Chapter 6 Homework

advertisement

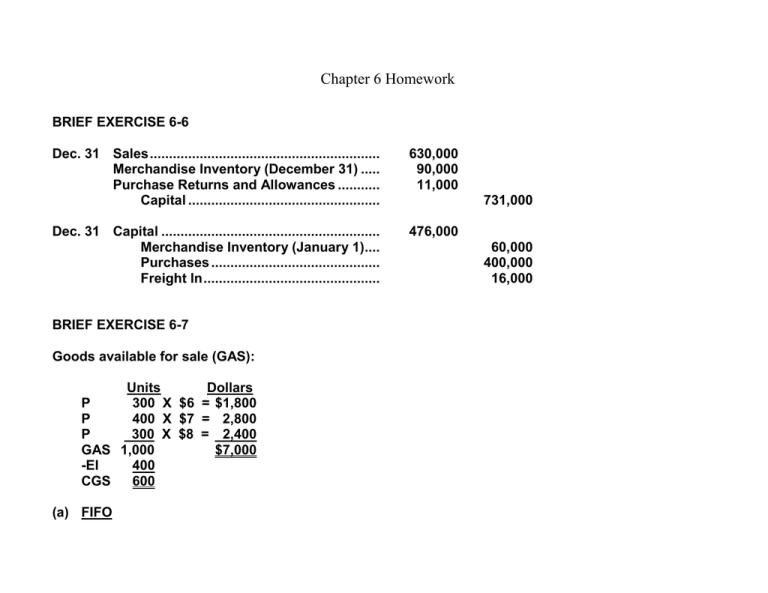

Chapter 6 Homework BRIEF EXERCISE 6-6 Dec. 31 Sales ............................................................ Merchandise Inventory (December 31) ..... Purchase Returns and Allowances ........... Capital .................................................. 630,000 90,000 11,000 Dec. 31 Capital ......................................................... Merchandise Inventory (January 1).... Purchases ............................................ Freight In .............................................. 476,000 BRIEF EXERCISE 6-7 Goods available for sale (GAS): Units Dollars P 300 X $6 = $1,800 P 400 X $7 = 2,800 P 300 X $8 = 2,400 GAS 1,000 $7,000 -EI 400 CGS 600 (a) FIFO 731,000 60,000 400,000 16,000 CGS: 300 x $6 = $1,800 300 x $7 = 2,100 600 = $3,900 EI: 300 x $8 = $2,400 100 x $7 = 700 400 = $3,100 Check: CGS + EI = GAS $3,900 + $3,100 = $7,000 (b) Weighted Average Cost Weighted average unit cost: $7,000 1,000 = $7 CGS: 600 x $7 = $4,200 EI: 400 x $7 = $2,800 Check: CGS + EI = GAS $4,200 + $2,800 = $7,000 BRIEF EXERCISE 6-7 (Continued) (c) LIFO CGS: 300 x $8 = $2,400 300 x $7 = 2,100 600 = $4,500 EI: 300 x $6 = $1,800 100 x $7 = 700 400 = $2,500 Check: CGS + EI = GAS $4,500 + $2,500 = $7,000 BRIEF EXERCISE 6-8 (a) LIFO gives the highest inventory valuation when prices are falling. This is because the cost of the units purchased earlier, at a higher cost, are assumed to be still in inventory. (b) FIFO gives the highest cost of goods sold amount. This is because the cost of the units purchased earlier, at a higher cost, are assumed to have been sold first and are allocated to cost of goods sold. (c) In selecting a cost flow method, the company should consider their type of inventory and its actual physical flow. While it is not essential to match the actual physical flow to the assumed cost flow method, it does give the company an indication as to its flow of costs throughout the period. What is important is choosing a method that best matches these costs to the revenue they generate. BRIEF EXERCISE 6-9 BI + CGP = GAS – EI = CGS - U$7,000 = O$7,000 Sales – CGS = NI - O$7,000 = U$7,000 The understatement of ending inventory caused cost of goods sold to be overstated $7,000 and net income to be understated $7,000. The correct net income for 2002 is $97,000 ($90,000 + $7,000). A = L + OE U$7,000 = U$7,000 Total assets and owner’s equity in the balance sheet will both be understated by the amount that ending inventory is understated, $7,000. Remember that if net income is understated, then owner’s equity is also understated as net income is a component of owner’s equity. Check your work by ensuring that the accounting equation balances. EXERCISE 6-4 Co. 1 BI +P $1,500 - PR&A 40 = NP (a) 1,460 + FI 110 = CGP + CGP (b) 1,570 = CGAS Co. 2 Co. 3 Co. 4 $ 250 $ 120 $1,000 (j) $ 2,960 $1,080 (g) $7,500 $44,590 (d) 60 290 (k) 260 1,020 7,210 44,330 (e) 210 (h) 730 2,240 (b) 1,570 1,230 1,230 7,940 7,940 (l) 46,570 (l) 46,570 1,820 1,350 (i) 8,940 49,530 - EI =CGS 310 (c) 1,510 (f) 100 1,250 1,450 7,490 Supporting Detail: (a) $1,460 ($1,500 - $40) (b) $1,570 ($1,460 + $110) (c) $1,510 ($1,820 - $310) (d) $60 ($1,080 - $1,020) (e) $210 ($1,230 - $1,020) (f) $100 ($1,350 - $1,250) (g) $7,500 ($290 + $7,210) (h) $730 ($7,940 - $7,210) (i) $8,940 ($1,000 + $7,940) (j) $2,960 ($49,530 - $46,570 from (l)) (k) $260 ($44,590 - $44,330) (l) $46,570 ($44,330 + $2,240) 6,230 43,300 EXERCISE 6-5 (a) OKANAGAN COMPANY Income Statement For the Year Ended January 31, 2003 Sales revenues Sales ........................................................................... Less: Sales returns and allowances ......................... Net sales ............................................................................... 000 Cost of goods sold Inventory, February 1, 2002 ....................................... Purchases .................................................. $200,000 Less: Purchase returns and allowances . 6,000 Net purchases ........................................... 