SCHRODER MUTUAL FUNDS 2013 IMPORTANT TAX REPORTING INFORMATION

advertisement

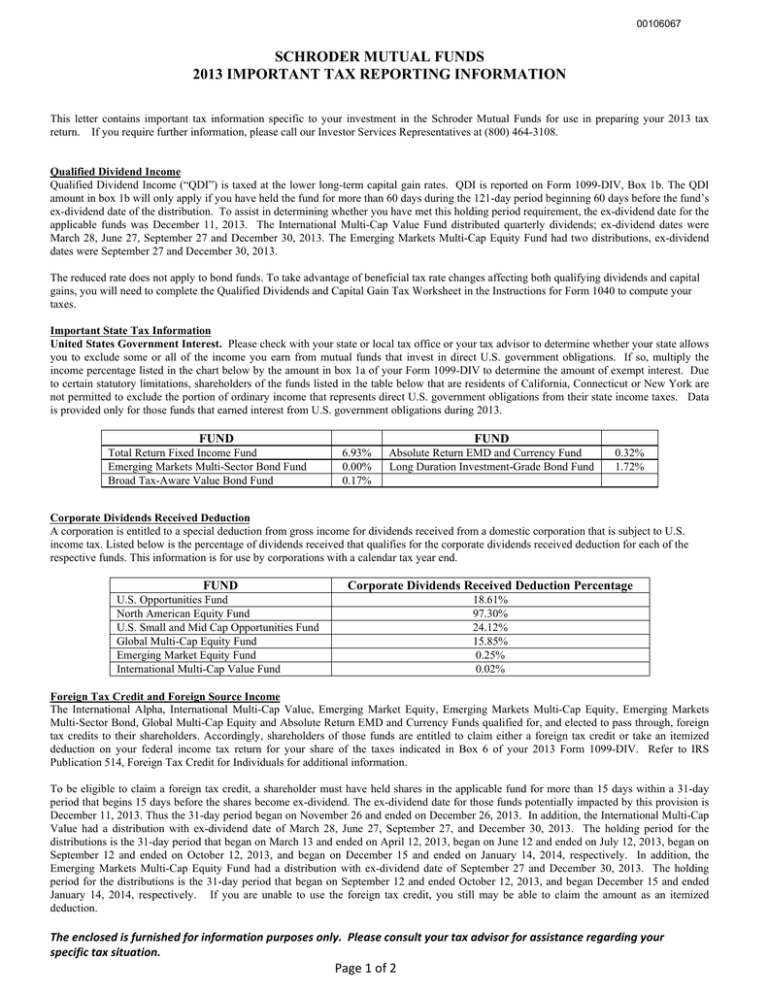

00106067 SCHRODER MUTUAL FUNDS 2013 IMPORTANT TAX REPORTING INFORMATION This letter contains important tax information specific to your investment in the Schroder Mutual Funds for use in preparing your 2013 tax return. If you require further information, please call our Investor Services Representatives at (800) 464-3108. Qualified Dividend Income Qualified Dividend Income (“QDI”) is taxed at the lower long-term capital gain rates. QDI is reported on Form 1099-DIV, Box 1b. The QDI amount in box 1b will only apply if you have held the fund for more than 60 days during the 121-day period beginning 60 days before the fund’s ex-dividend date of the distribution. To assist in determining whether you have met this holding period requirement, the ex-dividend date for the applicable funds was December 11, 2013. The International Multi-Cap Value Fund distributed quarterly dividends; ex-dividend dates were March 28, June 27, September 27 and December 30, 2013. The Emerging Markets Multi-Cap Equity Fund had two distributions, ex-dividend dates were September 27 and December 30, 2013. The reduced rate does not apply to bond funds. To take advantage of beneficial tax rate changes affecting both qualifying dividends and capital gains, you will need to complete the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040 to compute your taxes. Important State Tax Information United States Government Interest. Please check with your state or local tax office or your tax advisor to determine whether your state allows you to exclude some or all of the income you earn from mutual funds that invest in direct U.S. government obligations. If so, multiply the income percentage listed in the chart below by the amount in box 1a of your Form 1099-DIV to determine the amount of exempt interest. Due to certain statutory limitations, shareholders of the funds listed in the table below that are residents of California, Connecticut or New York are not permitted to exclude the portion of ordinary income that represents direct U.S. government obligations from their state income taxes. Data is provided only for those funds that earned interest from U.S. government obligations during 2013. FUND Total Return Fixed Income Fund Emerging Markets Multi-Sector Bond Fund Broad Tax-Aware Value Bond Fund FUND 6.93% 0.00% 0.17% Absolute Return EMD and Currency Fund Long Duration Investment-Grade Bond Fund 0.32% 1.72% Corporate Dividends Received Deduction A corporation is entitled to a special deduction from gross income for dividends received from a domestic corporation that is subject to U.S. income tax. Listed below is the percentage of dividends received that qualifies for the corporate dividends received deduction for each of the respective funds. This information is for use by corporations with a calendar tax year end. FUND Corporate Dividends Received Deduction Percentage U.S. Opportunities Fund North American Equity Fund U.S. Small and Mid Cap Opportunities Fund Global Multi-Cap Equity Fund Emerging Market Equity Fund International Multi-Cap Value Fund 18.61% 97.30% 24.12% 15.85% 0.25% 0.02% Foreign Tax Credit and Foreign Source Income The International Alpha, International Multi-Cap Value, Emerging Market Equity, Emerging Markets Multi-Cap Equity, Emerging Markets Multi-Sector Bond, Global Multi-Cap Equity and Absolute Return EMD and Currency Funds qualified for, and elected to pass through, foreign tax credits to their shareholders. Accordingly, shareholders of those funds are entitled to claim either a foreign tax credit or take an itemized deduction on your federal income tax return for