Talking Point Schroders What can investors learn from Leicester City’s Premier League title?

May 2016

Schroders

Talking Point

What can investors learn from Leicester

City’s Premier League title?

Stuart Podmore, Investment Propositions Director

Leicester City has surprised everyone by challenging for and winning the English Premier League title, but what does the club's fortunes reveal about behavioural psychology and how does that relate to investing?

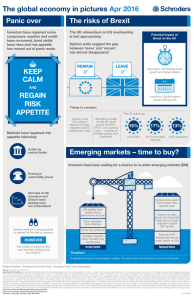

If you thought the most important investment-related news story of 2016 so far was Brexit, Donald Trump,

China, the oil price, or politicians’ tax return revelations, you’d have missed a point. It’s Leicester City FC and its winning of the first Premier League title.

Loss aversion

I don’t make this statement to trivialise or belittle either the fortunes of our clients in uncertain markets or the success of a proud football club.

Our clients’ success is ours, given our goals are completely aligned with theirs: the creation of long-term value to assist them in meeting their future financial needs. And the conviction, patience and support shown by UK football fans could be a timely reminder of core values for struggling investors in tough times.

The reason I believe Leicester City’s story relates so closely to markets and investment is due to the behavioural psychology that those fortunes reveal.

It was Matthew Syed at The Times (The Game, Monday 14 March 2016) who first highlighted this parallel;

Leicester City, in trying not to lose the race for the Premier League rather than playing to win it, was facing the challenge of loss aversion.

It’s the equivalent of the fund manager’s temptation to lock in gains too soon and become overly protective, or an advisory client’s counter-productive desire to avoid losses at all costs without understanding risk as manifested by volatility.

In the case of Leicester City, it has affected those fans cashing out on their start of season bets at 5000-1.

Locking in a gain becomes very tempting when so much is at stake and I don’t blame them for that.

Committing to the cause

What our clients need is assistance to differentiate when they are selling out of conviction, as opposed to the fear of losing a gain, and an advisory reminder of the importance of a long-term financial plan.

Loss aversion, first demonstrated by Amos Tversky and Daniel Kahneman, is the most pervasive of all

Schroders Talking Point Page 2 behavioural biases, mainly because people have always had a tendency to prefer avoiding losses to acquiring gains.

For those advisers facing clients who insist on trying to time the markets and sell at the first sign of increased volatility, here is the Schroders 2 Step Journey to Rational Decision Making:

• Remember that capacity for loss goes far beyond a number and an objective definition.

•

“The easiest way to increase happiness is to control your use of time.” (Daniel Kahneman, Thinking,

Fast and Slow, 2013) Give clients permission to do things to increase their overall life satisfaction and reduce the worry that loss aversion can cause.

Sticking by long-term tactics

We all make choices that don’t make sense – it’s human nature.

Mix in the fact that clients are often over-confident in their own financial acumen (our recent research found that 65% of investors are confident in their ability to make sound investment decisions) and you have a potent, destructive force that can de-rail your financial plans and advice.

Our value fund managers frequently talk about their unemotional appraisal of risk and reward, and their conviction in the value style.

Winning the league, Leicester City has demonstrated that it has stuck to its long-term, tactical success with low squad turnover and an absence of fear as it beat loss aversion.

Important Information

Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy.

Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document.

The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments.

Derivatives carry a high degree of risk and should only be considered by sophisticated investors.

The fund is authorized by the SFC but such authorization does not imply official approval or recommendation.

Schroder does not provide any securities or investment products for offer, solicitation or trading within The People’s Republic of China (PRC).

Should illegitimacy arise thereof, contents of this document shall not be construed as an offer or solicitation or trading for such securities or products. All items mentioned herein are sold through financial products issued by commercial bankers in the PRC under regulations by the

China Banking Regulatory Commission (CBRC). Investors should read the relevant documents clearly before invest in the mentioned funds.

Please consult the relevant commercial bankers in the PRC and/or professional consultants if necessary.

This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited.

Schroder Investment Management (Hong Kong) Limited

Level 33, Two Pacific Place, 88 Queensway, Hong Kong

Telephone +852 2521 1633 Fax +852 2530 9095