Lesson Plan The Purpose of Financial Statements Financial Analysis

advertisement

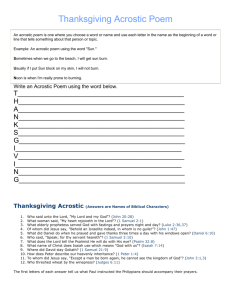

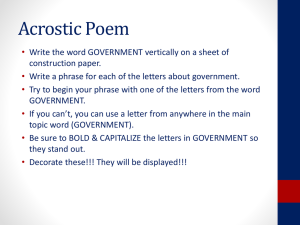

The Purpose of Financial Statements Financial Analysis Finance Lesson Plan Performance Objective Students will understand financial statements, their relationships to each other, and their significance to understanding the financial condition of a business. Specific Objectives Understand components of the balance sheet Understand components of an income statement Understand components of a statement of changes in owner’s equity Understand components of a cash flow statement Terms Financial Statement‐ reports that summarize the financial position of a business Balance Sheet‐ the financial statement that reports assets, liabilities, and owner’s equity on a specific date Assets‐ anything of value that is owned Liabilities‐ any amount owed Owner’s Equity‐ the difference between assets and liabilities Income Statement‐ a financial statement that shows the revenue and expenses for an accounting period Revenues‐ the income/money generated by the business from the sales of goods and/or services Expenses‐ the costs of operating a business Statement of Changes in Owner’s Equity‐ a financial statement that shows changes in the ownership account (Capital) during an accounting period Net Income‐ results when total revenue is greater than total expenses Net Loss‐ results when total expenses are greater than total revenue Withdrawals‐ also called Drawing; when assets are taken from the business for personal use Statement of Cash Flow‐ a financial statement that shows cash receipts and payments from operating, financing, and investing activities of a business Operating activities‐ day‐to‐day cash receipts and payments necessary to operate a business Investing activities‐ the purchase or sale of assets Financing activities‐ activities involving debt transactions Time When taught as written, this lesson should take approximately four to five days to teach. Copyright © Texas Education Agency, 2014. All rights reserved. 1 Preparation TEKS Correlations This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.168 (c) Knowledge and Skills (3) The student demonstrates mathematics knowledge and skills required to pursue the full range of postsecondary education and career opportunities. The student is expected to: (a) demonstrate knowledge of arithmetic operation such as addition, subtraction, multiplication, and division. (4) The student manages financial resources to ensure solvency. The student is expected to: (a) describe the nature of budgets; (b) explain the nature of operating budgets; (c) determine relationships among total revenue, marginal revenue, output, and profit; and (g) identify problems and issues with financial statements. Interdisciplinary Correlations English‐English I 110.31(b)(1) Reading/Vocabulary Development. Students understand new vocabulary and use it when reading and writing. 110.3(b)(11) Reading/Comprehension of informational text/procedural texts. Students understand how to glean and use information in procedural texts and documents. Math‐Algebra I 111.32(b)(1)(C) Interpret and make decisions, predictions, and critical judgments from functional relationships. Occupational Correlation (O*Net – www.onetonline.org/): Job Title: Financial Managers O*Net Number: 11‐3031.02 Reported Job Titles: Consumer Lending Vice President, Consumer Loan Manager, Loan Systems Director Tasks Examine, evaluate, or process loan applications. Approve, reject, or coordinate the approval or rejection of lines of credit or commercial, real estate, or personal loans. Prepare financial or regulatory reports required by laws, regulations, or boards of directors. Copyright © Texas Education Agency, 2014. All rights reserved. 2 Soft Skills: Judgment and Decision Making, Monitoring, Critical Thinking Accommodations for Learning Differences It is important that lessons accommodate the needs of every learner. These lessons may be modified to accommodate your students with learning differences by referring to the files found on the Special Populations page of this website. Preparation Review and familiarize yourself with the terminology and website links. Have materials and websites ready prior to the start of the lesson. References http://faculty.philau.edu/lermackh/financial_analysis.htm http://faculty.business.utsa.edu/tthompson/Lec_pdf/f3033pp007.ppt Century 21 Accounting: Advanced, South‐Western Publishing http://www.sec.gov/investor/pubs/begfinstmtguide.htm Contemporary Mathematics for Business and Consumers, South‐Western Publishing Instructional Aids Textbook or Computer Program Diagrams/Charts Lesson 1.01 Presentation Instructor Computer/Projection Unit Websites Introduction The main purposes of this lesson are to help students understand the reasons companies use financial statements the reasons investors review financial statements the limitations of financial statements Ask students if they know how financial statements are related to each other. Ask students if they know why it’s important to learn about financial statements. Copyright © Texas Education Agency, 2014. All rights reserved. 