FOR ACTION Board of Trustees Charles Stewart Mott Community College

advertisement

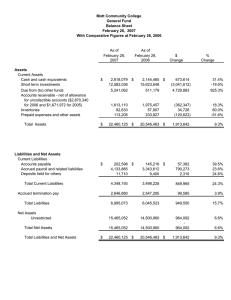

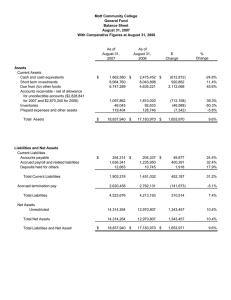

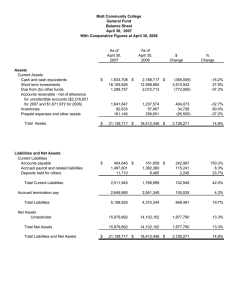

FOR ACTION Board of Trustees Charles Stewart Mott Community College Regular Meeting, March 23, 2009 Volume 42 Treasurer’s Report for February 2009 This resolution is recommended. Be it Resolved, That The Charles Stewart Mott Community College Board of Trustees Accepts the financial report of the College for the month of February 2009 as presented by the Administration. Reviewed and Submitted By: _____________________________________ Lawrence A. Gawthrop, Interim CFO Date: March 13, 2009 Board Policy Statement Reference: “3100 Budget Adoption: General: The Board recognizes that its annual budget represents the programmatic direction and vision of the College. It is also designed to meet both the legal requirements and needs of the College. 1. The Finance Committee shall receive and review budget reports on a monthly basis.” February Treasurer’s Report Lawrence A. Gawthrop, CPA Interim Chief Financial Officer March 13, 2009 Summary of Expenditures: Month of February Spending: General Fund: All Other Funds: Total: $ 5,197,835 $ 2,802,622 ----------------$ 8,000,457 ======== Comments on General Fund Financial Statements: • Statement of Revenues, Expenditures and Changes in Net Assets Total revenues for the eight month period ending February 28, was $52 million, representing 73% of the annual budget. This was slightly behind last year at this time, when we had recognized 74.5% of budgeted revenues. Expenditures year-to-date were at $39.1 million dollars, which represented 55% of the annual budget. This was 2.7% lower compared to the previous year’s budget. Revenues Tuition and fee revenues were $24.3 million through February, an increase of $1.4 million from last year at this time. The fall and winter enrollment figures were higher than anticipated causing a majority of the increase. Property taxes were $18.3 million through February, a decrease of $586 thousand. Currently, collections are slightly below the budgeted amounts, but are expected to come in at or near budgeted amounts, as property taxes are recorded on a cash basis and variances are caused by timing of payments from the various local taxing authorities. State appropriations payments for FY2008-09 are paid in monthly installments starting with October. The total allocation for the current year is $15.2 million. We received the January payment as scheduled. . Expenditures Salaries and wages are down $1.5 million, or 6.8% compared to the prior year. Fringe benefit expenses also showed a comparable decrease of 7.7%. This decrease is largely due to the implementation of the Faculty Assignment module in Datatel. The final salary and related costs of the labor negotiations is still uncertain at this time and a reserve has been incorporated in the budget. Other Expenditures The Contracted Services and Operations and Communications show the largest variances relating to the reclassification of the Datatel maintenance invoices from contracted services to the operations/communications area. • Balance Sheet Overall, Total Assets were at $25.7 million, the same as February 2008. The largest individual differences were comprised of a $1.1 million increase in Short-term investments, a $700 thousand decrease in Cash and cash equivalents, and a $435 thousand decrease in Accounts receivable. The College continues to seek to maximize its investment earnings by continually monitoring its cash needs and leaving as much of its reserves as possible