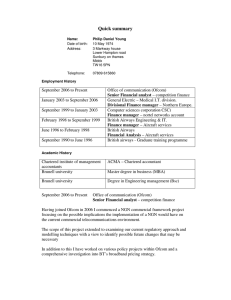

Regulatory teach-in 15 June 2012 BT Group plc

advertisement

BT Group plc Regulatory teach-in 15 June 2012 Agenda and introductions Regulatory framework in the UK Regulatory remedies and impact on BT Regulatory reporting and accounts Current regulatory activity 2 © British Telecommunications plc Regulatory framework in the UK Mark Shurmer, Group Director, Regulatory Affairs UK regulatory framework history 1981 British Telecom split off from the Post Office 1984 Telecommunications Act and BT privatised Oftel created 1998 First set of EU Directives in force Competition Act gives Oftel competition authority powers 2003 Oftel replaced by converged communications regulator Ofcom Second set of EU Directives in force – includes market review framework Communications Act 2005 BT Undertakings and the creation of Openreach 2011 EU Directives refreshed 4 © British Telecommunications plc UK regulatory framework today EU Directives • Establish EU-wide “Common Regulatory Framework” • Specify market review process for imposing remedies, including frequency • National regulators must consult EU on remedies, including charge controls, to ensure consistency BT’s Undertakings • Offered by BT in lieu of reference under the Enterprise Act • Creation of Openreach, Equivalence of Inputs (EOI), Equality of Access Board • Vast majority of Undertakings delivered UK Communications Act • Gives Ofcom legal powers and implements the EU Directives • Review ongoing – White Paper expected early 2013 “Horizontal” UK legislation • Competition law • Consumer protection legislation 5 © British Telecommunications plc UK regulatory framework BT’s objectives Clarity in the framework and rule set Ability to make fair and reasonable return on investment Level playing field relative to competitors Less friction in the system – break out of cycle of litigation Evolution to a truly converged framework 6 © British Telecommunications plc UK regulatory framework market review process • Principle is to ensure regulation is only implemented where competition is not effective • Focus is on “access bottlenecks” to facilitate market entry further downstream • Key access markets (set out in EC Recommendation) must be reviewed every three years to assess where regulation is still required Step 1: Market definition Regulators define relevant markets, having regard to Recommendation and following competition law approach (e.g. are mobile calls a constraint on provision of fixed calls?) Step 2: SMP assessment Regulators assess whether any CP has Significant Market Power (SMP) - “position of economic power affording an undertaking the power to behave to an appreciable extent independent of competitors, customers and ultimately consumers” Step 3: Impose remedies Regulators assess what ex ante remedies are appropriate to impose on any CP found to have SMP 7 © British Telecommunications plc UK regulatory framework upcoming market reviews 2012-13 2013-14 Business Connectivity - Ethernet, Partial Private Circuits Wholesale Local Access - LLU (MPF/SMPF), GEA Wholesale Broadband Access - WBC, IPStream Wholesale Fixed Narrowband Access - WLR, ISDN2 Wholesale Narrowband Calls - CPS, Indirect Access 8 © British Telecommunications plc High Severity of constraint Low UK regulatory framework SMP remedies 9 © British Telecommunications plc Supply - Must supply services in market to others on reasonable request Non-discrimination - Must not show undue discrimination against others/in favour of own activities - EOI is a stronger form Accounting separation - Must publish financial statements to enable transparency Cost orientation - Must ensure prices are reasonably derived from costs of provision Charge control - Must ensure prices change by no more than RPI-X% each year UK regulatory framework enforcement powers Dispute resolution: – Under the framework, CPs can refer commercial disputes about network access to Ofcom for resolution – Pricing disputes can relate to past periods, giving rise to retrospective repayments Compliance investigations: – Triggered by complaints or by proactive Ofcom reviews – Enforcement powers analogous with Competition Law – CPs affected by any non-compliance could subsequently seek damages Competition Act: – Ofcom has concurrent powers with the Office of Fair Trading („OFT‟) in the electronic communications sector under the Competition Act and EU competition law – Ofcom may investigate suspected infringements of the prohibitions of anti-competitive agreements and abuse of a dominant position – Where an infringement is found, Ofcom may give directions they consider appropriate to bring the infringement to an end – Fines of up to 10% of group worldwide turnover may be imposed 10 © British Telecommunications plc UK regulatory framework appeal process All Ofcom decisions can be appealed on the merits to the Competition Appeals Tribunal: – Market definitions, SMP findings, choice of remedies, including setting of