The global economy in pictures Jan 2016 2015 in review

advertisement

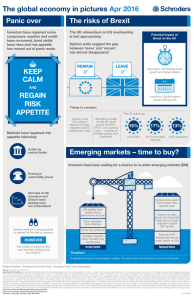

The global economy in pictures Jan 2016 2015 in review Spring Summer •ECB* announce QE* of €60 billion per month •Weakness in China prompted monetary easing and fiscal stimulus •Strength in US shale gas led to a fall in commodity prices •Panic after China equity bubble popped leading to equity sell-off •Further worries after authorities devalue CNY A desynchronised Winter in 2015 Winter Autumn •China fears spread to Emerging Markets - as commodity prices fall - and the US, leading the FED against raising interest rates Historic agreement on climate change, but will it change the world? Fears reduced as government announced fiscal stimulus measures and PBoC* announce monetary policy easing BoJ* refrained from increasing QQE* despite disappointing economic growth, but did keep policy loose ECB* disappoints investors with small increase in stimulus FED* finally raises rates resulting in strong rally in the USD 2015 will probably be remembered for the lacklustre performance of markets, and the uncertainty caused by central banks’ actions (and inactions) Five lessons from 2015 Rumours of Chinese market reforms were greatly exaggerated Oil producers were resilient as oil prices stayed low US rates were able to rise without causing mayhem Greece forced to take bailout package ECB* President loses popularity after refraining from adding monetary easing Political uncertainty Five themes for 2016 China enters the currency war Services vs. manufacturing split The desynchronised cycle continues Emerging markets continue to struggle Gradual depreciation of CNY challenges competitors International sectors likely to become pressurised, domestic service sector should continue to thrive Monetary tightening in the US, loosening policy elsewhere Pressure on Emerging Markets commodity prices. Investors may be deterred by potential downgrades and an increase in defaults US presidential election year leading to Trump presidency? UK referendum on EU membership leading to Brexit? Uncertainty will weigh heavy on investment decisions *ECB - European Central Bank, *FED - Federal Reserve, *QE - Quantitative Easing, *QQE - Qualitative and Quantitative Easing, *PBoC - People’s Bank of China, *BoJ - Bank of Japan Source: Schroders as at January 2016. Important Information: Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as longterm investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. The fund is authorized by the SFC but such authorization does not imply official approval or recommendation. Schroder does not provide any securities or investment products for offer, solicitation or trading within The People’s Republic of China (PRC). Should illegitimacy arise thereof, contents of this document shall not be construed as an offer or solicitation or trading for such securities or products. All items mentioned herein are sold through financial products issued by commercial bankers in the PRC under regulations by the China Banking Regulatory Commission (CBRC). Investors should read the relevant documents clearly before invest in the mentioned funds. Please consult the relevant commercial bankers in the PRC and/or professional consultants if necessary. This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 9095 0116/CNEN