Statistics and Risk Management Fiscal Stability Performance Objective:

advertisement

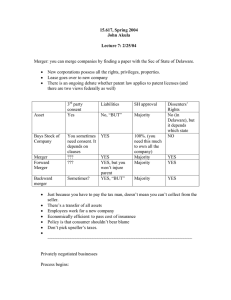

Statistics and Risk Management Fiscal Stability Performance Objective: After completing this lesson, the student will understand what events can affect the stability of business entities. Approximate Time: When taught as written, this lesson should take 4-5 days to complete. Specific Objectives: The student will discuss how change imposes risk on businesses. The student will discuss the importance anticipating and managing change. The student will understand the different types of ownership changes that can occur and the risks associated with each. This lesson corresponds with Unit 10 of the Statistics and Risk Management Scope and Sequence. Copyright © Texas Education Agency, 2012. All rights reserved. 1 TEKS Correlations: This lesson, as published, correlates to the following TEKS for Regression. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.169(C)(4) (R) analyze ownership change transactions, including: (i) comparing mergers and acquisitions; (ii) explaining the nature of hostile takeovers; (iii) discussing issues that arise from mergers and acquisitions; (iv) explaining methods for evaluating potential merger/acquisition targets; (v) evaluating potential merger and acquisition targets; and (vi) analyzing the nature of restructurings. 130.169(C)(5) (A) manage risk to protect business stability (i) analyzing the relationship between risk management and business finance; (ii) discussing the nature of risk measurement; (iii) measuring risk; (iv) explaining the nature of interest rate risk; (v) managing interest rate risk; (vi) explaining approaches to financial risk management; (vii) discussing the use of derivatives in financial risk management; (viii) evaluating the risks of derivatives; (ix) explaining reasons to integrate risk management into business operations; (x) identifying business risks; and (xi) integrating risk management into business operations; and InterdisciplinaryTEKS: English: 110.31 (C) (21) (B) … organize information gathered from multiple sources to create a variety of graphics and forms (e.g., notes, learning logs)… 110.31 (C) (22) (B) …evaluate the relevance of information to the topic and determine the reliability, validity, and accuracy of sources (including Internet sources) by examining their authority and objectivity… 110.31 (C) (23) (C) … use graphics and illustrations to help explain concepts where appropriate… Copyright © Texas Education Agency, 2012. All rights reserved. 2 110.31 (C) (23) (D) … use a variety of evaluative tools (e.g., self-made rubrics, peer reviews, teacher and expert evaluations) to examine the quality of the research… Math: 111.36 (C) (4) (A) … compare theoretical and empirical probability; 111.37. (C) (3) (B) … use probabilities to make and justify decisions about risks in everyday life Occupational Correlation (O*Net - http://www.onetonline.org/) Financial Analyst 13-2051.00 Similar Job Titles: Securities Analyst, Investment Analyst, Credit Product Officers Tasks: Draw charts and graphs, using computer spreadsheets, to illustrate technical reports. Inform investment decisions by analyzing financial information to forecast business, industry, or economic conditions. Monitor developments in the fields of industrial technology, business, finance, and economic theory. (Soft) Skills: Deductive reasoning; Written comprehension; Reading Comprehension; Originality Copyright © Texas Education Agency, 2012. All rights reserved. 3 Instructional Aids: 1. Display for presentation, websites for assignments and class discussion 2. Assignment Worksheets 3. Supporting Spreadsheets Materials Needed: 1. Printer paper 2. Assignments and website information ready to distribute to students. Student projects will be displayed to increase interest in Statistics Equipment Needed: 1. Computer with presentation and Internet Access 2. Computers for Students to Conduct Research and Collect Data for Projects Copyright © Texas Education Agency, 2012. All rights reserved. 4 References: Business Ownership Types You may operate your business or organization under any one of several organizational structures. Each type of structure has certain advantages and disadvantages that should be considered. The descriptions of the structures below are provided to assist applicants and are not intended to be legal definitions with the force of law. You should contact an attorney, accountant, financial advisor, banker, or other business or legal advisors to determine which form is most suitable for your business or organization. Read more at http://www.sos.wa.gov/corps/registration_structures.aspx http://www.sos.wa.gov/corps/registration_structures.aspx Anticipation Change: Staying Current with Your Business Plan This podcast by the Small Business Administration discusses the importance of anticipation and planning for change as a part of running a successful business. The types of changes discussed include revenue, disasters, succession strategy, and successful growth. http://www.sba.gov/content/anticipating-change-staying-current-with-yourbusiness-plan Leading and Managing Change This article discusses the simple and often forgotten rules of leading and managing a change within a business. It provides an easy step by step process for managing business changes. http://gbr.pepperdine.edu/2010/08/leading-and-managing-change/ Copyright © Texas Education Agency, 2012. All rights reserved. 