Mexican-American Entrepreneurship National Poverty Center Working Paper Series

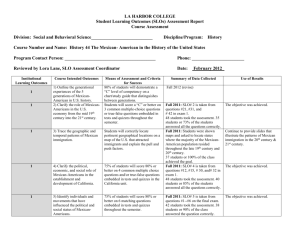

advertisement