fed talk

advertisement

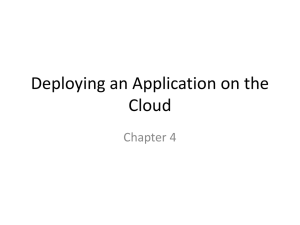

Inside This Issue: fedtalk Learning How to Use AMI and SCI ........................ 3 What People Are Saying About AMI and SCI ........ 3 How AMI Was Built to Meet Bankers’ Needs ......... 5 FedLine’s Future? It’s on the Web ......................... 7 FedLine for the Web Resources .............................. 8 FINANCIAL SERVICES UPDATE OF THE FEDERAL RESERVE BANK OF BOSTON ........................................................................ MAY 2002 Two New Web-based Applications Help Meet Accounting Info Needs Y ou’ve suggested a host of ways that we can make the accounting and billing statements that you receive each month for Federal Reserve Bank services less complex, easier to use, timelier, and more accessible. We took your suggestions and turned them into two new accounting applications. Account Management Information (AMI) and Service Charge Information (SCI) will allow you online access to the information found on your Fed accounting and billing statements through one common gateway, FedLine® for the Web. Using AMI and SCI you have the freedom to view information when you want it from virtually any Internet-connected PC within your institution. The web also allows us to provide you with realtime updates. You get to see what happens in your account as it happens. Here are brief overviews of the two new applications. Account Management Information – AMI The development of AMI began in January 2000, and a Boston Reserve Bank team did most of the work. (See “A Talk with Alan Bloom” on page 5.) The first thing we did was focus in on how we could make accounting information easier for you to access. We decided that the best thing that we could do for you was to minimize the number of systems you use. Therefore, one of the key features of AMI is that it provides access to the Integrated Accounting System (IAS) and the Account Balance Monitoring System (ABMS) through one common application that: ✔ Is continuously updated and always available; ✔ Lets you select the amount and complexity of the information you receive; ✔ Takes advantage of the latest web-based technologies; and ✔ Delivers specific customer service contact information to help make problem resolution easier than ever. continued on page 2 customer spotlight Tolland Bank Enjoys Judging AMI M any banks today promote banking by mail, by phone, or over the Internet. How many, though, can boast of “bankby-train” service? One that can — although it has to look back some 15 years to do so — is Tolland Bank. Over its 160-year existence, Tolland Bank has experienced significant growth. Today its nine offices span an area between Hartford and Connecticut’s border with Massachusetts. The bank’s executives recall with particular fondness the period from 1976 until the late 80’s when its first branch in Willington was housed in a converted Vermont railroad station. As Willington grew, the branch needed additional space, and in 1979 it expanded into a 1925 Delaware and Hudson caboose! continued on page 4 ........................................................................ FEDTALK • MAY 2002 ........................................................................... Web Accounting Apps continued from page 1 Information for the current business day is continuously updated and immediately available. You also have the option of viewing end-of-day information for the previous business day. Based on your needs, you can drill down through multiple levels of data — from the most basic information to more complex transaction details. ■ A one-stop information source Because AMI consolidates so much information, it’s a one-stop resource. You no longer have to access both IAS and ABMS to get the information you need to manage your account. AMI also integrates these reports: ABMS Inquiry, IAS Detail, and IAS Payment System Risk. Managing paper or multiple sources of information to access details in these accounts will become a thing of the past. Additionally, AMI provides access to your daily Statement of Account, IAS Notifications, and Advices. If your institution subscribes, Cash Management is also included. Your Statement of Account is provided as a PDF file, allowing the information to be stored and printed. Five days of statements are available for retrieval over the web. ■ Extra optional security On top of the security already built into FedLine for the Web, AMI comes with a new, optional level of security: Restricted and Non- AMI and SCI Are On the Way Both AMI and SCI will be available to First District institutions sometime in the second quarter of this year. If you haven’t already seen an announcement letter, expect one very soon. Now that we are focused on FedLine for the Web as our platform for the delivery of new information services, you can look forward to more web-based applications with new features and increased functionality. Restricted views. We have identified as potentially “sensitive” four items that appear in AMI — available funds balance, collateral, memo post, and