FOR ACTION Board of Trustees Charles Stewart Mott Community College

advertisement

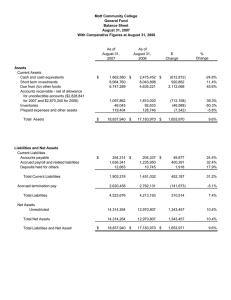

FOR ACTION Board of Trustees Charles Stewart Mott Community College Regular Meeting, October 20, 2008 Volume 40 Treasurer’s Report for September 2008 This resolution is recommended. Be it Resolved, That The Charles Stewart Mott Community College Board of Trustees Accepts the financial report of the College for the month of September 2008 as presented by the Administration. Reviewed and Submitted By: _____________________________________ Lawrence A. Gawthrop, CFO Date: October 20, 2008 Board Policy Statement Reference: “3100 Budget Adoption: General: The Board recognizes that its annual budget represents the programmatic direction and vision of the College. It is also designed to meet both the legal requirements and needs of the College. 1. The Finance Committee shall receive and review budget reports on a monthly basis.” September Treasurer’s Report Lawrence A. Gawthrop, CPA Chief Financial Officer October 10, 2008 Summary of Expenditures: Month of September Spending: General Fund: All Other Funds: Total: $ 4,261,427 $ 7,370,597 ----------------$ 11,632,024 ======== Comments on General Fund Financial Statements: • Statement of Revenues, Expenditures and Changes in Net Assets In summary, total revenues for the three-month period ended September 30, was approximately $21.7 million, representing 30.9% of the annual budget. This is 2.3% ahead of last year at this time, when we had recognized 28.6% of budgeted revenues which totaled $20.3 million. Expenditures year-to-date were at $11.8 million dollars, which represents 16.8% of the annual budget. This was .1% lower in spending than last year at this time when compared to the previous year’s budget. Revenues Tuition and fee revenues are $12.3 million for the three months ended, an increase of $871 thousand from last year at this time. This positive variance is mainly due to creditside enrollment figures for summer and fall being slightly higher than last year and higher than anticipated. Property taxes were $8.7 million through September, and are on pace with the budgeted amounts. We have budgeted a $60,000 decrease in total tax collections for the year based on the final taxable value figures provided to us from the Genesee County Equalization Department. State appropriations payments for FY2008-09 are paid in monthly installments starting with October. The total budgeted amount for the current year is $15.2 million based on a 2.9% increase from the prior year. After our budget was adopted, the State through its budget balancing measures has informed us that we will only receive a 2% increase. The decrease of approximately $132,500 will be adjusted in the January budget amendment. The $121,525 variance from the prior year is the timing of the receipt of our Renaissance Zone tax rebate. Expenditures Salaries and wages continue to be slightly higher than last year, and total $6.2 million for the three months ended September 30. Fringe benefit expenses at approximately $2.8 million are consistent when compared with the prior year. We currently have four Collective Bargaining Agreement Contracts open in this fiscal year that most certainly will have a future financial impact. Other Expenditures The most significant changes in the Other Expenses area were a decrease of approximately $354 thousand in the Contracted Services line item and an increase of approximately $518 thousand in the Operations and Communications line item. As noted in the July Treasurer’s report, the Datatel license payments were previously charged to the Contracted Services area. It was determined that a more accurate depiction of this expenditure should be in Operations and Communications. This change in classification and a significant payment made to Teoma Systems in the previous fiscal year that did not occur in the current year comprise the variances reflected on the September statement. In the Transfer line item, an allocation the 72 fund was made in July of 2007 that did not occur this year. • Balance Sheet On the Balance Sheet, figures shown “As of September 30, 2008” are preliminary until the FY 07-08 year-end closeout and audit are complete. At that point, final June 30, 2008 totals will be carried forward. This is scheduled to take place at the end of October, with the November Treasurer’s Report being the first month to reflect the final audited beginning balances for this fiscal year. Total Assets were at approximately $23.4 million, compared with $20.1 million at the same time one year ago. The largest