194,000 Add: Freight in........................................... 10,000 Cost of goods purchased .......................................... Cost of goods available for sale ............................... Inventory, January 31, 2003....................................... Cost of goods sold ........................................................ 183,000 Gross profit .................................................................... 116,000 Operating expenses Salary expense ........................................................... Rent expense .............................................................. Insurance expense ..................................................... Freight out .................................................................. Total operating expenses .................................... 100,000 Net income ..................................................................... 16,000 $312,000 13,000 $299, $ 42,000 204,000 246,000 63,000 $ 61,000 20,000 12,000 7,000 $ EXERCISE 6-5 (Continued) (b) Jan. 31 Sales ............................................................... Merchandise Inventory (Jan. 31, 2003) ......... Purchase Returns and Allowances............... Capital ..................................................... 312,000 63,000 6,000 Capital ............................................................. Merchandise Inventory (Feb. 1, 2002) ... Purchases ............................................... 365,000 381,00 0 42,000 200,00 0 Freight In ................................................ Salary Expense ...................................... Rent Expense ......................................... Insurance Expense ................................ Freight Out.............................................. Sales Returns and Allowances ............. 10,000 61,000 20,000 12,000 7,000 13,000 EXERCISE 6-6 (a) FIFO Cost of Goods Sold: (#1012) $500 + (#1045) $450 = $950 (b) It could choose to sell specific units purchased at specific costs if it wished to impact income selectively. If it wished to minimize net income, it would choose to sell the units purchased at higher costs. In this case, the cost of goods sold would be $950 [(#1012) $500 + (#1045) $450]. If it wished to minimize net income, it would choose to sell the units purchased at lower costs. In this case, the cost of goods sold would be $850 [(#1045) $450 + (#1056) $400]. (c) I recommend Discount uses the FIFO method. FIFO provides a more relevant balance sheet valuation for decision making (closer to replacement cost) and reduces the opportunity to manipulate net income. Note to Instructor: This answer may vary depending on the method the student chooses. EXERCISE 6-7 (a) FIFO Cost of Goods Sold: Date Units Unit Cost 5/1 5/15 5/24 30 25 15 70 $08 010 012 Date Units Unit Cost 5/24 20 $12 Total Cost $240 0250 180 $670 Ending Inventory: Proof: CGS + EI = GAS $670 + $240 = $910 (b) WEIGHTED AVERAGE $910 ÷ 90 = $10.11 average unit cost Cost of Goods Sold: 70 x $10.11 = $708 (rounded) Ending Inventory: 20 x $10.11 = $202 (rounded) Proof: CGS + EI = GAS $708 + $202 = $910 Total Cost $240 EXERCISE 6-8 Beginning inventory (200 X $5) ......................................... $1,000 Purchases: June 12 (300 X $6) ........................................... $1,800 June 23 (500 X $7)........................................... 03,500 5,300 Cost of goods available for sale (1,000 units) .................. 6,300 Less: Ending inventory (180 units) Cost of goods sold (820 units) (a) (1) FIFO Cost of Goods Sold: Date Units Unit Cost 6/1 6/12 6/23 200 300 320 820 $5 6 7 Date Units Unit Cost 6/23 180 $7 Total Cost $1,000 1,800 2,240 $5,040 Ending Inventory: Total Cost $1,260 Proof: CGS + EI = GAS $5,040 + $1,260 = $6,300 (2) LIFO Cost of Goods Sold: Date 6/23 6/12 6/1 Units 500 300 20 820 Unit Cost $7 6 5 Total Cost $3,500 1,800 100 $5,400 Ending Inventory: Date 6/1 Units Unit Cost 180 $5 Total Cost $900 Proof: CGS + EI = GAS $5,400 + $900 = $6,300 EXERCISE 6-8 (Continued) (b) The FIFO method will produce the higher ending inventory because costs have been rising. Under this method, the earliest costs are assigned to cost of goods sold, and the latest costs remain in ending inventory. For Dene Company, the ending inventory under FIFO is $1,260 compared to $900 under LIFO. (c) The LIFO method will produce the higher cost of goods sold for Dene Company. Under LIFO, the most recent costs are charged to cost of goods sold, and the earliest costs are included in the ending inventory. The cost of goods sold is $5,400 compared to $5,040 under FIFO. EXERCISE 6-5 (a) OKANAGAN COMPANY Income Statement For the Year Ended January 31, 2003 Sales revenues Sales ........................................................................... Less: Sales returns and allowances ......................... Net sales ............................................................................... 