Document 14239445

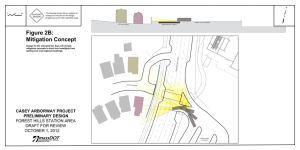

advertisement

Matakuliah Tahun : Manajemen Kinerja Sistem Komputer : Feb - 2010 03. Business Measurement Systems: Information Reliability and Risk Assessment Pertemuan 05-06 03. Business Measurement Systems: Information Reliability and Risk Assessment Pertemuan 05 – 06 03. Business Measurement Systems: Information Reliability and Risk Assessment 01. Decision Making and Risk Business Decision Model and Risk • The owners or managers of a business entity determine its objective, strategies to achieve objectives, and business processes to implement strategies. • Business measurement systems are designed to measure and display key success factors for achieving objectives. • The measurements facilitate planning and coordination of day-to-day activities, as well as subsequent evaluation of performance. Business Risk • • Business risk has been defined as " the threat that an event or action will adversely affect an organization's ability to achieve its business objectives and execute its strategies successfully". External environment risks – Threats from broad factors external to the business including substitute products, catastrophic loss, changes in customers' tastes and preferences, competitors, the political environment, laws/regulations, and capital and labor availability. • Business process and asset loss risks – Threat from ineffective or inefficient business process for acquiring, financing, transforming, and marketing goods and services, and threats of loss of firm assets including its reputation. • Information risks – Threats from poor-quality information for decision making within the business and erroneous information provided to outsiders. Figure 3.1 Figure 3.1 presents more details of risk in each of the three broad categories. 02. Risk Identification and Mitigation Risk identification, Sourcing, and Sizing. • Managing risk is essential to achieving long-term and short-term objectives of a business . • One approach to risk management has been developed by Arthur Andersen and summarized in Managing Business Risks : An Integrated Approach. Figure 3.2 is a diagram based on its risk assessment and control steps. Risk/Reward Trade-off and Risk Mitigation • For each potentially important risk identified, sourced, and sized, the risks versus reward trade-off is evaluated Monitoring Risk • Whatever the route taken, the last step in risk mitigation is continued monitoring for unexpected conditions and changes in conditions. • Figure 3.3 presents a chart showing application of the risk identification, sourcing, sizing, assessment, and response (RISSAR) approach as it might be applied by Guinness PLC. 03. Information Reliability Quantifying Information Misstatements • The difference between recorded value and true value will be called misstatement . • That is, Misstatement = Record value - true value, M = Yr - Y. Three Examples of Information Risk Mitigation • Inventory Errors – Several years ago, due to poor record keeping for individual items of inventory, LJ Appliances experienced frequent stockouts for some items, while other items had many months' supply on hand. – Figure 3.4 • A. Inventory Misstatement Distribution • B. Un collectable Receivables Distribution. • C. Aggregate Earnings Misstatement Distribution. • Credit Risks – Several years ago, LJ Appliances was experiencing what it considered to be excessive losses on recorded receivables due to salews to customers who did not pay their bills. • Bid Price Discount – Figure 3.4 part C, shows Tim's mental image of possible earnings misstatement . – If audited earnings are $.12, then Tim is willing to pay 8 X $.12 = $.96 . Figure 3.5 Partial RISSAR Chart for LJ‘ s Appliances Information Risk. 04. Risk Mitigation and Reliability Enhancement Methods Internal Control and Risk Mitigation • Two principal means by which management can mitigate the consequences of risk and enhance information reliability are internal control and assurance services. Internal Control Component and Limits In chapter 1, Internal Control was defined as : a process by an entity's board of directors, management and other personnel designed to provide reasonable assurance regarding the achievement of objectives in the following categories : effectiveness and efficiency of operations, reliability of financial information, compliance with the applicable laws and regulations. Figure 3.6 Figure 3.6 diagrams the Three COSO categories as overlapping circles with seven identifiable subcategories. Risk and Information Reliability Assurance Service • Assurance services as defined in chapter 1 include services directed toward improving relevance and reliability of information and its context for decision makers. • Risk-related services encompass improving information about risks faced by a business -- their identification sourcing, and sizing. Figure 3.7 • Figure 3.7 is a sketch of how an independent attestor audits a financial statement information display, with the bold boxes indicating management activities. 05. Accounting Information Decomposition as a Risk Assessment Tool Figure 3.8 Figured 3.8 diagrams the distribution of true value expectations. 06. Risk to Outside Directors and Auditors