your share of the taxes indicated in Box 6 of your 2013 Form 1099-DIV. Refer to IRS Publication 514, Foreign Tax Credit for Individuals for additional information. To be eligible to claim a foreign tax credit, a shareholder must have held shares in the applicable fund for more than 15 days within a 31-day period that begins 15 days before the shares become ex-dividend. The ex-dividend date for those funds potentially impacted by this provision is December 11, 2013. Thus the 31-day period began on November 26 and ended on December 26, 2013. In addition, the International Multi-Cap Value had a distribution with ex-dividend date of March 28, June 27, September 27, and December 30, 2013. The holding period for the distributions is the 31-day period that began on March 13 and ended on April 12, 2013, began on June 12 and ended on July 12, 2013, began on September 12 and ended on October 12, 2013, and began on December 15 and ended on January 14, 2014, respectively. In addition, the Emerging Markets Multi-Cap Equity Fund had a distribution with ex-dividend date of September 27 and December 30, 2013. The holding period for the distributions is the 31-day period that began on September 12 and ended October 12, 2013, and began December 15 and ended January 14, 2014, respectively. If you are unable to use the foreign tax credit, you still may be able to claim the amount as an itemized deduction. The enclosed is furnished for information purposes only. Please consult your tax advisor for assistance regarding your specific tax situation. Page 1 of 2 00106067 SCHRODER MUTUAL FUNDS 2013 IMPORTANT TAX REPORTING INFORMATION Tax-Exempt Interest • Federal Tax Treatment Federal tax law generally allows income from mutual funds investing in municipal obligations to be considered tax-exempt income. Any income distribution that qualifies as tax-exempt interest is reported on your Form 1099-DIV box 10. You must report this amount on Line 8b of your 2013 Form 1040. The amount reported in Box 11 of Form 1099-DIV must be used in preparing Form 6251 to determine if you are subject to Alternative Minimum Tax. Any income distribution that is taxable income is included on your Form 1099-DIV Box 1a. This amount must be reported on Line 9a of Form 1040. • State and Local Tax Treatment Some of the Federal tax-exempt income may also be exempt from state and local taxes, depending on where you file your return. Listed below is the percentage of income earned by state for each fund. As state and local tax regulations vary from state to state, not all permit such exclusion. For example, Illinois does not exempt the portion of dividends from state or local obligations held indirectly through a mutual fund. If the tax laws of your state provide for the exemption, multiply the amount in Box 10 of Form 1099-DIV by the appropriate percentage below. This amount can be excluded and the remaining balance should be reported on your state tax return. Sate Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri • Broad Tax-Aware Value Bond Fund 0.04% 0.15% 3.17% 0.00% 36.30% 0.00% 0.46% 0.00% 0.01% 1.15% 1.42% 0.00% 0.00% 4.36% 0.41% 0.00% 0.00% 0.00% 0.50% 0.00% 0.00% 4.65% 0.10% 0.54% 0.00% 5.64% State Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming US Territories & Other Broad Tax-Aware Value Bond Fund 0.00% 2.00% 0.00% 0.00% 6.95% 0.60% 10.28% 1.18% 0.00% 4.86% 0.00% 0.00% 0.01% 0.00% 0.26% 0.00% 0.38% 12.38% 0.00% 0.00% 0.00% 2.20% 0.00% 0.00% 0.00% 0.00% For Residents of California and Minnesota all of the income distribution is subject to state income tax. The enclosed is furnished for information purposes only. Please consult your tax advisor for assistance regarding your specific tax situation. Page 2 of 2