Schroders 2011 Half-Year Results Michael Dobson Chief Executive

advertisement

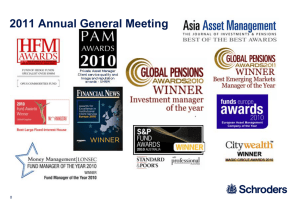

Schroders 2011 Half-Year Results trusted heritage advanced thinking Michael Dobson Chief Executive 4 August 2011 H1 2011: Summary 1 • Focus on investment performance – 77% of funds outperforming over 3 years • Broad product range Proven Distribution capability – Net new business £5.1bn (H1 2010: £16.1bn) – Assets under management £204.8bn (31 Dec 2010: £196.7bn) • Global franchise – 73% of new business outside UK • Investment in organic growth – Added 96 people across Investment, Distribution, Private Banking, Infrastructure • Strong financials – Profit before tax £215.7m (H1 2010: £188.2m) – Earnings per share 60.7p (H1 2010: 49.4p) – Interim dividend 13.0p per share (interim dividend 2010: 11.0p) H1 2011: Gross sales £bn 50 41.2 40 36.7 34.2 30 33.1 26.0 19.9 20 15.6 10 0 H1 2008 H2 2008 Equities 2 H1 2009 Fixed Income H2 2009 H1 2010 Multi-Asset H2 2010 Alternatives H1 2011 Private Banking H1 2011: Net inflows £bn 20 16.1 15 13.3 11.0 10 5.1 5 -1.1 1.7 -8.5 0 -5 -10 H1 2008 Equities 3 H2 2008 H1 2009 Fixed Income H2 2009 Multi-Asset H1 2010 H2 2010 Alternatives H1 2011 Private Banking Regional diversification: gross sales 73% of gross sales outside UK Continental Europe £12.7bn Asia Pacific £8.1bn UK £8.8bn North America £2.0bn 4 South America £0.6bn Middle East £0.9bn Regional diversification: assets under management 67% of revenues outside UK UK £72.2bn Continental Europe £47.1bn North America £22.0bn 5 South America £6.2bn Middle East £5.2bn Asia Pacific £52.1bn Institutional Assets under management: £112.7bn (31 Dec 2010: £106.4bn) £bn • Strong results in UK and Europe 20 16.3 • All regions positive 15.1 15 13.1 12.1 • Good pipeline of unfunded wins • Institutional revenues doubled in 2 years 9.8 10 7.0 6.4 5.7 4.6 5 0 -0.8 -5 -7.2 -6.4 -6.5 -10 H1 2009 H2 2009 Gross inflows 6 H1 2010 Gross outflows -8.1 -8.5 H2 2010 H1 2011 Net flows Intermediary Assets under management: £75.4bn (31 Dec 2010: £74.1bn) £bn • Gross sales close to H2 2010 level • Net result impacted by move away from risk assets in Europe 25 21.1 18.4 20 18.2 17.7 15 10.7 • • Closure of funds for capacity reasons Well positioned for recovery in demand 10 7.2 5.1 5 2.9 2.5 0.4 0 -5 -10 -8.2 -11.2 -15 -16.0 -15.3 H1 2010 H2 2010 -17.3 -20 H1 2009 H2 2009 Gross inflows 7 Gross outflows H1 2011 Net flows Private Banking Assets under management: £16.7bn (31 Dec 2010: £16.2bn) • Successful transition of new clients won in 2010 • Management fee revenues up 25 per cent • Net new business in 2011 impacted by market uncertainty • No provisions for doubtful debts • Profit up 86 per cent 8 Schroders 2011 Half-Year Results Kevin Parry Chief Financial Officer 4 August 2011 Key figures Profit before tax (£m) Total costs: net revenue ratio (%) 215.7 188.2 173.3* 81* 69* 68 76.9* H1 2008 H1 2009 H1 2010 Earnings per share (pence) H1 2011 H1 2008 60.7 H1 2009 H1 2010 H1 2011 Dividend per share (pence) 13 49.4 46.5* 65 10 10 H1 2008 H1 2009 11 20.3* H1 2008 H1 2009 H1 2010 H1 2011 * Before exceptional items of 2009: £40.6m; 2008: £37.6m relating to cost reductions and losses on financial assets. 