Working Paper Number 84 February 2006

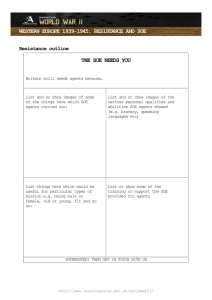

advertisement