The Functional Relations between Third Party Logistics and Intermodal Transport Systems

advertisement

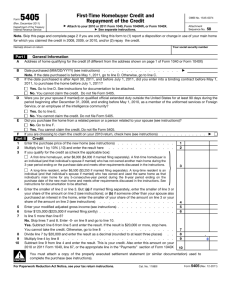

4th Translog Conference, Hamilton (Canada), June 15-16 2011 The Functional Relations between Third Party Logistics and Intermodal Transport Systems Jean-Paul Rodrigue Associate Professor, Dept. of Global Studies & Geography, Hofstra University, New York, USA Marc-André Roy Vice President, CPCS - North America, 72 Chamberlain Avenue, Ottawa, Ontario, Canada The Product as a Supply Chain… iPad 1 (2010) iPad 2 (2011) 3.1 lbs. 25.4 cm 2.8 lbs. 4.3 cm 5.1 cm Let’s Begin with the Conclusion about 3PLs… Growing organizational and functional complexity Blurring of roles and services Asset stigma Significant clustering of actors Layers to Logistics Services Actors Services 1PL Manufacturing, Retailing Carriers 2PL Transportation Logistics service providers 3PL Lead logistics providers & consultants 4PL Service integration Cargo owners Supply chain integration Logistics Supply chain management 3PL: An Attempt at a Definition A firm that adds value to the supply chains of beneficial cargo owners, directly or indirectly, by providing a range of logistics services beyond the mere carriage of goods. 3PLs control 40% of the global TEU in transit through maritime shipping Third Party Services • A firm other than the BCO, and usually but not necessarily independent of the carrier(s). • Range of logistics services provided can be narrow or wide, regional or global, sector or commodity specific. Assets Value Added • 3PLs can be asset-based (operator of modes, terminals or DCs) or nonasset based (forwarding, planning, consulting) logistics services providers. • Value is supply chain specific (e.g. time or cost, increased reliability) rather than specific to physical characteristics of goods. Key Drivers for Third and Fourth Party Logistics Providers Globalization • Supply chains becoming increasingly global (even within manufacturing processes), requiring greater management of supply chains Core competencies • Manufacturers and retailers are focusing on their core business (and outsourcing logistics services to specialized firms) Innovation and management • 3PLs becoming increasingly sophisticated in supply chain management, making investments, realizing economies of scale Asset utilization • 3PL model promotes greater asset utilization (e.g. balancing flows, backhaul, within their networks) and asset-sharing alliances Main Core Competencies of Third Party Logistics Providers Sourcing Shipping Product Transport Warehousing Routing Getting Blurry: Services Offered by Third and Fourth Party Logistics Providers 3PL ► ◄ 4PL Standard Advanced Complete Integrated Transportation services Carrier selection Rate negotiation Fleet management Warehousing Cross docking Pick and Pack Distribution (direct to store/home) Dispatching Delivery documentation Shipment consolidation Vendor managed inventories Stock accounting Customs clearance and documentation Assembly Packaging Labeling Managing product returns Financing Retail delivery, set up and on site training Inventory tracking Order planning and processing Information and Communications Technologies (ICT) management Single invoice Landed duty paid cost (per piece) Payment collection Real time inventory updates Just in Time (JIT) inventory management Production planning Sourcing Routing transit times air vs. ocean Supply chain consulting Complete real time supply chain monitoring and adjustment Location of 3PLs in Canada by Number of Employees Reflective of the Canada’s commercial geography of gateways and corridors. Ontario: 50.2% of employees Source: base data from Dun & Bradstreet, primary NAICS code 488510 Location of 3PLs in Canada by Number of Headquarter Employees Reflective of the Canada’s urban hierarchy and crossborder intensity. Ontario: 64.2% of headquarter employees Source: base data from Dun & Bradstreet, primary NAICS code 488510 Asset and Non-Asset Issues ■ Asset Stigma • Perception that an asset-based firm will be pressured to route flows through its own assets. • Majority (85%) of 3PLs brand themselves as non-asset based (may lease facilities or use hybrid model). • Large 3PLs: • Greater share of asset-based firms. • Networks of assets. • Small / micro 3PLs: • More alliances (sharing of assets). • Smaller long-term commitments to assets and more focus on being agile. The Clustering of 3PL Activities: Observed Patterns Transactional centric • A location within major central business districts where close interactions with major customers, in the form of corporate head offices, is key. Airport centric • A location in proximity to a major airport terminal to effectively deal with the time sensitivity of air cargo. Border centric • A location in proximity to a major cross-border gateway to assist customsrelated procedures and take advantage of cargo consolidation / deconsolidation opportunities. Port centric • A location in