in interest bearing accounts. At $6.2 million, Total Liabilities were down 15.7%, or $1.1 million from last year’s February balance. The largest variances were a decrease of $2.7 million in accrued payroll and related liabilities, a result of the accounting implementation of the Faculty Assignment application in Datatel in the current year. An estimate of the total faculty salaries are no longer accrued at the beginning of each semester and are now expensed as they are paid. The $1.7 million increase in the Due to other funds is the timing difference of the property tax revenue transfer from the General Fund to the Debt Retirement Fund for retirement of our bonded debt. Comments on spending from other funds: • The February expenditures in the other funds was comprised mainly in Restricted Funds, most of which was for student financial aid and grant activities which totaled $1.9 million. The Maintenance and Replacement and 2008 Bond issue funds comprised another $945 thousand of the total. Mott Community College General Fund Statement of Revenues, Expenditures and Changes in Net Assets For the 8 Months Ended February 28, 2009 With Comparative Totals at February 29, 2008 Actual to Actual $ Change FY 2008-2009 YTD Actuals as YTD Actuals as Amend 1 Budget of 2/28/09 of 2/29/08 Actual to Actual % Change Revenues: Tuition and fees 27,557,348 $ 24,334,453 Property taxes 24,440,631 18,340,872 18,927,229 (586,357) -3.20% State appropriations 15,159,600 6,971,516 8,248,971 (1,277,455) -18.32% Ballenger trust 1,841,880 1,223,295 1,188,350 34,945 Grants and other 2,166,199 1,092,847 1,695,585 (602,738) -55.15% 71,165,658 51,962,983 52,966,566 (1,003,583) -1.93% Salaries and wages 36,707,271 22,534,877 24,072,996 (1,538,119) -6.83% Fringe benefits 14,826,825 8,882,338 9,563,130 (680,792) -7.66% Contracted services 4,696,833 2,217,600 2,465,661 (248,061) -11.19% Materials and supplies 1,945,047 1,116,931 1,070,869 46,062 4.12% 214,949 135,364 127,527 7,837 5.79% Utilities and insurance 2,923,927 1,545,300 1,603,951 (58,651) -3.80% Operations/communications 5,627,184 2,150,208 1,435,255 714,953 33.25% Transfers 3,849,217 459,942 521,043 (61,101) -13.28% 217,813 17,003 42,151 (25,148) -147.90% 71,009,066 39,059,563 40,902,583 (1,843,020) -4.72% 156,592 12,903,420 12,063,983 Total revenues $ $ 22,906,431 $ 1,428,022 5.87% 2.86% Expenditures: Facilities rent Capital outlay Total expenditures Net increase/(decrease) in net assets 839,437 6.51% Mott Community College General Fund Balance Sheet February 28, 2009 With Comparative Totals at February 29, 2008 As of February 28, 2009 Assets Current Assets Cash and cash equivalents Short term investments Accounts receivable - net of allowance for uncollectible accounts ($2,770,822 for 2009 and $2,381,428 for 2008) Inventories Prepaid expenses and other assets Total Assets Liabilities and Net Assets Current Liabilities Accounts payable Accrued payroll and related liabilities Deposits held for others Due to other funds $ 1,252,049 22,573,832 As of February 29, 2008 $ 1,481,525 74,296 275,573 1,986,995 21,433,415 $ Change $ 1,917,021 46,045 271,162 (435,496) 28,251 4,411 $ 25,657,275 $ 25,654,638 $ $ 232,618 1,447,503 36,464 1,876,451 $ 355,023 4,156,856 15,346 168,531 $ Total Current Liabilities (734,946) 1,140,417 2,637 (122,405) (2,709,353) 21,118 1,707,920 3,593,036 4,695,756 (1,102,720) 2,562,595 2,605,327 (42,732) 6,155,631 7,301,083 (1,145,452) Net Assets Unrestricted 19,501,644 18,353,555 1,148,089 Total Net Assets 19,501,644 18,353,555 1,148,089 Accrued termination pay Total Liabilities Total Liabilities and Net Assets $ 25,657,275 $ 25,654,638 $ 2,637