000 Cost of goods sold Inventory, February 1, 2002 ....................................... Purchases .................................................. $200,000 Less: Purchase returns and allowances . 6,000 Net purchases ........................................... 194,000 Add: Freight in........................................... 10,000 Cost of goods purchased .......................................... Cost of goods available for sale ............................... Inventory, January 31, 2003....................................... Cost of goods sold ........................................................ 183,000 Gross profit .................................................................... 116,000 $312,000 13,000 $299, $ 42,000 204,000 246,000 63,000 Operating expenses Salary expense ........................................................... Rent expense .............................................................. Insurance expense ..................................................... Freight out .................................................................. Total operating expenses .................................... 100,000 Net income ..................................................................... 16,000 $ 61,000 20,000 12,000 7,000 $ EXERCISE 6-5 (Continued) (b) Jan. 31 Sales ............................................................... Merchandise Inventory (Jan. 31, 2003) ......... Purchase Returns and Allowances............... Capital ..................................................... 312,000 63,000 6,000 Capital ............................................................. Merchandise Inventory (Feb. 1, 2002) ... Purchases ............................................... 365,000 381,00 0 42,000 200,00 0 Freight In ................................................ Salary Expense ...................................... Rent Expense ......................................... Insurance Expense ................................ Freight Out.............................................. Sales Returns and Allowances ............. 10,000 61,000 20,000 12,000 7,000 13,000 EXERCISE 6-6 (a) FIFO Cost of Goods Sold: (#1012) $500 + (#1045) $450 = $950 (b) It could choose to sell specific units purchased at specific costs if it wished to impact income selectively. If it wished to minimize net income, it would choose to sell the units purchased at higher costs. In this case, the cost of goods sold would be $950 [(#1012) $500 + (#1045) $450]. If it wished to minimize net income, it would choose to sell the units purchased at lower costs. In this case, the cost of goods sold would be $850 [(#1045) $450 + (#1056) $400]. (c) I recommend Discount uses the FIFO method. FIFO provides a more relevant balance sheet valuation for decision making (closer to replacement cost) and reduces the opportunity to manipulate net income. Note to Instructor: This answer may vary depending on the method the student chooses. EXERCISE 6-7 (a) FIFO Cost of Goods Sold: Date Units Unit Cost 5/1 5/15 5/24 30 25 15 70 $08 010 012 Date Units Unit Cost 5/24 20 $12 Total Cost $240 0250 180 $670 Ending Inventory: Proof: CGS + EI = GAS $670 + $240 = $910 (b) WEIGHTED AVERAGE $910 ÷ 90 = $10.11 average unit cost Cost of Goods Sold: 70 x $10.11 = $708 (rounded) Ending Inventory: 20 x $10.11 = $202 (rounded) Proof: CGS + EI = GAS $708 + $202 = $910 Total Cost $240 EXERCISE 6-8 Beginning inventory (200 X $5) ......................................... $1,000 Purchases: June 12 (300 X $6) ........................................... $1,800 June 23 (500 X $7)........................................... 03,500 5,300 Cost of goods available for sale (1,000 units) .................. 