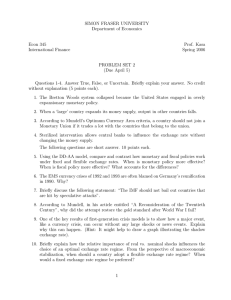

DP China's Role in the Current Global Economic Imbalance Li-Gang LIU

advertisement