net debit cap totals. If you choose, you can restrict access to these four items to particular employees. Other employees will be able to view everything else in AMI. Knowing that you are able to grant different levels of access, you can feel more comfortable using AMI to assist you in managing and reconciling your Federal Reserve account. Service Charge Information – SCI Around the same time we began work on AMI, the results of a separate study indicated that many of you also wanted changes made to your monthly Billing Statement of Service Charges. Specifically, you voiced concerns regarding the amount and accuracy of billing information, along with the timeliness and delivery method of the statements. The Service Charge Information application was developed to address these concerns. SCI summarizes all of the information found on your monthly Billing Statement of Service Charges. This includes your own activity, subaccount and/or respondent activity, charges passed to correspondents, and earnings credits. Adjustments or reversals processed to your account during the monthly billing cycle are also available. Much like AMI, with SCI you can select the level of detail that you want to see. You can start by looking at summary information, and then drill down to the more detailed levels as needed. SCI also offers a variety of reports and inquiry capabilities that provide insight into the specific billing activity in your account. If you need to look up information from last month or the month before, that’s not a problem: SCI maintains three cycles of billing data. FedLine is a registered trademark of the Federal Reserve Banks. 2 ........................................................................ ........................................................................... FEDTALK • MAY 2002 Learning How to Use the Two New Web Applications M any of the individuals who participated in the AMI and SCI pilots found the applications so intuitive and easy to use that they did not need any training. While we were pleased to hear that, every new user of either application will receive computer-based training materials on a CD-ROM. These materials contain step-by-step tutorials, which take you through each screen within the application. The tutorials are designed to teach you how to navigate easily around both AMI and SCI. Why computer-based training? Computer-based training offers multiple benefits. For most of you it will be a good introduction to these new applications. The tutorials provide guided tours of AMI and SCI; along the way, you will become familiar with the features and functionality of each application. Using the computer as a training tool allows you to learn the application at your own pace, and you can tailor the training sessions to fit your schedule: stop when it’s convenient and pick up at the same point you left off. Also, because you receive the training modules on CD-ROM, you can go back and refresh your knowledge at any point after you start using either application. In conjunction with the CD-ROM, you will receive User Guides that contain detailed information about each screen within AMI and SCI. All of the information in the User Guides is indexed, enabling you to find what you are looking for quickly and efficiently. Pilot participants who used the computer-based training were pleased with the level of information on the CD-ROM and on how the information is presented. We hope that you have the same positive experience. What People Are Saying About AMI and SCI D uring November and December of last year, 31 financial institutions around the nation (including several in New England) participated in the AMI pilot, along with Reserve Bank staff. The feedback has been resoundingly positive. Over 90 percent were either “satisfied” or “very satisfied” with the application, and over 95 percent found AMI “easy to navigate” and “intuitive.” (See Customer Spotlight on page 1 for a Connecticut bank’s experience testing AMI.) Here are some examples of what the testers had to say about AMI: “Everything was great and very user-friendly . . .” “This will be a big step forward for us.” “We have the potential to reduce operational costs and reassign responsibilities when we reach the full potential of the system.” During November and December of last year, 34 institutions along with Reserve Bank staff from all 12 districts had the opportunity to test-drive SCI. The responses from the SCI pilot participants mirrored the responses of their AMI counterparts. Close to 87 percent were either satisfied or very satisfied with SCI and over 90 percent found the application easy to navigate. A number of our pilot customers said that SCI reduced their workload and paper output, and that SCI makes the entire reconcilement process much easier. In fact, the reconcilement process for several customers was reduced by a few hours. The labor-saving potential of our new FedLine for the Web application was highlighted by this comment in one tester’s evaluation: “Billing tasks that currently take three hours took 15 