3 Outline I. Purposes of Financial Statements A. presents financial position of the business B. shows effectiveness of management C. can be an indicator of future performance when compared to past performance II. III. IV. The Four Financial Statements A. Balance Sheet B. Income Statement C. Statement of Changes in Owner’s Equity D. Cash Flow Statement Balance Sheet A. also called Statement of Financial Position B. based upon the Accounting Equation: Assets = Liabilities + Owner’s Equity C. provides a “snapshot” of a company’s position on a particular date in time D. shows what a company owns (assets), owes (liabilities), and the difference between them (stockholder’s equity) Ask students, especially the ones who have debit cards, how they keep track of what they spend, or, if they have a job, what they earn on their paychecks. Discuss that businesses have to keep track of everything they do as well, through financial statements. With businesses though, their transactions are grouped into categories. These categories are on the different financial statements. Tell students that they will have to know how to prepare their own version of a balance sheet when they apply for a car loan someday, or a mortgage loan. They will need to know what they own and what they owe. Show them examples (although if they have had Accounting 1 they have already seen these) of company’s balance sheets and how the account names are similar for most companies in the same industry. Income Statement A. also called a Profit and Loss Statement Multiple Intelligences Guide Existentialist Interpersonal Intrapersonal Kinesthetic/ Bodily Logical/ Mathematical Musical/Rhythmic Naturalist Verbal/Linguistic Copyright © Texas Education Agency, 2014. All rights reserved. 4 Visual/Spatial B. shows gains and losses for an accounting period C. takes into account different revenue and expense items during the period D. General calculation of net income/loss: 1. Sales – Cost of Goods Sold = Gross Profit 2. Gross Profit – Expenses = Net Income/Loss V. Revenue Relationships A. Relationship among total revenue, marginal revenue, output and profit is: Marginal revenue is when total revenue increases due to the sale of an additional unit of output which maximizes profit. B. Calculation of marginal revenue: 1. If the first item generates $20 in revenue and an additional item sold brings $15, the marginal revenue is $5 2. change in total revenue / the number of additional units sold 3. 20 – 15 = 5 / 1 additional unit = $5 VI. Statement of Changes in Owner’s Equity A. also called the Statement of Retained Earnings An Income and Expense statement is similar to a personal budget. Ideally, after expenses are subtracted from income, there should be money left. With businesses, it is a little more complicated. Show students corporate income and expense statements. These statements can be found directly at a company’s web site under an “Investor Relations” tab or link. Ask students what revenue is. Explain that revenue is more complicated than just making a sale. Calculate for them marginal revenue and explain how revenue, total revenue, marginal revenue, and profit are interrelated. Multiple Intelligences Guide Existentialist Interpersonal Intrapersonal Kinesthetic/ Bodily Logical/ Mathematical Musical/Rhythmic Naturalist Verbal/Linguistic Copyright © Texas Education Agency, 2014. All rights reserved. 5 Visual/Spatial B. shows the balance of stockholder’s equity from the beginning of an accounting period to the end of the period and the changes that took place in the account during that time VI. Cash Flow Statement‐ examines the sources and uses of cash as a result of the following activities: A. Operating activities‐ associated with delivering goods for sale or providing services for sale and include receipts from sales as well as payments for inventories, wages, and other common operating expenses B. Investing activities‐ includes sale of predominantly long‐term assets and interest received from loans or vice versa, i.e., buying long‐term assets as investments and making loans with other companies C. Financing activities‐ selling securities as well as paying out dividends to investors VII. Budgets vs. Financial Statements A. Budgets 1. use estimated numbers to make predictions This statement is important because of its relationship to the other financial statements; however, the other three statements are predominantly used in ratio analysis. The Cash Flow Statement shows cash from operating, investing, and financing activities. This statement is critical in identifying the specific sources and uses of cash by dividing them into these categories. Locate a Cash Flow Statement that you can show students to provide examples of the types of cash in each of the activity categories. Budgets and financial statements are different in the main concept that budgets use estimates to make predictions or forecasts. Multiple Intelligences Guide Existentialist Interpersonal Intrapersonal Kinesthetic/ Bodily Logical/ Mathematical Musical/Rhythmic Naturalist Verbal/Linguistic Copyright © Texas Education Agency, 2014. All rights reserved. 