Reconciliation Report

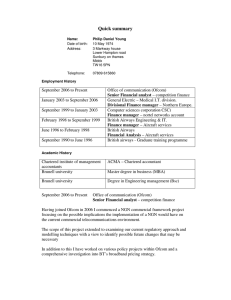

advertisement