charge controls – Dispute resolution determinations Ofcom decisions stand pending outcome of appeal CAT will refer “specified price control matters” to the Competition Commission (CC): – CC will consider evidence and issue Determination back to the CAT answering the specific questions asked of it CAT Judgment can order Ofcom to implement different outcome or to reconsider the issues addressing identified errors in analysis CAT Judgments can also be challenged by affected parties (including Ofcom) to: – The Court of Appeal on judicial review grounds; or – The High Court on judicial review 11 © British Telecommunications plc Regulatory remedies and impact on BT James Tickel, Head of Operational Regulation & Economics, Regulatory Affairs Remedies imposition of charge controls Charge Controls in the UK now generally last three years to align with market review frequency Controls require defined prices in the SMP market to move by no more than “RPIX%” in each year The setting of the control is essentially a forecasting exercise. The value of X is set so that by the end of the control period, BT is forecast to recover relevant costs of provision, including a fair return. It is prices rather than actual returns earned that are controlled. As such, BT has incentives to keep costs beneath levels forecast by Ofcom. 13 © British Telecommunications plc Remedies operation of charge controls Current unit price RPI-X glide path “Target” unit price Unit price/cost ROCE Operating costs Depreciation Year x 14 © British Telecommunications plc Base year actual unit costs Year x+3 Final year forecast efficient unit costs Remedies operation of charge controls Current unit price ….or possible “step” followed by RPI-X glide path “Target” unit price Unit price/cost ROCE Operating costs Depreciation Year x 15 © British Telecommunications plc Base year actual unit costs Year x+3 Final year forecast efficient unit costs Remedies charge controls “relevant costs” Ofcom needs to identify the annual operating costs that will be incurred in providing the relevant service(s) and the value of the assets required to provide the relevant service(s) To this end, base year costs tend to be assessed by reference to BT‟s Current Cost Accounting Fully Allocated Costs (“CCA FAC”) for the relevant service(s) as reported in our Regulatory Financial Statements (see below) However, Ofcom makes some adjustments to BT‟s published costs in defining the costs it views as “relevant” to be recovered through regulated charges – e.g. it can decide that for policy reasons certain reported costs should not be recovered through the allowed regulated charges Key factors behind Ofcom‟s forecasting final year costs: – How will volumes change over the period? – How will unit costs change with volumes? – What efficiency savings is BT expected to make? – What is BT‟s estimated cost of capital? 16 © British Telecommunications plc Remedies charge controls RAV The “RAV adjustment” Prior to 1997, regulated prices were set on basis of Historic Cost Accounting (HCA) asset valuations Ofcom considers that BT would receive a windfall gain if prices today were now set on a CCA basis for any in-life assets originally in place prior to 1997 (mainly duct assets with some copper) Ofcom therefore adjusts the CCA values of the RAV in our RFS to use HCA values for those pre-1997 assets We disagree with Ofcom‟s adjustment and have appealed its use in the latest WLR/LLU charge control 17 © British Telecommunications plc Remedies charge controls: WACC Estimate of Weighted Average Cost of Capital (“WACC”) Ofcom use the Capital Asset Pricing Model (CAPM) to calculate the rate by reference to both general and BT-specific financial market information Ofcom has recently set the WACC for Openreach (copper products) at 8.8% and rest of BT at 9.7%. This was reduced from WACC used in setting 2009 controls due to changes in financial market parameters, including falls in the risk free rate Sensitivity to WACC: round 1/3 of the relevant costs for setting WLR and MPF rental prices is made up by the allowed WACC 18 © British Telecommunications plc Remedies cost orientation Imposed as “Basis of Charges” remedy requiring that prices in the SMP market are “reasonably derived” from the costs of provision including “reasonable” mark up for recovery of common costs and “reasonable” return As such remedy is not “prescriptive” about the level of the charge (unlike a charge control) Disagreement with Ofcom on its interpretation: focus seems to be exclusively on individual prices being between reported “floors” and “ceilings” with no account being taken of other factors – such as how costs are recovered across related services Driver of number of recent high value retrospective disputes: 2009 PPC trunk circuits decision 2012 Ethernet/high bandwidth draft decisions 19 © British Telecommunications plc Remedies cost orientation: floors and ceilings As noted, charge controls tend to be set to by reference to FAC (Fully