Document 14130371

advertisement

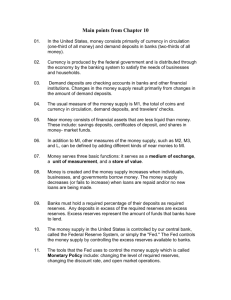

Money Creation and Control CHAPTER 27 CHAPTER CHECKLIST When you have completed your study of this chapter, you will be able to 1 Explain how banks create money by making loans. 2 Explain how the Fed controls the quantity of money. 27.1 HOW BANKS CREATE MONEY Creating a Bank To see how banks create money, we’ll work through the process of creating a bank and see how our new banks creates money. 27.1 HOW BANKS CREATE MONEY There are eight steps: • Obtain a license to operate a commercial bank • Raise some financial capital • Buy some equipment and computer programs • Accept deposits • Establish a reserve account • Clear checks • Buy government securities • Make loans 27.1 HOW BANKS CREATE MONEY Obtaining a Charter Apply to the Comptroller of the Currency Raising Financial Capital Virtual College Bank creates 2,000 shares, each worth $100, and sells these shares in your local community. Balance sheet A statement that summarizes assets (amounts owned) and liabilities (amounts owed). 27.1 HOW BANKS CREATE MONEY Table 27.1 shows Virtual College Bank’s balance sheet #1. 27.1 HOW BANKS CREATE MONEY Buy some equipment and computer programs Buy some office equipment, a server, banking database software, and a high-speed Internet connection. These items cost you $200,000. 27.1 HOW BANKS CREATE MONEY Table 27.2 shows Virtual College Bank’s Balance Sheet #2 27.1 HOW BANKS CREATE MONEY Accepting Deposits Offer the best terms available and the lowest charges on checkable deposits. Deposits begin to roll in. You have accepted $120,000 of deposits. 27.1 HOW BANKS CREATE MONEY Table 27.3 shows Virtual College Bank’s Balance Sheet #3 27.1 HOW BANKS CREATE MONEY Establishing a Reserve Account Establish a reserve account at local Federal Reserve Bank. 27.1 HOW BANKS CREATE MONEY Table 27.4 shows Virtual College Bank’s Balance Sheet #4 27.1 HOW BANKS CREATE MONEY Reserves: Actual and Required A bank’s required reserve ratio is the ratio of reserves to deposits that banks are required, by regulation, to hold. Suppose that the required reserve ratio is 25 percent of total deposits. A bank’s required reserves are equal to its deposits multiplied by the required reserve ratio. So for Virtual College Bank, Required reserves = $120,000 x 25 ÷100 = $30,000. 27.1 HOW BANKS CREATE MONEY Actual reserves minus required reserves are excess reserves. Virtual College Bank’s Excess reserves = $120,000 - $30,000 = $90,000. Whenever banks have excess reserves, they can make loans. 27.1 HOW BANKS CREATE MONEY Clearing Checks Virtual College Bank’s depositors want to be able to make and receive payments by check. Funds must move from an account at your bank to an account at another bank. In the process, one bank loses reserves and the other bank gains reserves. Figure 27.1 on the next slide shows how a bank clears a check. 27.1 HOW BANKS CREATE MONEY Jay banks at Virtual College. Jay writes a check for $20,000 on his account at Virtual College to pay Hal PCs. Hal PCs banks at First America. When Hal PCs deposits the check, First American sends it for collection to the Dallas Fed. 27.1 HOW BANKS CREATE MONEY The Dallas Fed increases First American’s reserves by $20,000. The Dallas Fed decreases Virtual College’s reserves by $20,000. 27.1 HOW BANKS CREATE MONEY First American increases Hal’s PCs’ checkable deposit by $20,000. Virtual College decreases Jay’s checkable deposit by $20,000. 27.1 HOW BANKS CREATE MONEY First American’s assets and liabilities have both increased by $20,000. Virtual College’s assets and liabilities have both decreased by $20,000. 27.1 HOW BANKS CREATE MONEY Buying Government Securities Government securities provide a bank with an income and a safe asset that is easily converted back into reserves. Suppose that Virtual College decides to buy $60,000 worth of government securities. On the same day, First American decides to sell $60,000 of government securities. In reality, a bond broker will match the First American sale with Virtual College’s purchase. 27.1 HOW BANKS CREATE MONEY Virtual College buys $60,000 worth of government bonds from First American. Virtual College’s government securities increase by $60,000 and First American’s government securities decrease by that amount. 