Chairman’s

advertisement

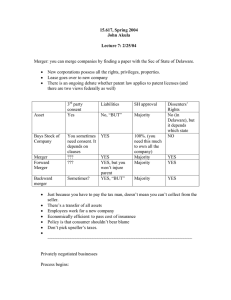

Black Cyan Magenta Yellow PMS300 Red Chairman’s statement In my remarks at the Extraordinary Things have not stood still while General Meeting held in April, merger talks were in progress, and I described the merger as a “rite of your company has had a most passage” for BT – on the journey satisfactory year. Turnover grew by 1996/97 was the most from nationalised monopoly to 3.4 per cent, helped by innovative significant year for BT since its leading global competitor. In some and successful marketing and by privatisation some 12 years of the press coverage this was growth in the demand for advanced ago. It was the year in which reported as a “right of passage” services, such as FeatureNet and BT and MCI made history by and, as so often happens, such a high-speed ISDN connections. announcing our intention to slip revealed a new truth. merge and form Concert, a leading player in the global telecommunications industry of the future. A great deal has to happen between the announcement of a proposed merger and eventual closure. But we have already safely passed a number of key milestones. The merger has received overwhelming shareholder approval on both sides of the Atlantic and we have made good progress towards the necessary regulatory clearances. offers excellent value for money passage” for your company, in the was further enhanced by price sense that it is something that we reductions on a range of call types have earned. and other services worth a total of P a g e over £800 million in the year. Order No: 00000 If BT had not become so customer- Earnings per share increased to competition, innovative, and 32.8p and I am pleased to report a committed to quality, we would final dividend for the year of 11.95p simply not have been in a position per share. This will be paid at the to make this merger work. The fact same time as the 35p per share that we are is a splendid testimony special dividend, which was to the BT people who have announced in connection with the reshaped this company over the merger and which brings the total last decade, and to the enlightened dividend for the year to 54.85p. and rigorous regulation pursued by changes that have taken place the outgoing UK Government. great companies of the twentyfirst century. We have yet to see how the policies of the incoming Government will develop. But I am encouraged by its clear enthusiasm for the benefits that information technology can bring. 2 N o : 0 2 R evision: MT Date: 21/05/97 driven many of the dramatic chance to build one of the first Job Disc No: 1 O r i g i nati o n: S I focused, so responsive to policies of privatisation, liberalisation decade. We are now seizing the Wordwork Bag No: 48278 BT and MCI, between us, have in our industry over the last Our reputation as a company that Concert is indeed a “right of Excluding the special dividend, this represents an increase of 6.1 per cent on last year. P r o o f N o : 1 1 Black Cyan Magenta Yellow PMS300 C H A I R M A N ’ S S TAT E M E N T Your company has continued to make substantial investments in its Financial highlights FOR THE YEAR ENDED 31 MARCH 1997 UK network, over the year, to match 1997 1996 £14,935m £14,446m Profit before taxation £3,203m £3,019m Profit after taxation £2,101m £1,992m 32.8p 31.6p the ever-rising level and scope of Turnover service our customers expect. The growth in demand for advanced services is especially marked. For personal customers, the Earnings per share Dividends per share – ordinary benefits are clear. Particularly in such areas as education, – special Capital expenditure 19.85p 18.70p 35.00p – £2,719m £2,771m healthcare and public information, Wordwork your company is developing products and services that really do Job Disc No: 1 Bag No: 48278 add value to our customers’ lives. P a g e N o : 0 3 Order No: 00000 This has been a record year, too, for The recent agreements that we There is no apparent slowing in the awards to BT on its unique have put in place with Spain’s rate at which new markets and new Date: 20/05/97 community programme. Telefonica and with Portugal opportunities – both geographical P r o o f N o : For business customers, the Telecom illustrate the opportunities and technical – are emerging. Internet and corporate intranet that abound in global The demand for communications markets are growing at an telecommunications markets. We services around the world is exhilarating rate and BT and MCI will be especially well positioned to intense and it is growing. in Concert will carry around half of seize opportunities in Latin America the world’s Internet traffic. and among the Spanish-speaking O r i g i nati o n: S I R evision: MT communities of the USA. We are focusing on developing This is the world of opportunity in which Concert will find its place. Our task is to convert that integrated solutions that meet the The Asia-Pacific region is also of opportunity into long-term whole range of a company’s needs, great importance to us. We are shareholder value. helping it to gain competitive already a leading supplier of advantage in its own marketplace. value-added data networks in Electronic commerce, for example, Japan. We have significant has the capacity to revolutionise the initatives underway in each of the way businesses bring their sub-regions. products to market and interact One particularly encouraging with their customers. development was the On the international front, as we announcement, in March, that BT approach the liberalisation of and Japan’s NTT had joined forces telecommunications markets to bid, with local partners, for a throughout the European Union second telecoms licence in from 1 January 1998, we are Singapore. Sir Iain Vallance Chairman 20 MAY 1997 building a presence across the continent. BT is now particularly well positioned in all the major European countries. 3 10