Allocated Cost): - Cost of providing a service including a specific allocation of fixed and common costs shared across different BT services “Floors” for cost orientation are based on “DLRIC” (Distributed Long Run Incremental Cost): - LRIC for a service is calculated by taking its FAC and stripping out the fixed and common cost (FCC). DLRIC includes an attribution of any FCCs shared between services within defined “increments” within BT‟s business, but not with services outside the increment “Ceilings” for cost orientation based on “DSAC” (Distributed Stand Alone Cost) - DSACs are calculated from the LRIC for a service plus an allocation of all FCCs shared with all other BT services across only those services within the defined increment DLRICs and DSACs then reported in BT‟s Regulatory Financial Statements 20 © British Telecommunications plc Remedies cost orientation: floors and ceilings Pricing too high Cost Ceiling “DSAC” “FAC” Pricing flexibility Cost Floor “DLRIC” 21 © British Telecommunications plc Pricing too low Effect on BT where does BT have SMP? Line of Business BT Retail, BT Global Services Retail Leased lines BT Wholesale Broadband Market 1 and 2 PPCs Call origination termination Passives WLR Openreach LLU ISDN30 ISDN2 Market Review 22 © British Telecommunications plc WLR, ISDN30 Ethernet <=1G GEA WLA, WBA BCMR/LLCC Narrowband Calls Effect on BT where is BT charge controlled? Line of Business BT Retail, BT Global Services BT Wholesale Openreach Broadband Market 1 WLR LLU PPCs Call origination termination Ethernet <=1G ISDN30 Market Review 23 © British Telecommunications plc WLR, ISDN30 WLA, WBA BCMR/LLCC Narrowband Calls Regulatory reporting Michael Rickard, Group Regulatory Finance Regulatory reporting summary Regulatory reporting obligations are determined by EU Directives and by Ofcom: – The Annual Ofcom reporting consultation process amends (and generally increases) reporting requirements – The content is also impacted by market reviews and other changes Required to show – Cost orientation, Non-discrimination, Market level returns by each market and more Accounts are prepared on CCA basis – Accounts also use different (Ofcom) terms e.g. AISBO for Ethernet Extremely detailed – Over 2000 pages of information (but mostly reference tables) – Useful information is in Section 7 and 8 (Access and Wholesale markets) and section 10 (Openreach report) 25 © British Telecommunications plc Regulatory reporting Current Cost Accounting (CCA) Reflect assets at „current‟ value to the business – Should reflect „economic cost‟ and is „forward looking‟ – Ofcom requirement Key assets affected by CCA – Duct and copper CCA adjustments flow through P&L as: – Supplementary depreciation (ongoing return) – Holding gain / loss (one-off impact) – Other CCA adjustments (one-off impact – methodology changes etc.) 26 © British Telecommunications plc Regulatory reporting regulatory accounts Ofcom statement (front of statement before page 1) Section 1 – Introduction (Pages 3 to 8) Section 2 – Statement of Responsibility (Pages 9 and 10) Section 3 – Audit Report (Pages 11 to 14) Section 4 – Basis of Preparation (Pages 15 to 19) Section 5 – Summary of Financial Performance (Pages 20 and 21) Section 6 – Attribution of Current Costs and MCE (Pages 22 to 28) Sections 7 & 8 – Review of Access and Wholesale Markets (Pages 29 to 82) Section 9 – Reconciliation to BT Group‟s statutory accounts (Pages 83 to 87) 27 Section 10 – Openreach statements – to comply with Undertakings (Pages 87 to 94) Appendices (Pages 95 to 124) Glossary of terms © British Telecommunications plc Regulatory reporting overview of RFS 28 © British Telecommunications plc Current regulatory activity Mark Shurmer, Group Director, Regulatory Affairs Current regulatory activity Market reviews and charge controls – Business Connectivity Market Review: consultation imminent – Leased Lines Charge Control : consultation expected end-June – Wholesale Narrowband Market Review: responses due to Ofcom call for inputs at end June – Wholesale Local Access/Broadband Access Market Review: preparation starting soon, call for inputs expected early 2013 Appeals and disputes – WACC appeal: CC determination now published; CAT Judgment later – Pensions appeal: CC determination now published; CAT Judgment later – WLR/LLU charge control appeal (includes BT challenge of RAV adjustment): expected to conclude May 2013 – Ethernet £145m /high bandwidth disputes: decision from Ofcom expected in next 2-3 months Other key activity – Regulatory reporting and cost orientation: consultation expected before end June – Wholesale Calls Competition Act case: Ofcom investigation ongoing 30 © British Telecommunications plc BT Group plc Q&A Remedies operation of charge controls Current unit price RPI-X glide path “Target” unit price Unit price/cost ROCE Operating costs Depreciation Year x 32 © British Telecommunications plc Base year actual unit costs Year x+3 Final year forecast efficient unit costs