27.1 HOW BANKS CREATE MONEY Virtual College pays for the bonds by check. When the check clears, the Dallas Fed increases First American’s reserves by $60,000 and decreases Virtual College’s reserves by the same amount. 27.1 HOW BANKS CREATE MONEY First American’s assets are unchanged: Reserves have increased by $60,000. Government securities have decreased by $60,000. 27.1 HOW BANKS CREATE MONEY Virtual College’s assets are unchanged: Reserves have decreased by $60,000. Government securities have increased by $60,000. 27.1 HOW BANKS CREATE MONEY Table 27.5 shows Virtual College Bank’s Balance Sheet #5 27.1 HOW BANKS CREATE MONEY Making Loans With reserves of $40,000 and required reserves of $25,000, Virtual College has excess reserves of $15,000. So the bank decides to make loans of this amount. 27.1 HOW BANKS CREATE MONEY Table 27.6 shows Virtual College Bank’s Balance Sheet #6 Virtual College has now created $15,000 of new money. 27.1 HOW BANKS CREATE MONEY Spending a Loan To spend their loans, the borrowers write checks on their checkable deposits. Assume they spend the entire $15,000. Most likely, the people to whom these checks are paid do not bank at Virtual College. The receiving banks send the checks to the Dallas Fed for collection. The Fed increases the reserves of the receiving banks by $15,000 and decreases the reserves of Virtual College by $15,000. 27.1 HOW BANKS CREATE MONEY Table 27.7 shows Virtual College Bank’s Balance Sheet #7 The deposits that Virtual College created are now at some other banks in the system. 27.1 HOW BANKS CREATE MONEY Limits to Money Creation When Virtual College creates money and its customers spend the new money, other banks receive reserves and have excess reserves. These banks now create money just like Virtual College did. At each stage, the amount of new loans get smaller. 27.1 HOW BANKS CREATE MONEY When a bank receives deposits, it keeps 25 percent in reserves and lends 75 percent. The amount loaned becomes a new deposit at another bank. The next bank in the sequence keeps 25 percent and lends 75 percent, and the process continues until the banking system has created enough deposits to eliminate its excess reserves. At the end of the process, an additional $100,000 of reserves creates an additional $400,000 of deposits. Figure 27.3 on the next slide shows the multiple creation of bank deposits. 27.1 HOW BANKS CREATE MONEY 27.1 HOW BANKS CREATE MONEY Why is the increase in deposits equal to 4 times the initial increase in reserves? The answer is because the required reserve ratio is 25 percent (or 0.25). Once the banking system has excess reserves, banks keep on lending and creating deposits until all the new reserves are required. This outcome occurs when deposits have increased by 1/0.25 (or 4) times the initial increase in reserves. 27.2 INFLUENCING THE QUANTITY OF MONEY The Fed constantly takes actions that influence the quantity of money, and open market operations are the Fed’s major policy tool. An open market operation is the purchase or sale of government securities by the Fed in the open market. 27.2 INFLUENCING THE QUANTITY OF MONEY How An Open Market Operation Works When the Fed buys securities in an open market operation, it pays for them with newly created bank reserves and money. With more reserves in the banking system, the supply of interbank loans increases, the demand for interbank loans decreases, and the federal funds rate falls. The federal funds rate in the interest rate on loans in the interbank market. 27.2 INFLUENCING THE QUANTITY OF MONEY Similarly, when the Fed sells securities in an open market operation, buyers pay for them with bank reserves and money. With fewer reserves in the banking system, the supply of interbank loans decreases, the demand for interbank loans increases, and the federal funds rate rises. The Fed sets a target for the federal funds rate and conducts open market operations on the scale needed to hit its target. 27.2 INFLUENCING THE QUANTITY OF MONEY A change in the federal funds rate is only the first stage in an adjustment process that follows an open market operation. If banks’ reserves increase, they increase their lending, which increases the quantity of money. If banks’ reserves decrease, they decrease their lending, which decreases the quantity of money. 