6 Visual/Spatial 2. compares estimated to actual, to determine variances 3. usually short‐term (less than one year) 4. includes mainly income and expenses B. Financial statements 1. use actual numbers 2. use analysis methods to make forecasts VIII. Financial Statement Relationships A. Net Income or Loss from the Income Statement is transferred to the Statement of Changes in Owner’s Equity B. The Ending Capital Balance on the Statement of Changes in Owner’s Equity transfers to the Capital on the Balance Sheet C. The Cash at the end of the period on the Cash Flow Statement transfers to Cash on the Balance Sheet IX. Footnotes to Financials A. includes explanations for items that are not typical in financial statements B. may explain how certain items are accounted for C. occasionally includes an explanation of depreciation methods or goodwill Financial statements use actual data to attempt to make predictions about future performance. As you are showing the slide with the relationships between the financial statements, show how this relationship works on a real company’s financial statements. Have students volunteer a company name and then search on the Internet, either at the company’s website or the finance section of a popular search engine. Occasionally there are items in a financial statement that need further clarification. Depreciation is an example. There is no place on a statement to state which method is used to calculate depreciation, but it may be explained in the footnote section. Multiple Intelligences Guide Existentialist Interpersonal Intrapersonal Kinesthetic/ Bodily Logical/ Mathematical Musical/Rhythmic Naturalist Verbal/Linguistic Copyright © Texas Education Agency, 2014. All rights reserved. 7 Visual/Spatial X. XI. Analyzing Financial Statements A. Horizontal, or trend, analysis‐ compares the same accounts across different time periods B. Vertical, or common‐size, analysis ‐ compares different accounts to a total within the same time period C. Ratio analysis‐ a comparison of different accounts on a statement and typically compared over different time periods. Limitations of Financial Statements A. no right or wrong numbers to compare to B. finding accurate competitors to compare to can be difficult due to differences even between similar companies C. making future predictions based on the past is not an exact science D. management expertise is difficult to quantify but should be an important factor in analyzing company performance Several methods exist to analyze company financial data (which will be explained in subsequent lessons), but use the presentation slides to show a summary of the different types of analysis methods. Have students in pairs locate a template online for a Balance Sheet and fill in the blanks with appropriate numbers, keeping in mind that the Accounting Equation must be balanced. Multiple Intelligences Guide Existentialist Interpersonal Intrapersonal Kinesthetic/ Bodily Logical/ Mathematical Musical/Rhythmic Naturalist Verbal/Linguistic Copyright © Texas Education Agency, 2014. All rights reserved. 8 Visual/Spatial Application Guided Practice The teacher should make several enlarged copies of financial statements and then cut individual account names from each of the four financial statements. Another way of doing this can be to write down account names on sticky notes. Divide students into pairs or groups of three or four, depending upon the class size. Mix up all of the pieces and distribute sets of the pieces to each pair or group. Have them put the pieces on the correct financial statements in the correct order. A timer can also be used to make the activity more competitive. Independent Practice Have students individually see if they can list the proper accounts for each of the four financial statements. Then compare the list to actual financial statements to see if the accounts were correct. Summary Review Ask students the following questions on exit tickets or using a matching activity. Question #1: What is one purpose of financial statements? Answer #1: They can show how past data can be an indicator of future performance. Question #2: What are four financial statements? Answer #2: The four statements are balance sheet, income and expense statement, statement of changes in owner’s equity, and cash flow statement. Question #3: What types of accounts are on the Balance Sheet? Answer #3: The Balance Sheet contains assets, liabilities, and owner’s equity. Question #4: What are three types of cash on the Cash Flow Statement? Answer #4: The Cash Flow Statement shows cash from operating, investing, and financing activities. Question #5: What is a difference between a budget and a financial statement? Answer #5: A budget uses estimated amounts while financial statements use actual data. Evaluation Informal Assessment Any and all of the following can be used as informal assessments. Exit tickets with vocabulary Pair‐share activities Class discussion and participation Copyright © Texas Education Agency, 2014. All rights reserved. 9 Formal Assessment The following can be considered a formal evaluation in order to keep students engaged during both the pre‐ test(s)s and post‐test(s). Financial Statement Venn Diagram Assignment #1 Have students create a Venn diagram, either on paper or using a diagram feature on the computer, containing any three of the four main financial statements: Balance Sheet, Income Statement, Statement of Changes in Owner’s Equity, and/or Cash Flow Statement. They should list the component accounts found on each statement, and where the circles overlap, list the accounts that are found on more than one financial statement. Financial Statement Acrostic Assignment #2 Students will select one of the four financial statements and create an acrostic for that statement. They should use phrases or sentences related to the chosen statement that show the student thoroughly understands what that financial statement is all about. For example, for Balance Sheet, the ‘B’ could say “Balances of Total Assets should equal the balances of Liabilities plus Owner’s Equity.” Financial Statement Interrelationships Assignment #3 In pairs, students will create each of the four financial statements in condensed form with fictitious numbers. This will show that students understand the Accounting Equation of Assets = Liabilities + Owner’s Equity, and they must show how the statements relate to each other as they did in the presentation. They should create these on a small poster or flip chart paper. Enrichment Extension Students will interview someone who works in an accounting department of a company. They should formulate their questions ahead of time, but some may include the following: who prepares the financial statements, how do they get their data to put onto the financial statements, what type of accounting system do they use, etc. Students can record their interview questions and answers in a table. Copyright © Texas Education Agency, 2014. All rights reserved. 