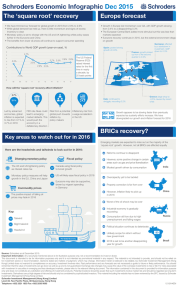

Schroders Economic Infographic Dec 2015 The ‘square root’ recovery Europe forecast

advertisement

Schroders Economic Infographic Dec 2015 The ‘square root’ recovery • We have trimmed our forecast for global growth in 2016 from 2.9% to 2.6% • While global demand has held up, there is little momentum and signs of excess inventory to clear • Monetary policy is set to diverge with the US and UK tightening whilst policy eases further in the Eurozone and China • The benefits from lower oil prices will continue to support consumer spending Contributions to World GDP growth (year-on-year), % 6 3 2.3% 2.7% 2.5% 3.5% 2 Spain: posted strong growth of 0.8% 2.6% 2.8% 2.6% 2.5% 1 0 -1 -1.0% -2 -3 • Growth in Europe lost momentum over Q3, with GDP growth slowing from 0.4% to a disappointing 0.3% • The European Central Bank added more stimulus but this was less than markets expected • Eurozone recovery continues in 2016, but the external environment drags on growth 4.7% 5 4 Europe forecast 08 09 10 11 12 13 14 15 16 The US Federal Reserve (FED) raised interest rates for the first time in nearly a decade, by 25 basis points Germany: affected by a slowdown in investment. GDP France: growth picked down to 0.3% up from a flat second quarter to 0.3% 17 How will the ‘square root’ recovery affect inflation? 3.7% Italy: continued to struggle, recording 0.2% 3.1% Led by advanced economies, global inflation is expected to rise from 3.1% to 3.7% in 2016 FED rate hikes could lead to emerging market defaults. This would push the economy in a deflationary direction Risk from a potential Inflationary risk from global push towards a wage acceleration reflation by in the US policy-makers Key areas to watch out for in 2016 Greece: large drop to -0.5% caused by recent crisis Growth appears to be slowing faster than previously expected as austerity efforts increase. We have downgraded our growth and inflation forecast for 2016 BRICs recovery? Emerging markets are expected to miss out on the majority of the ‘square root’ growth. However, not all BRICs are affected equally Here are the headwinds and tailwinds to look out for in 2016: Reforms continue to disappoint Diverging monetary policy Fiscal policy The UK and US tightening policy as interest rates rise Canada using fiscal policy to boost growth Monetary policy measures will help growth in the EU, China and Japan US will likely ease fiscal policy in 2016 Commodity prices Eurozone may also be supportive, driven by migrant spending in Germany However, some positive change in certain areas such as gas and price liberalisation Modest growth driven by consumption Overcapacity yet to be tackled Property correction is far from over However, inflation likely to pick up in 2016 The positive impact of falling oil prices may fade in 2016 India China Worst of the oil shock may be over Industrial economy is gradually recovering Key: Consumption still low due to high unemployment and falling wages Tailwind Slight tailwind Russia Political situation continues to deteriorate Headwind The Global Economy Unlikely scope for reform without new government 2016 is set to be another disappointing year for growth Brazil Source: Schroders as at December 2015. Important Information: Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as longterm investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. The fund is authorized by the SFC but such authorization does not imply official approval or recommendation. Schroder does not provide any securities or investment products for offer, solicitation or trading within The People’s Republic of China (PRC). Should illegitimacy arise thereof, contents of this document shall not be construed as an offer or solicitation or trading for such securities or products. All items mentioned herein are sold through financial products issued by commercial bankers in the PRC under regulations by the China Banking Regulatory Commission (CBRC). Investors should read the relevant documents clearly before invest in the mentioned funds. Please consult the relevant commercial bankers in the PRC and/or professional consultants if necessary. This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 9095 1215/CNEN