5 Teacher Preparation: Teacher will: 1. presentation, and handouts. 2. resources and websites. 3. websites ready. Review terms in outline, Locate and evaluate various Have assignments and Learner Preparation: It is time to wrap up what the students have learned about statistics. You will briefly describe commercial software for statistics with examples the student might find interesting. Then the student will get to apply what they have learned to analyzing data. Introduction: STUDENTS will watch the Unit video found here: jukebox.esc13.net/untdeveloper/Videos/Fiscal%20Stability.mov STUDENTS will take the practice test and review using the Key, found in Common/Student Documents. EXHIBIT: Excitement for discovering the types of risk within businesses. INTRODUCE: Risk as a business changes. ASK: Ask students to talk about a local business that changed hands, and to name the changes that occurred. Copyright © Texas Education Agency, 2012. All rights reserved. 6 I. Understanding Fiscal Stability A. Change = Instability 1. Change in Market 2. Aging Customer Base 3. Change in Expenses 4. Energy Prices 5. Change in Technology 6. Computers 7. Example In 1998/1999 computer consulting firms grew at an alarming rate. The US imported foreign nationals to meet the demand. The year 2001 many consulting firms closed and many programmers were unemployed. 8. Anticipate Change Stay current with Government 9. Rules and Regulations Stay current with Industry Issues and Practices 9. Participate in the Company Culture 10. Read Individuals’ Attitudes Example There once was a video store on every corner. Now there may be one video store in every town and its days are numbered. Why??? 11. Embrace Change 12. The skill is to promote the attitude of seeing if change will benefit the organization. 13. Manage Change 14. Gather Data 15. Analyze data 16. Present findings to decision makers Use 14.1_ UnderstandingFiscalStabity 17. Follow up on implications of any decisions or lack of. a. Financing Risks b. Financing can be risky for an organization. c. Exposure can be unpredictable. Copyright © Texas Education Agency, 2012. All rights reserved. 7 Example Floating Interest Loan for Plant refitting at bargain rates. Federal Reserves wanted to slow Inflation. Plant closed three years later. Why??? B. Financial Derivatives 1. Financial derivatives should be considered for inclusion in any organization's risk-control arsenal. 2. Financial instrument whose payoff depends on another financial instrument. a. Example An Airline wanted to hedge their rising fuel costs. They purchased huge Derivative Contracts. Fuel prices dropped, they went broke. Why??? C. Are Financial Derivatives a form of Gambling? So, only Gamble which you can afford to lose. Provide Assignment sheets and discuss and answer any questions about assignment (In class or take homeInstructor’s Option) Use files: 14.1a_ UnderstandingFiscalStabity II. Understanding Ownership Changes A. Restructuring 1. Restructuring is often tied to Bankruptcies 2. Assets are protected from Creditors 3. Debt is discharged or repayment renegotiated 4. Management teams are changed 5. Steps a. Secure enough liquidity to operate during restructuring. b. Produce accurate working capital forecasts. Copyright © Texas Education Agency, 2012. All rights reserved. 8 c. Provide open & clear lines of communication with creditors who control the company's ability to raise financing. d. Update detailed business plan and considerations. B. Acquisitions 1. Acquiring Organization will look for an opportunity to purchase the assets, expertise, products, clients, and markets they want for expansion. 2. Leveraged Buy Outs 3. Acquiring Organization will Finance its purchase of the controlling interest of stock. 4. Loans often secured against company assets. 5.Often challenged in Bankruptcy court. 6. Stock Swaps a. Acquiring company uses its own stock to pay for the acquired company. 