SCHRODER MUTUAL FUNDS 2010 IMPORTANT TAX REPORTING INFORMATION

SCHRODER MUTUAL FUNDS

2010 IMPORTANT TAX REPORTING INFORMATION

This letter contains important tax information specific to your investment in the Schroder Mutual Funds for use in preparing your 2010 tax return.

If you require further information, please call our Investor Services Representatives at (800) 464-3108.

In May 2006, the Taxpayer Increase Prevention and Reconciliation Act (the “Act”) was enacted. The Act extends for two additional years (through

2010) the 15 percent maximum tax rate on long-term capital gains and qualified dividend income.

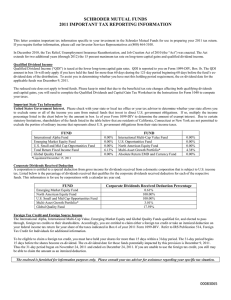

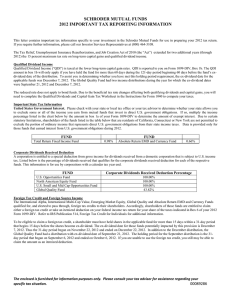

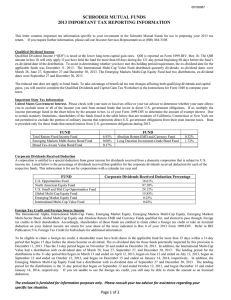

Qualified Dividend Income

Qualified Dividend Income (“QDI”) is taxed at the lower long-term capital gain rates. QDI is reported to you on Form 1099-DIV, Box 1b. The QDI amount in box 1b will only apply if you have held the fund for more than 60 days during the 121-day period beginning 60 days before the fund’s exdividend date of the distribution. To assist you in determining whether you have met this holding period requirement, the ex-dividend date for the applicable funds was December 10, 2010, except for QEP Global Quality Fund which was December 29, 2010.

The reduced rate does not apply to bond funds. Please keep in mind that due to the beneficial tax rate changes affecting both qualifying dividends and capital gains, you will need to complete the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040 to compute your taxes.

Important State Tax Information

United States Government Interest.

Please check with your state or local tax office or your tax advisor to determine whether your state allows you to exclude some or all of the income you earn from mutual funds that invest in direct U.S. government obligations. If so, multiply the income percentage listed in the chart below by the amount in box 1a of your Form 1099-DIV to determine the amount of exempt interest. Due to certain statutory limitations, shareholders of the funds listed in the table below that are residents of California, Connecticut or New York are not permitted to exclude the portion of ordinary income that represents direct U.S. government obligations from their state income taxes.

FUND FUND

International Alpha Fund

Emerging Market Equity Fund

0.00% International Multi-Cap Value Fund

0.00% U.S. Opportunities Fund

0.00%

0,00%

U.S. Small and Mid Cap Opportunities Fund

Total Return Fixed Income Fund

QEP Global Quality Fund

0.00% North American Equity Fund

2.35% Multi-Asset Growth Portfolio

0.00%

0.00%

7.89%

Corporate Dividends Received Deduction

A corporation is entitled to a special deduction from gross income for dividends received from a domestic corporation that is subject to U.S. income tax. Listed below is the percentage of dividends received that qualifies for the corporate dividends received deduction for each of the respective funds. This information is for use by corporations with a calendar tax year end.

FUND

Emerging Market Equity Fund

North American Equity Fund

Corporate Dividends Received Deduction Percentage

0.96%

99.44%

Multi-Asset Growth Portfolio

QEP Global Quality Fund

1.36%

61.71%

Foreign Tax Credit and Foreign Source Income

The International Alpha, International Multi-Cap Value and Emerging Market Equity Funds qualified for, and elected to pass through, foreign tax credits to their shareholders. Accordingly, you are entitled to claim either a foreign tax credit or take an itemized deduction on your federal income tax return for your share of the taxes indicated in Box 6 of your 2010 Form 1099-DIV. Refer to IRS Publication 514, Foreign Tax Credit for

Individuals for additional information.

To be eligible to claim a foreign tax credit, you must have held your shares for more than 15 days within a 31day period. The 31-day period begins

15 days before the shares become ex-dividend. The ex-dividend date for those funds potentially impacted by this provision is December 10, 2010.

Thus the 31-day period began on November 25, 2010 and ended on December 25, 2010. If you are unable to use the foreign tax credit, you still may be able to claim the amount as an itemized deduction.

The enclosed is furnished for information purposes only. Please consult your tax advisor for assistance regarding your specific tax situation.

00077130