minutes with Service Charge Information.” ........................................................................3 FEDTALK • MAY 2002 ........................................................................... customer spotlight Tolland Bank Enjoys Judging AMI continued from page 1 them” — typically, several times a day. Although the bank’s Willington office now Also, she notes, signing in to FedLine for occupies more conventional space, a much-prized the Web each morning is simple and quick. mural of the caboose covers one wall. Aside from the fact that AMI is so fast, Marliese Tolland Bank’s railroading past is described on likes the flexibility of a web-based system. its very contemporary web site, www.tollandbank.com. “We’re not locked into proprietary hardware, so The bank’s management prides itself on meeting we can bring the system up on almost any PC in the banking needs of the western Connecticut the bank.” communities it serves, and on using the most up-todate technology to help meet those needs — behind the scenes as well as on the banking floor. “What’s different about AMI is its ‘drill down’ So it was no surprise when Marliese Shaw, Vice President and Treasury Officer at Tolland capability. We used to have to research Bank, volunteered her staff to test the Fed’s newest an item… maybe call the Fed for the FedLine for the Web application, Account Manageunderlying detail or activity. ment Information or AMI (described elsewhere in this issue of Fedtalk). Marliese, who manages her That’s no longer the case with AMI.” bank’s investment portfolio and Fed account, among other responsibilities, saw potential benefits for Tolland Bank in the new system and wanted to That makes it much easier and less costly be among the first to try it out. for different functional areas within a bank — After a six-week pilot, Marliese is sold on accounting and operations, for example — AMI’s benefits. “It’s been great, especially as independently to access the FedLine applications they need. According to Tolland’s CFO a timesaver for my Dave Gonci, “That’s especially valuable for a staff,” she recently bank like us that’s functionally decentralized.” observed. Until AMI In practice, Tolland staffers bring up came along, it took FedLine for the Web in the morning and keep Tolland Bank several the web site going all day, refreshing it whenminutes a day to ever they want to retrieve current data. retrieve account What about the format of the AMI reports? balances from their DOS FedLine PC. With “The summary information is quite similar to what we’re accustomed to,” says Marliese. AMI on the web, “it’s nearly instantaneous, so “What’s different about AMI — and makes it we can afford to update especially convenient — is its ‘drill down’ capability. We used to have to research an account balances whenever we need continued on page 6 Marliese Shaw, Vice President and Treasury Officer at Tolland Bank ▼ 4 ........................................................................ ........................................................................... FEDTALK • MAY 2002 A TALK WITH ALAN BLOOM How AMI Was Built to Meet Bankers’ Needs A few years ago we began noticing signs of Customer participation didn’t end there. In obsolescence in the tools available to our addition to the focus groups, before AMI was financial institution customers to help finalized the project team obtained the perspective them manage their accounts, and we decided to do of customer advisory groups and of individual something about it.” The speaker is Alan Bloom, bankers who volunteered to participate in “usabilAssistant Vice President in charge of the Boston ity labs.” Finally, over the last six weeks of 2001 Reserve Bank’s Central Accounting Technology we conducted pilot tests of the new application in Services group, and the “something” the Bank every Federal Reserve district, including New decided to do was to England. “That way,” build a new, integrated said Alan, “at every Account Management stage of AMI’s developInformation system, or ment we were able to AMI. identify and incorporate About two years requirements that ago, Alan assigned to genuinely satisfy what the AMI project almost bankers are looking for one-third of his staff — to manage their aca mix of analysts, counts.” programmers, accountants, and outside A compelling option: consultants. Their task The Web One of the first was to take the 15-yearthings the development old DOS FedLine team decided was to applications that provide take a look at how AMI accounting information would be delivered to to our customers, and our customers. Finding give them a complete “We started out by building prototype screens and retrieving accountmakeover to make them and showing them to customer focus groups. ing information over more feature-rich, Based on the feedback we received, we made DOS FedLine worked flexible, and easy to use. changes and went back to bankers to see well in its time, but by Put another way, Alan’s 2000 the Internet was a goal was to build a how well they liked what we’d