar to call options in some respects. D. The number of warrant needed to purchase one ordinary share is determined by the exercise price of the warrant. 59. In the fixed income market, price risk and re-investment risk: A. Act in opposite direction. B. Act in the same direction. C. Act independently. D. Act in direction that cannot be predicted. 60. Which of the following statements is true? A. A callable bond is one that can be retired early at the instance of the holder. B. The minimum value of a convertible bond is the lower of its conversion value or its straight bond value. C. A floating rate note holder is usually less exposed to interest rate risk than a straight bondholder. D. Stripped bonds are zero-coupon bonds artificially created from corporate bonds with low credit risk. Total = 60 marks Question 2 - Corporate Finance List six factors that determine the dividend policy of a company. (3 marks) Question 3 – Equity Valuation and Analysis Mention four possible reasons why a company would prefer raising additional capital through issue of shares rather than by borrowing? (4 marks) Question 4 – Fixed Income Valuation and Analysis Define Macaulay duration. In what way is it different from modified duration? (3 marks) Question 5 - Corporate Finance 5(a) After analyzing the stock of Biggs Plc, you believe that it will sell for N180 one year from today. The stock is expected to pay a dividend of N7 one year from today, and the required return is 12%. The current market price of the stock is N165. Should you buy the stock? Justify your answer using the NPV and IRR criteria for investment. (5 marks) 5(b) Apple Limited has 10 million N1 ordinary shares in issue that have a current market value of N2·40 per share. The cost of the equity shares is estimated at 12% per year. The company also has irredeemable, 9% loan notes in issue with a nominal value of N40 million, which are quoted at N120 per N100 nominal value. The rate of taxation is 20%. What is the weighted average cost of capital for the company? (5 marks) Question 6 - Equity Valuation and Analysis 6(a) Rich Limited’s common stock dividends have been growing at 7% per year for the past 15 years. Current dividends are N1.70 per share. What is the current value of a share of this stock to an investor requiring a 12% rate of return if the following conditions exist? 6(a1) The dividend growth rate is expected to continue at the historic rate. (2 marks) 6(a2) The dividend growth rate is expected to increase to 10% per year. (2 marks) 6(a3) From the results in 6(a1) and 6(a2), what can you say about the relationship between the rate of growth of dividend and value of shares? (2 marks) 6(b) Briefly discuss, using appropriate illustrations, how price-to-sales ratio may be used in the valuation of a company’s stock. Does it have any advantages over priceearnings ratio valuation model? (4 marks) Question 7 - Fixed Income Valuation and Analysis 7(a) Explain what is meant by the expression ‘term structure of interest rates’. Briefly outline two of the theories that attempt to explain this expression. (5 marks) 7(b) A four year, 8 per cent annual coupon bond, redeemable at N100, trades with a gross redemption yield of 7 per cent. Calculate the Macaulay duration of the bond. (5 marks)