10 Financial Analysis The Purpose of Financial Statements Financial Statement Venn Diagram Assignment #1 Student Name: ________________________________________ CATEGORY 20 15 8 Required Elements The diagram includes all required elements as well as additional information. All required elements are included on the diagram. All but one of Several required the required elements were elements are missing. included on the diagram. Knowledge Gained Student can Student can accurately accurately answer all answer 76‐99% questions related of questions to facts in the related to facts diagram and in the diagram processes used and processes to create the used to create diagram. the diagram. Student can Student appears accurately to have answer about insufficient 75% of questions knowledge about related to facts the facts or in the diagram processes used and processes in the diagram. used to create the diagram. Attractiveness The diagram is exceptionally attractive in terms of design, layout, and neatness. The diagram is attractive in terms of design, layout, and neatness. The diagram is The diagram is acceptably distractingly attractive, messy or very though it may be poorly designed. a bit messy. It is not attractive. Content ‐ Accuracy At least seven accurate facts are displayed on the diagram. Five to six accurate facts are displayed on the diagram. Three to four accurate facts are displayed on the diagram. Less than three accurate facts are displayed on the diagram. Grammar There are no grammatical mistakes on the diagram. There is one grammatical mistake on the diagram. There are two grammatical mistakes on the diagram. There are more than two grammatical mistakes on the diagram. Maximum Points Possible: 100 1 Student Points: Copyright © Texas Education Agency, 2014. All rights reserved. 11 Financial Analysis The Purpose of Financial Statements Financial Statement Acrostic Assignment #2 Student Name: ________________________________________ CATEGORY 20 15 8 Required Elements The acrostic includes all required elements as well as additional information. All required elements are included on the acrostic. All but one of Several required the required elements were elements are missing. included on the acrostic. Knowledge Gained Student can Student can accurately accurately answer all answer most questions related questions to facts in the related to facts acrostic. in the acrostic. Student can Student appears accurately to have answer about insufficient 75% of questions knowledge about related to facts the acrostic. in the acrostic. Content ‐ Accuracy All facts in the acrostic are accurate. 80‐90% of the facts in the acrostic are accurate. 60‐79% of the facts in the acrostic are accurate. Attractiveness The acrostic is exceptionally attractive in terms of design, layout, and neatness. The acrostic is attractive in terms of design, layout, and neatness. The acrostic is The acrostic is acceptably distractingly attractive, messy or very though it may be poorly designed. a bit messy. It is not attractive. Grammar There are no grammatical mistakes on the acrostic. There is one grammatical mistake on the acrostic. There are two grammatical mistakes on the acrostic. Maximum Points Possible: 100 1 Less than 60% of the facts in the acrostic are accurate. There are more than two grammatical mistakes on the acrostic. Student Points: Copyright © Texas Education Agency, 2014. All rights reserved. 12 Financial Analysis The Purpose of Financial Statements Financial Statement Interrelationships Assignment #3 Student Name: ________________________________________ CATEGORY 20 15 8 1 Requirements All requirements All requirements One requirement More than one are met and are met. was not requirement was exceeded. completely met. not completely met. Content Covers topic in‐ depth with details. Subject knowledge is excellent. Mechanics No misspellings Three or fewer or grammatical misspellings errors. and/or mechanical errors. Four misspellings More than four and/or errors in spelling grammatical or grammar. errors. Workload The workload is The workload is divided and divided and shared equally by shared fairly by all team all team members. members, though workloads may vary from person to person. The workload The workload was divided, but was not divided OR several one person in people in the the group is group are viewed as not doing his/her fair viewed as not doing their fair share of the share of the work. work. Organization Proper financial Adequate statement organization of format is used on financial all statements. statement data. Financial statement data is somewhat out of order. Maximum Points Possible: 100 Includes Includes essential essential knowledge about information the topic. Subject about the topic knowledge but there are appears to be one to two good. factual errors. Content is minimal OR there are several factual errors. Data missing and/or much of it does not follow proper format. Student Points: Copyright © Texas Education Agency, 2014. All rights reserved. 13