Florida Department of Financial Services Uniform Chart of Accounts Cost Estimate Report

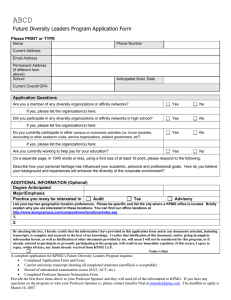

advertisement