27.2 INFLUENCING THE QUANTITY OF MONEY The Fed Buys Securities Suppose the Fed buys $100 million of U.S. government securities in the open market. The seller might be • A commercial bank • The non-bank public 27.2 INFLUENCING THE QUANTITY OF MONEY Figure 27.4 shows what happens when the Fed buys securities from a bank. 27.2 INFLUENCING THE QUANTITY OF MONEY Figure 27.5 shows what happens when the Fed buys securities from the public. 27.2 INFLUENCING THE QUANTITY OF MONEY The Fed Sells Securities Suppose the Fed sells $100 million of U.S. government securities in the open market. The Fed’s assets decrease by $100 million. The reserves of the banking system decrease by $100 million and banks must borrow in the interbank market to meet their required reserve ratio. The change in bank reserves is just the beginning. A multiplier effect on the quantity of money begins. 27.2 INFLUENCING THE QUANTITY OF MONEY The Multiplier Effect of an Open Market Operation An open market purchase that increases bank reserves also increases the monetary base. The increase in the monetary base equals the amount of the open market purchase, and initially, it equals the increase in bank reserves. 27.2 INFLUENCING THE QUANTITY OF MONEY If the Fed buys securities from the banks, the quantity of deposits (and quantity of money) does not change. If the Fed buys securities from the public, the quantity of deposits (and quantity of money) increases by the same amount as the increase in bank reserves. Either way, the banks have excess reserves that they now start to lend. 27.2 INFLUENCING THE QUANTITY OF MONEY The following sequence of events takes place: • An open market purchase creates excess reserves. • Banks lend excess reserves. • The quantity of money increases. • New money is used to make payments. • Some of new money is held as currency—currency drain. • Some of the new money remains on deposit in banks. • Banks’ required reserves increase. • Excess reserves decrease but remain positive. 27.2 INFLUENCING THE QUANTITY OF MONEY Figure 27.6 illustrates this sequence of events. The process repeats until excess reserves have been eliminated. 27.2 INFLUENCING THE QUANTITY OF MONEY Figure 27.7 provides an example of the multiplier effect of an open market operation with numbers. • When the Fed provides the banks with $100,000 of additional reserves in an open market operation, the banks lend those reserves. • Of the amount loaned, $33,333 (33.33 percent) leaves the banks in a currency drain and $66,667 remains on deposit. • With additional deposits, required reserves increase by $6,667 (10 percent required reserve ratio) and the banks lend $60,000. 27.2 INFLUENCING THE QUANTITY OF MONEY • Of this amount, $20,000 leaves the banks in a currency drain and $40,000 remains on deposit. • The process repeats until the banks have created enough deposits to eliminate their excess reserves. • An additional $100,000 of reserves creates $250,000 of money. The next slide summarizes this sequence of events. 27.2 INFLUENCING THE QUANTITY OF MONEY 27.2 INFLUENCING THE QUANTITY OF MONEY The Money Multiplier The money multiplier is the number by which a change in the monetary base is multiplied to find the resulting change in the quantity of money. Change in quantity of money = Money x multiplier Change in monetary base 27.2 INFLUENCING THE QUANTITY OF MONEY The larger the currency drain and the larger the required reserve ratio, the smaller is the money multiplier. Required reserves = R Deposits Currency = C Deposits Monetary base, MB, is the sum of required reserves and currency, so MB = (R + C) Deposits The quantity of money, M, is the sum of deposits and currency, so M = Deposits + C Deposits = (1 + C) Deposits 27.2 INFLUENCING THE QUANTITY OF MONEY MB = (R + C) Deposits M = (1 + C) Deposits So M MB = M = (1 + C) (R + C) (1 + C) MB (R + C) Money Creation in YOUR Life It might surprise you to realize just how big a role you play in the money creation process. Every time you charge something to your credit card, you help the bank that issued your card to create money. The increase in your outstanding balance is a loan from the bank to you. The bank pays the seller right away. So the bank deposit of the seller and your outstanding balance increase together. Money has been created. Cash from the ATM is part of the currency drain. You and millions of other students play a big role in the money creation process.