proximity to port terminals. This type of location tends to be coincidental with central business districts. Quebec – Windsor Corridor: Location of 3PL Firms and Value of Freight Transiting at Gateways Source: base data from Dun & Bradstreet, primary NAICS code 488510 The clustering of 3PLs around major ports of entry along the Quebec‐Windsor corridor is notable. Ambassador Bridge is largest Transit Point, but not largest cluster of 3PLs. Largest 3PL cluster around Pearson Intl. Airport. Asia Pacific Gateways and Corridors: Location of 3PL Firms and Value of Freight Transiting at Gateways Clustering around Western Canadian cross-border ports of entry. Related to customs activities and represent a specialized and localized segment of the 3PL industry. Vancouver: Canada’s sole “all-centric” 3PLs cluster. Source: base data from Dun & Bradstreet, primary NAICS code 488510 High concentration of 3PLs along the “sweet spot”; Louisville –Pittsburg. Market-centric 3PL clusters around centroids of optimal regional accessibility or intermediary locations along corridors of freight circulation (e.g. Allentown, PA) Source: base data from Dun & Bradstreet, primary NAICS code 488510 Services and Commodities ■ Size matters • Degree of supply chain integration tends to increase proportionally to firm size. • Largest firms most likely to offer a variety of service: • Large 3PLs handle 90% of commodity/sector categories on average. • Focus on economic sectors characterized by economies of scale (mass market) along with stable demand. • Some kinds of cargo (e.g. project cargo) are highly localized; dominance of small / micros. • Large players use a broad network, while smaller firms use a patchwork quilt of alliances. Vertical and Horizontal Integration in 3PLs Level of Services Offered (Vertical integration) Large Medium Micro & Small Commodities Served (Horizontal integration) Trade Focus ■ Import bias • General focus on 3PL services to imports, rather than exports. • Importers also include pure freight forwarders who are generally indifferent with respect to asset placement. • Micros were significantly more inclined to be import-focused. • Exports of raw materials: • Tend to lean on economies of scale, move in large loads, have a limited number of buyers and few value-added activities involved. • The expertise of 3PLs is much less required and the tasks are assumed by the carrier. Main Export-Oriented Regions and Shipping Routes Servicing North America: A Shift to Near-Sourcing? The Big Port Squeeze: Largest Available Containership, 1970-2013 (in TEUs) 20,000 “Triple E” Class (18,000 TEU) 18,000 16,000 E “Emma” Class (12,500 TEU) 14,000 12,000 10,000 S “Sovereign” Class (8,000 TEU) 8,000 6,000 4,000 2,000 0 L “Lica” Class (3,400 TEU) R “Regina” Class (6,000 TEU) Supply Chain Differentiation: Pick Your Preference Costs (38%) Stability of the cost structure. Relation with the cargo being carried. Time (12%) Influence inventory carrying costs and inventory cycle time. Routing options in relation to value / perishability. Reliability (43%) Stability of the distribution schedule. Reliability can mitigate time. Comparative Advantages in Supply Chain Preferences: A Complex Balancing Act Shipping Rate from Shanghai for a 40 Foot Container, Mid 2010 Vancouver Montreal $2,300 $2,110 $4,040 $3,950 Time New York $3,700 $1,830 Los Angeles $2,620 $1,400 $3,510 $2,560 Inbound rates: function of distance Outbound rates: function of trade imbalances Houston Reliability (?) $1,300 $2,100 Inbound Outbound The “Terminalization” of Logistics Terminalization BottleneckDerived • • • • Terminal as a constraint Rational use of facilities to maintain operational conditions Storage space, port call frequency, gate access Volume, frequency and scheduling changes WarehousingDerived • • • • Terminal as a buffer Incorporating the terminal as a storage unit “Inventory in transit” with “inventory at terminal” Reduce warehousing requirements at distribution centers CRB Index (CCI), Monthly Close, 1970-2011 800 700 Paradigm shift in input costs… Reaping the consequences of monetary policy. 600 500 400 300 200 100 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 1972 1970 0 100 Jan-70 Jan-71 Jan-72 Jan-73 Jan-74 Jan-75 Jan-76 Jan-77 Jan-78 Jan-79 Jan-80 Jan-81 Jan-82 Jan-83 Jan-84 Jan-85 Jan-86 Jan-87 Jan-88 Jan-89 Jan-90 Jan-91 Jan-92 Jan-93 Jan-94 Jan-95 Jan-96 Jan-97 Jan-98 Jan-99 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 West Texas Intermediate, Monthly Nominal Spot Oil Price (1970-2011) 140 120 This is also going to propagate along supply chains. Response from shipping companies: slow steaming 80 60 40 20 0 Conclusion (Take 2): 3PLs as the Emerging Supply Chain Management Paradigm Shift from shippers and carriers to 3PLs Inherent propensity to cluster around commercial gateways Customs procedures as the most salient issue for the industry Significant knowledge gap (operational and education) Expertise dominantly in import logistics