done.” compelling alternative. system that made sense According to Alan, for the twenty-first century. the web held particular appeal to AMI’s developers As Alan describes it, the process of designing for a couple of reasons: “Pretty much every banker uses one business application or another on the AMI involved a great deal of input from bankers Internet, so it’s a familiar and comfortable environ— in New England and throughout the country. ment for our customers. Also, it’s much faster and “We started out by building prototype screens and easier to make system changes on the web; the showing them to customer focus groups,” he explained. “Based on the feedback we received, we software is centrally managed, so individual users made changes and went back to bankers to see how aren’t inconvenienced each time a fix or enhancewell they liked what we’d done.” continued on page 6 “ ▼ ........................................................................5 Alan Bloom, Assistant Vice President in charge of the Boston Reserve Bank’s Central Accounting Technology Services group FEDTALK • MAY 2002 ........................................................................... Alan Bloom continued from page 5 ment is implemented. And we knew when we started up the project two years ago that the Federal Reserve planned to shift our delivery to bankers of both information and transactional services onto FedLine for the Web just as soon as it makes sense.” “At every stage of AMI’s development we were able to identify and incorporate requirements that genuinely satisfy what bankers are looking for to manage their accounts.” As for the AMI application itself, Alan explains some of the most significant improvements: “Under FedLine for DOS, some accounting information is stored in our ABMS application, some in IAS. Depending on what information you’re looking for, you’ll need to open either (or both) applications. But not with AMI on FedLine for the Web. AMI acts as a gateway. You specify what you want to see and AMI will track it down and retrieve it for you.” Another issue that a DOS FedLine user has to contend with is learning Fed jargon. To find the data you need, you may have to enter an ABA number, one or more service category codes, and possibly a few transaction codes. Not in AMI. The first thing you’ll see is a summary screen. Then, all you need to do is click each time you want to drill down to view more detailed information. It’s an intuitive approach that will be familiar to anyone who has Internet experience. In building AMI, Alan notes, “our goal was to provide a more integrated presentation of financial services information to our customers.” Judging from the comments of pilot test participants, the development team has certainly met that goal. Customer Spotlight: Tolland Bank continued from page 4 item…maybe call the Fed for the underlying detail or activity. That’s no longer the case with AMI.” Krista Squiers, a Treasury analyst who has been piloting AMI, gives an example. “Say you “Say you have the account balance, and you want to see more detail — such as the credits and debits for today’s cash letter. On AMI, you can get at that with a keystroke. It’s so much easier to use.” 6 have the account balance, and you want to see more detail…such as the credits and debits for today’s cash letter. On AMI, you can get at that with a keystroke. It’s so much easier to use.” It’s also easy to learn, according to Krista. “They gave me a manual, but I didn’t need to read it. There was scarcely any learning curve.” Although Tolland Bank evaluators suggested several improvements, which were passed along to the Fed development team, everyone at Tolland who had the chance to try it out was impressed with the application’s overall performance. Marliese summed it up this way: “AMI is a winner, and I’ll look forward to web versions of other FedLine applications.” ........................................................................ ........................................................................... FEDTALK • MAY 2002 FedLine’s Future? It’s on the Web T platform. That’s because a truly secure Internet Protocol (IP) doesn’t yet exist. The Federal Reserve is actively engaged in identifying a secure approach to value transfer over the web, and a strategic decision to focus all of our efforts on FedLine for the Web will help us to bring that solution forward sooner. As for information services, if you are currently a FedLine user, you’ll have a choice. As we make the transition to a full suite of web information and transaction services, all financial services currently offered by the Federal Reserve will continue to be available through our existing DOS-based FedLine product. So one option will be to continue using the DOS platform for informational services. We’ve been working with Dell on a new DOS FedLine PC that will enable you to use modern laser printers. This will be available soon and should help make the DOS version of FedLine faster and more convenient. Even today, however, you may find that FedLine for the Web is a