Document 14046232

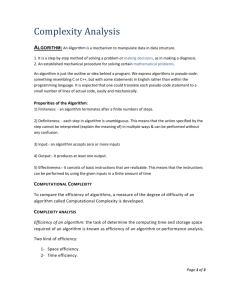

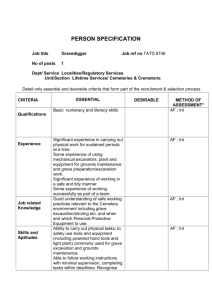

advertisement