CARO 2015 1 A Presentation by: KHUSHROO B. PA

advertisement

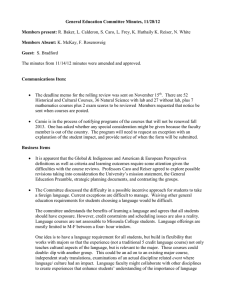

CARO 2015 A Presentation by: KHUSHROO B. PA ANTHAKY 1 3/5/2015 APPLICABILITY OF CARO O Every Company including a foreign Com mpany as per section 2(42) of Companies Act,2013 except 1. A banking company 2. An insurance company 3. Non-Profit company (Section 8 of Co ompanies Act,2013); 4. A One Person Company; 5. A private limited company with a) paid up capital and reserves no ot more than INR 50 lakhs and b) does d nott have h loan l outstanding t t di g exceeding di INR 25 lakhs l kh from f any bank or financial institution and d; c) does not have turnover exceed ding INR 5 crore at any point of time during the financial year. 3/5/2015 POWERS AND DUTIES OF AUDITOR R U/S 143 OF COMPANIES ACT,, 2013 Section 143(1): Make enquiries during audit Section S ti 143(2) 143(2): Prepare P reportt to t mem mbers b off company on th the accounts t and d fi financial i l statements. Section 143(3): Matters to be reported in audit report. (a) Obtain information & explanation to t the best of his knowledge, (b) Maintenance of proper books of acccounts, (c) Report of accounts of branch office e of a company, (d) Balance a a ce ssheet ee a and d P& & L dea dealt a are e in ag agreement ee e with boo bookss of o accounts, accou s, (e) Compliance of Accounting Standa ards, ((f ) Observations or comments having g adverse effect on functioning g of company, p y, (g) Disqualification of any director, ((h)) Anyy qualification, q , reservation or ad dverse remark on maintenance of accounts. 3/5/2015 REPORTING U/S 143(3)(F) OF F COMPANIES ACT,2013 RELEVANT EXTRACT “The auditor’s report shall also state(f) The observations or comments of the auditors on financial statements or matters nctioning of the company,” which have any adverse effect on the fun Observation/Comments Modification to auditor opinion/emphasis of matter Qualified /Adverse/Disclaimer of opinion 3/5/2015 REPORTING U/S 143(3)(H) OF COMPANIES ACT,2013 RELEVANT EXTRACT “The auditor’s report shall also state(h) Any qualification, reservation or adverse remark relating to the maintenance of accounts t and d other th matters tt connected t d th therewith.” ith ” ‘Books of Accounts’ include: Sums S ms of mone money receipts and e expend pend dit re diture, Sales and purchases of goods and services, s Assets and liabilities, liabilities Items of cost u/s 148 in the case of a company which belongs to any class of companies p specified. p 3/ /201 3/5/2015 KEY AMENDM MENTS CARO 2003 (i) Fixed Assets a) Whether the company is maintaining proper p records showing full particulars, including quan ntitative details and situation of fixed assets; b) Whether these fixed assets have been n physically verified by the management at reason nable intervals; whether any material discrepancies were noticed on such verification and if so, whether the e same have b been properly l d dealt lt with ith iin th the b books k of of account; t c) If a substantial part of fixed assets hav ve been disposed off during the year, whether it has affected the going concern. (ii) Inventory PBK & CO CARO 2015 (i) Fixed Assets ---------No Change-------- ---------No No Change-------Change ---------Deleted--------(ii) Inventory Inventory- No change 4/25/2015 KEY AMENDM MENTS CARO 2003 CARO 2015 (iii) Loans covered u/s 301 of Co’s Act,19 956 (iii) Loans u/s 189 Co’s Co s Act, Act 2013 (a) Has the company granted any loans, se ecured or unsecured to companies, firms or other parties covered in n the register maintained under section 301 of the Act. If so, give the number of parties and amount involved in the transactions. Deleted : The requirement on disclosure of numbe of parties and amou of loans g granted (secured or unsecur to companies, firms other parties covere in the register maintained under section 189 of the Companies Act,201 (b) Whether the rate of interest and other te erms and conditions of loans given by the company, secured or uns secured are prima facie prejudicial to the interest of the company. (e) Has the company taken any loans, secu ured or unsecured from companies, firms or other parties covered in n the register maintained under section 301 of the Act. If so,, give g the number of p parties and amount involved in the transactions. 