compelling choice for informational services. The web platform offers greater flexibility than DOS and you can run it on continued on page 8 FedLine and Windows NT are trademarks, respectively, of the Federal Reserve Banks and Microsoft Corporation. ........................................................................7 ▼ he future of FedLine® is on the Internet! On the heels of a complete reassessment of our FedLine platform strategy, the Federal Reserve has decided to move full speed ahead with FedLine for the Web and to discontinue all work on FedLine for Windows NT®. Prior to setting this strategy direction, development teams within the Fed were moving ahead simultaneously with both the web and Windows NT versions of FedLine. However, the platform review concluded that proceeding on two fronts was spreading us too thin and taxing resources — both yours and ours — to the limit and beyond. Of course, the analysis that led to the Federal Reserve’s strategic decision to discontinue FedLine for Windows NT looked at myriad factors. But the key issue came down to this: We need to dedicate our full energies to developing FedLine as an open system for our customers. From your perspective as a FedLine user, having to invest in two new FedLine platforms, maintain multiple FedLine PCs, and train staff to operate two or even three completely different versions of FedLine at the same time, was a daunting prospect. For us, a strategy that once made sense has been adjusted in response to the rapid development of Internet technology. We share the widely-held view that our industry’s future relies on using web-based technologies to provide information and transaction services. Developing and maintaining FedLine for Windows and for the Web, and then having to support both of those systems as well as a DOS platform, became increasingly complex, burdensome and costly. Where does that leave things? Now there are just two FedLine platforms for you to think about, DOS FedLine and FedLine for the Web. If you’re using FedLine with one of our three payments systems — Funds Transfer, Book-Entry Securities, or ACH — you’ll need to continue to use the DOS FedLine for the Web shown here with the new Account Management Information (AMI) application screen. FEDTALK • MAY 2002 ........................................................................... FedLine’s Future? It’s on the Web continued from page 7 almost any PC in your shop. Currently, Cash, Savings Bonds and informational check services (such as check adjustment information and check image services) are available on FedLine for the Web, and accounting (AMI) and service charge information (SCI) are about to follow. Reporting and Reserves services are available at www.reportingandreserves.org. As we continue to introduce new informational applications for FedLine for the Web, we are also developing a pricing strategy for web access to Reserve Bank financial services. For now, though, there is no charge to use FedLine for the Web services. The bottom line is that your choices come down to these: ■ For transaction services, you’ll continue to need FedLine for DOS — until we bring you safe, secure transaction services on FedLine for the Web. ■ For information services, you can still use FedLine for DOS, if you choose. However, FedLine for the Web will make sense for new FedLine users as well as for many current DOS customers today… and even more so in the future. For more information and for assistance in your resource planning, please call your Boston Reserve Bank Account Manager at 1-800-4477205, or our FedLine Help Desk at 1-800-435-7122. We also regularly update information on our FedLine plans on our national web site at www.frbservices.org. FedLine for the Web Resources Extensive information about services available on the web and a step-by-step guide to the set-up process is on our web site at www.bos.frb.org/finsvcs/html/services/ helpdesk/html/helpdesk.htm. Help is also available from our Account Managers (800-447-7205) and FedLine Customer Support (800-435-7122). You can also e-mail your questions to BosFedLine@bos.frb.org or to antonio.mendieta@bos.frb.org (or call Antonio at 617-973-3370). Fedtalk is a Federal Reserve Bank Services publication distributed three times a year to customers of the Federal Reserve Bank of Boston. It is designed to encourage communication between the Bank and its customers. Your comments are welcome. Send correspondence to the editor: Hank Grossman, T-6, Federal Reserve Bank of Boston, PO Box 2076, Boston, MA 02106-2076, hank.grossman@bos.frb.org. Fedtalk is available without charge. To receive Fedtalk via e-mail, please complete and send to us electronically the subscription form on our Web site at www.bos.frb.org/finsvcs/html/contacts/html/fsemail.htm. Throughout this newsletter, “banks” refers to all depository financial institutions. FIRST CLASS MAIL U. S. POSTAGE PAID BOSTON, MA PERMIT NO. 59702 FEDERAL RESERVE BANK OF BOSTON PO BOX 2076 BOSTON MA 02106-2076 8 ........................................................................