The Academic Journal of St Clements University December 2010 /

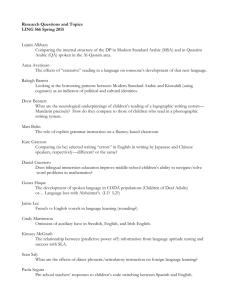

advertisement