3/5/2015 KEY AMENDMENTS S CARO 2003 (iii) Loans covered u/s 301 of Co’s Act 1956 Act,1956 (f) whether the rate of interest and other terms and conditions of loans taken by y the company, secured or unsecured are prima facie prejudicial to the interest of the company company. (iv) Internal Control System ((v)) Loans covered u/s 301 of Co’s Act,1956 , CARO 2015 (iii) Loans u/s 189 of Co’s Act, 2013 ---------Deleted--------- (iv) Internal Control System- No Change ---------Deleted--------- 3/5/2015 KEY AMENDM MENTS CARO 2015 CARO 2003 (vi) Deposits (v) Deposits In case the company has accepted deposits from the t public, whether the directives issued by the Reservve Bank of India and the provisions of Sections 58A and 58AA of the Act and the rules framed there under, where w applicable, have been complied with. If not, the natture of contraventions should be stated; If an order has beeen passed by Company Law Board or National Compaany Law Tribunal or Reserve Bank of India or any otherr Tribunal. Whether the same has been complied witth or not? Reference to Sections 58A and 58AA of Co’s Act, 1956 changed to the provisions of Sections 73 to 76 or any relevant provisions of the Companies Act 2013. 3/5/2015 KEY AMEN NDMENTS CARO 2003 CARO 2015 (vii) Internal Audit System In case of listed companies and/ or other companies having a paid up capital and resserves exceeding Rs. 50 lakhs as at the commenccement of the financial year concerned concerned, or having aan average annual turnover exceeding five croore rupees for a period of three consecutive finaancial years immediately i di t l preceding di th the fifinancial i l yyear concerned, whether the company has an innternal audit system commensurate with its size annd nature of its business; (viii) Cost Records ---------Deleted--------- (vi) Cost Records:- No Change 3/5/2015 KEY AMENDM MENTS CARO 2003 CARO 2015 (ix) Statutory Dues (vii) Statutory Dues:- VAT Included Is the company regular in depositing undisputeed statutory dues including Provident Fund, Invesstor Education and Protection Fund, Employees’ State S Insurance Income Insurance, Income-tax, tax Sales Sales-tax, tax Wealth tax tax, Service tax, Custom Duty, Excise Duty, cess and a any other statutory dues with the appropriate authorities th iti andd if not,t th the extent t t off th the arrears outstanding statutory dues as at the last day of o the financial year concerned for a period of more than t six months from the date they became payable, shall be indicated by the auditor Is the company regular in depositing undisputed statutory dues including Provident Fund, Investor Education and Protection Fund, Employees’ State Insurance Employees Insurance, Income Income-tax, tax Sales Salestax, Wealth tax, Service tax, Custom Duty, Excise Duty, Value Added Tax cess and any th statutory t t t dues d with ith th the appropriate i t other authorities and if not, the extent of the arrears outstanding statutory dues as at the last day of the financial year concerned for a period of more than six months from the date they became ppayable, y shall be indicated byy the auditor 3/5/2015 KEY AMEND DMENTS CARO 2003 CARO 2015 (x) Cash losses (viii) Cash losses:- No Change (xi) Repayment of Dues (ix) Repayment of Dues: Dues:- No Change (xii) Record Maintenance in case of advances against shares Whether adequate documents and recordds are maintained in cases where the compaany has granted loans and advances on the basis of security by way of pledge of shares, debentures and other securities; If not, thee deficiencies to be pointed out. out ---------Deleted--------- (xiii) Provisions to Chit Funds ---------Deleted--------- 3/5/2015 KEY AMENDMENTS CARO 2003 (xiv) Records of shares/debentures/securities CARO 2015 ---------Deleted--------- (xv) Guarantee for Loans (x) Guarantee for Loans:- No Change (xvi) Term Loans (xi) Term Loans:- No Change (xvii) Short Term Funds Usage for Lon ng Term ---------Deleted--------- (xviii) Preferential Allotment of Sharess to Related party ---------Deleted--------Deleted . 3/5/2015 KEY AMEND DMENTS CARO 2003 CARO 2015 (xix) Security Charge on Debentures ---------Deleted--------- (xx) Disclosure on Money raised byy Public issue ---------Deleted--------- (xxi) Report on Fraud (xii) Report on Fraud:- No Change 3/5/2015 THANK K YOU !