differences were comprised of an $8.6 million increase in Short-term investments a $1.0 million decrease in Cash and cash equivalents, a $.6 million increase in Accounts Receivable, and a $4.9 million decrease in Due from other funds for a total net increase of $3.3 million. The variances reflected in the Cash and cash equivalents and Short-term investments are the result of the continued focus of the College to maximize its investment earnings. The increase in Accounts Receivable is the result of a change in procedures related to the administering of Federal financial aid awards and how the credit balances are carried. At $6.8 million, Total Liabilities were up approximately $1.4 million from last year’s September balance. There were decreases in the areas of Accounts payable, Accrued payroll and related liabilities coupled with an increase in Due from other funds.. The Accounts payable and Accrued payroll and related liabilities decreases were the result of timing of payments between the two years. “Due to” and “Due from” The College maintains one checking account for all of its funds; deposits and disbursements. This necessitates the short-term “loaning” or “borrowing” between the funds throughout the year depending on which funds revenue or expenditures are being deposited or paid out. Each month the accounting department clears these “due to’s” and “due from’s” respectively assigning the activity to the proper fund. However, significant activity can occur after these transfers are completed, causing large variances when compared to the previous 12 month period. This is the case in the current month and the reason for the $2.7 million increase in this inter-fund activity. Comments on spending from other funds: • Of the $7.4 million spent in the other funds, $6.7 was spent out of the Agency, Scholarships, and Federal Grants, for grant activities and student scholarships, and $.7 million out of the Maintenance and Replacement Fund and Bond Issue 2008 fund for capital improvements. Mott Community College General Fund Statement of Revenues, Expenditures and Changes in Net Assets For the 3 Months Ended September 30, 2008 With Comparative Totals at September 30, 2007 FY 2008-2009 Original Budget YTD Actuals as YTD Actuals as of 9/30/08 of 9/30/07 $ 26,413,127 $ 12,300,031 Property taxes 24,437,088 8,737,761 State appropriations 15,159,600 Actual to Actual $ Change Actual to Actual % Change Revenues: Tuition and fees - $ 11,429,189 870,842 7.08% 864,094 9.89% 121,525 (121,525) 0.00% 2.86% 7,873,667 $ Ballenger trust 1,841,880 458,736 445,631 13,105 Grants and other 2,444,621 236,060 452,238 (216,178) 70,296,316 21,732,588 20,322,250 1,410,338 6.49% Salaries and wages 36,801,821 6,150,700 6,046,414 104,286 1.70% Fringe benefits 14,821,225 2,807,326 3,012,630 (205,304) -7.31% Contracted services 4,337,883 750,762 1,105,430 (354,668) -47.24% Materials and supplies 1,941,497 319,165 271,531 47,634 14.92% Total revenues -91.58% Expenditures: Facilities rent 216,628 62,479 56,182 6,297 10.08% Utilities and insurance 2,910,448 628,892 582,988 45,904 7.30% Operations/communications 5,658,234 1,029,662 511,562 518,100 50.32% Transfers 3,249,217 - 366,126 (366,126) -100.00% 206,313 4,896 12,505 (7,609) -155.41% 70,143,266 11,753,882 11,965,368 (211,486) -1.80% 153,050 9,978,706 8,356,882 Capital outlay Total expenditures Net increase/(decrease) in net assets 1,621,824 16.25% Mott Community College General Fund Balance Sheet September 30, 2008 With Comparative Totals at September 30, 2007 As of September 30, 2008 Assets Current Assets Cash and cash equivalents Short term investments Due from other funds Accounts receivable - net of allowance for uncollectible accounts ($2,904,193 for 2009 and $2,412,060 for 2008) Inventories Prepaid expenses and other assets Total Assets Liabilities and Net Assets Current Liabilities Accounts payable Accrued payroll and related liabilities Deposits held for others Due to other funds $ 3,763,237 15,856,875 - As of September 30, 2007 $ 3,576,101 52,769 154,873 4,797,613 7,228,366 4,865,421 $ Change $ 3,016,928 46,045 103,420 (1,034,376) 8,628,509 (4,865,421) 559,173 6,724 51,453 $ 23,403,855 $ 20,057,793 $ 3,346,062 $ 1,194,676 342,048 16,505 2,707,970 $ 1,903,917 873,571 13,393 - $ (709,241) (531,523) 3,112 2,707,970 Total Current Liabilities 4,261,199 2,790,881 2,565,725 2,620,458 6,826,924 5,411,339 1,415,585 Net Assets Unrestricted 16,576,931 14,646,454 1,930,477 Total Net Assets 16,576,931 14,646,454 1,930,477 Accrued termination pay Total Liabilities Total Liabilities and Net Assets $ 23,403,855 $ 20,057,793 1,470,318 (54,733) $ 3,346,062