7. Hostile Takeovers a. Hostile Takeovers mean the acquired company does not want to be acquired. b. However, if they are a publically traded corporation and the acquiring company can afford to buy most its stock new ownership is inevitable c. Sometime a Poison Pill strategy is used Hostile Takeovers are not all bad Provide Assignment sheets and discuss and answer any questions about assignment (In class or take homeInstructor’s Option) Use files: 14.2a_ UnderstandingOwnershipCha nges Copyright © Texas Education Agency, 2012. All rights reserved. 9 Guided Practice: See assignments. Independent Practice: Review document “Spreadsheets for Statistical Purposes” – in Common Documents. See assignments. Review: Question: Describe working forecast capital. Question: How do acquisitions work in a company that wants to expand? Informal Assessment: Instructor should observe student discussion and monitor interaction. Formal Assessment: Completion of provided assignments using included keys for grading. Copyright © Texas Education Agency, 2012. All rights reserved. 10 Student Assignment 14.1a Understanding Fiscal Stability Key Name: ____________________ You have heard of the Mortgage Crisis of recent times, how did mortgage derivatives contribute to the crisis? Explain what a mortgage backed derivative is and why its use or over use caused the Mortgage Melt-down. Answers will vary per student, but look that they have made an effort to fulfill the requirements of this assignment any various levels. You may ask yourself does this student demonstrate the ability to research and apply what they have learned about the Mortgage Crisis by forming an educated opinion. Copyright © Texas Education Agency, 2012. All rights reserved. 11 Student Assignment 14.2a Understanding Ownership Changes Key Name: ____________________ The Oil industry has a been a hot bed of acquisitions/mergers Exxon and Mobil Amoco, British Petroleum, ARCO Conoco and Phillips Chevron and Texaco Pick one of these four groups and see what you can find out about when, how, and why they merged. Did these mergers need government approval? Overall, what does the literature say about these mergers and the price of Gasoline? Answers will vary per student, but look that they have made an effort to fulfill the requirements of this assignment any various levels. You may ask yourself does this student demonstrate the ability to research and form an opinion on free-markets, competition, and antitrust issues. Copyright © Texas Education Agency, 2012. All rights reserved. 12 Fiscal Stability Project Research a famous merger, acquisition, or hostile takeover. Prepare a visual and oral presentation with solutions to the questions that follow. Use your CREATIVITY and expertise to provide as much information as possible. You should have at least one slide per item. 1. Provide an overview of the merger. Include date/timeline of merger and companies involved. Explain the type of merger. 2. Provide background/details about each company prior to the merger. Include type of business, sales, target market. 3. List the competition. Give specific company names of companies who were competitors before and after the merger. Did the competition change? If so, explain. 4. Provide details of the financial agreement of the merger. Include terms of contract. 5. Provide reasons for the merger. Why did the companies merge? 6. List the benefits of the merger. List the risks of the merger. What benefits did the companies see from merging? What risks did the companies incur from merging? 7. Explain changes made to the companies after the merger. Include changes in product, target market, customer base, personnel, etc. 8. Create two charts reflecting data from the merger. You choose which data and which type of chart. 9. Do you think that the merger was successful? Explain in detail why or why not. Be creative and provide details. This will count as two test grades…slideshow and presentation. Your slideshow will be graded based on details provided and creativity in your presentation. Your presentation to the class will be graded based upon your knowledge and professionalism. Refer to the rubric. Copyright © Texas Education Agency, 2012. All rights reserved. 13 Grading Rubric _____(5)Organization (logical sequence of slides): _____(5)Visuals/Graphics (relevant, size appropriate): _____(5)Mechanics (grammar, spelling, capitalization): _____(5)Backgrounds (relevant, don’t distract from writing): _____(6)Creativity _____(8)Overview of Merger _____(8)Background/Details About Each Company Prior To The Merger _____(8)Competition _____(8)Details of the Financial Agreements in the Merger _____(8)Reasons for the Merger _____(8)Benefits and Risks of the Merger _____(8)Changes Made to the Companies after the Merger _____(10)Charts Reflecting Data from the Merger _____(8)Do You Think that the Merger was Successful? _____Slideshow Test Grade _____(100)Presentation Test Grade Copyright © Texas Education Agency, 2012. All rights reserved. 14