10 H1 2010 H1 2011 Profit before tax Revenue growth flows through to the bottom line £m Net Revenue £56m PBT H1 2010 £188m 11 £216m Significant increase in net revenue £m Performance Fees £17m Group Revenue Markets and FX £9m £36m Net New Business £46m Net Revenue H1 2010 £537m 12 Net Revenue H1 2011 £593m Profit before tax Revenue growth flows through to the bottom line £m Compensation Costs £15m Other Costs £9m Net Finance Income £4m Associates Joint Ventures and Associates £8m Net Revenue £56m PBT H1 2010 £188m 13 PBT H1 2011 £216m Institutional net revenues £m 14 Breakdown of £39m net revenue increase on H1-10 (excluding performance fees) Intermediary net revenues £m Breakdown of £36m net revenue increase on H1-10 (excluding performance fees) 309 1 291 6 272 308 285 272 H1 2010 Intermediary 15 H2 2010 H1 2011 Performance fees Institutional and Intermediary net revenues £m 64bps 63bps 58bps 60bps H1 2010 Management Fees – Institutional 16 Management Fees – Intermediary Performance Fees 58bps 57bps H2 2010 H1 2011 Asset Management Combined Private Banking segment £m – Net Revenue £m – Costs 58.0 53.4 49.9 7.2 45.7 7.6 7.6 49.9 43.3 12.7 11.6 16.4 18.3 13.8 11.8 2.8 4.7 30.5 H1 2010 34.2 30.7 24.8 H2 2010 Management fees Net banking interest income 17 38.1 H1 2011 Transaction fees H1 2010 Compensation costs Other costs H2 2010 27.4 H12011 Doubtful debt provision Operating expenses £m H1 2010 H2 2010 H1 2011 Staff costs 242.4 263.1 257.8 Other costs 111.0 140.0 123.4 (16.6) 10.3 7.2 363.7 410.3 Depreciation and amortisation Total 18 H1 2011 VS H2 2010 (5.3) • Lower legal and regulatory costs following increase in H2 2010 - • Absence of loan provisions in Private Bank 388.4 (21.9) • Effective procurement • Small increase in other costs 7.2 Compensation cost: operating revenue ratio 46% 44% 44% (2%) Total cost: total net revenue ratio 68% 66% 65% (1%) Tax charge and earnings per share Benefit of higher profitability £m 19 H1 2010 H1 2011 % Change Profit before tax 188.2 215.7 14.6 Tax (47.5) (50.0) 5.3 Effective tax rate(%) 25% 23% - Profit after tax 140.7 165.7 18 Basic earnings per share 49.4p 60.7p 23 Dividend 11.0p 13.0p 18 Movement in Group Capital PAT £166m Group Capital H2 2010 FX £15m Pensions and Other £7m Share Awards £31m Share Purchases £101m Dividends £73m Group Capital H1 2011 £1,845m £1,800m 20 Group capital allocation Investment capital breakdown (%) £m H1 2010 H2 2010 H1 2011 4% 12% Asset Management & Private Banking operational capital 736 Investment capital* 721 774 807 Other (intangibles etc.) 141 162 188 Statutory Group capital 1,598 1,800 1,845 864 30% 850 9% 10% 7% 3% Cash and cash equivalents Long fixed income Long only EMD absolute return Legacy private equity * Not included in AUM 21 25% Seed capital: alpha exposures Long global macro Long only multi-asset absolute return Other Outlook Michael Dobson Chief Executive Outlook • Market concerns holding back Intermediary and Private Banking demand • Opportunities in Institutional • Continued investment in talent and infrastructure 23 24 Forward-Looking Statements These presentation slides may contain forward-looking statements with respect to the financial condition and results of the operations and businesses of Schroders plc. These statements and forecasts involve risk and uncertainty because they relate to events and depend upon circumstances that may occur in the future. There are a number of factors that could cause actual results or developments to differ materially from those expressed or implied by those forward-looking statements and forecasts. Forward-looking statements and forecasts are based on the Directors’ current view and information known to them at the date of this presentation. The Directors do not make any undertaking to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Nothing in this presentation should be construed as a profit forecast. 25