6,300 Less: Ending inventory (180 units) Cost of goods sold (820 units) (a) (1) FIFO Cost of Goods Sold: Date Units Unit Cost 6/1 6/12 6/23 200 300 320 820 $5 6 7 Date Units Unit Cost 6/23 180 $7 Total Cost $1,000 1,800 2,240 $5,040 Ending Inventory: Total Cost $1,260 Proof: CGS + EI = GAS $5,040 + $1,260 = $6,300 (2) LIFO Cost of Goods Sold: Date 6/23 6/12 6/1 Units 500 300 20 820 Unit Cost $7 6 5 Total Cost $3,500 1,800 100 $5,400 Ending Inventory: Date 6/1 Units Unit Cost 180 $5 Total Cost $900 Proof: CGS + EI = GAS $5,400 + $900 = $6,300 EXERCISE 6-8 (Continued) (b) The FIFO method will produce the higher ending inventory because costs have been rising. Under this method, the earliest costs are assigned to cost of goods sold, and the latest costs remain in ending inventory. For Dene Company, the ending inventory under FIFO is $1,260 compared to $900 under LIFO. (c) The LIFO method will produce the higher cost of goods sold for Dene Company. Under LIFO, the most recent costs are charged to cost of goods sold, and the earliest costs are included in the ending inventory. The cost of goods sold is $5,400 compared to $5,040 under FIFO. EXERCISE 6-9 (a) Cost of Goods Available for Sale $6,300 ÷ Total Units Available for Sale 1,000 = Weighted Average Unit Cost $6.30 Ending Inventory: 180 X $6.30 = $1,134 Cost of Goods Sold: 820 X $6.30 = $5,166 Proof: CGS + EI = GAS $5,166 + $1,134 = $6,300 (b) Ending inventory is lower than FIFO ($1,260) and higher than LIFO ($900). In contrast, cost of goods sold is higher than FIFO ($5,040) and lower than LIFO ($5,400). When prices are changing, the average cost method will always produce this type of result. That is, average results will fall somewhere between those of FIFO and LIFO. (c) The average cost method uses a weighted average unit cost, not a simple average of unit costs ($5 + $6 + $7 = $18 ÷ 3 = $6). EXERCISE 6-10 (a) Periodic Inventory Method Purchases (100 x $10) ........................................ Accounts Payable ...................................... 1,000 Accounts Receivable (70 x $15)......................... Sales ........................................................... 1,050 1,000 1,050 Perpetual Inventory Method (b) Merchandise Inventory (100 x $10) .................... Accounts Payable ...................................... 1,000 Accounts Receivable (70 x $15)......................... Sales ........................................................... 1,050 Cost of Goods Sold (70 x $10) ........................... Merchandise Inventory.............................. 700 1. FIFO 2. LIFO 3. Specific Identification 4. LIFO 1,000 1,050 700 EXERCISE 6-11 SELES HARDWARE Income Statement (Partial) Beginning inventory .............................................. Cost of goods purchased ..................................... Cost of goods available for sale ........................... Corrected ending inventory .................................. Cost of goods sold ................................................ a 2002 2003 $020,000 150,000 0170,000 a 0025,000 $145,000 $025,000 175,000 0200,000 b 0 39,000 $161,000 $30,000 – $5,000 = $25,000 $35,000 + $4,000 = $39,000 b SOLUTIONS TO PROBLEMS PROBLEM 6-1A 1. Title to the goods does not transfer to the customer until March 2. Include the $800 in ending inventory. 2. Kananaskis owns the goods once they are shipped on February 26. Include inventory of $375. 3. Include $500 in inventory. 4. Exclude the items from Kananaskis’ inventory. 5. Title of the goods does not transfer to Kananaskis until March 2. Exclude this amount from the February 28 inventory. 6. The sale will be recorded on February 26. The goods should be excluded from Kananaskis’ inventory at the end of February. PROBLEM 6-2A ONLY A PARTIAL ANSWER GUIDE ******* for this question…. (a) GENERAL JOURNAL J1 Date Account Titles and Explanation Debit Credit Apr. 5 7 9 Purchases ......................................................... Accounts Payable ..................................... 1,600 Freight In........................................................... Cash ........................................................... 80 Accounts Payable ............................................ Purchase Returns and Allowances.......... 100 1,600 80 100