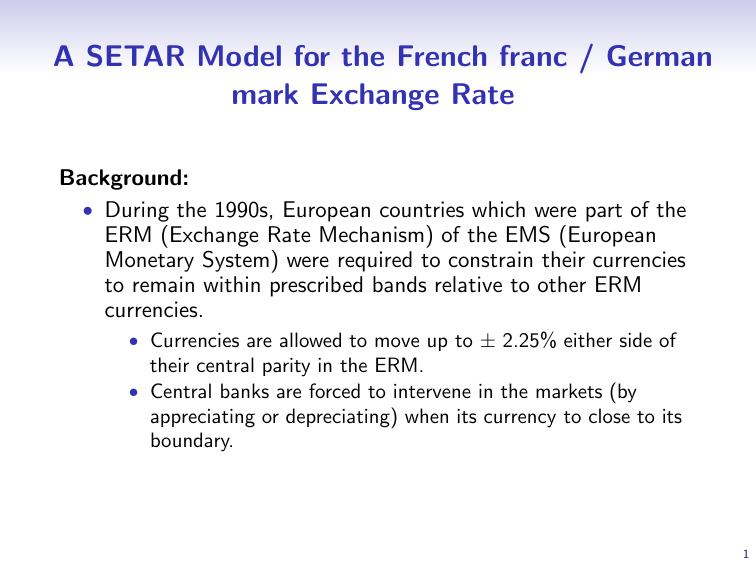

A SETAR Model for the French franc / German

advertisement

A SETAR Model for the French franc / German mark Exchange Rate Background: • During the 1990s, European countries which were part of the ERM (Exchange Rate Mechanism) of the EMS (European Monetary System) were required to constrain their currencies to remain within prescribed bands relative to other ERM currencies. • Currencies are allowed to move up to ± 2.25% either side of their central parity in the ERM. • Central banks are forced to intervene in the markets (by appreciating or depreciating) when its currency to close to its boundary. 1 Model: • The idea is to use a SETAR model to allow for different types of behaviour according to whether the exchange rate is close to the ERM boundary. • Close to the boundary, central banks will have to intervene to maintain the parity: such interventions may affect the usual market dynamics that ensure fast reaction to news and the absence of arbitrage opportunities. • Central banks are expected to intervene when either boundary (the ceiling and the floor boundary) is hit: • This suggests the use of the 2-threshold (3-state) SETAR. 2 Data and reconsideration of the model: • Study from Chappell et al. (1996, Journal of Forecasting) uses daily data from 1/5/90 to 30/3/92. • For the considered sample, DEM is never a weak currency: as a result, the FRF-DEM exchange rate is either at the top or in the center of the band, and never close to the bottom. • A model with 2-threshold (3 states) SETAR is NOT appropriate (spurious detection of the 2nd threshold). • A model with 1-threshold (2-state) SETAR is more appropriate. • The model orders for each regime are determined using AIC. 3 Estimation results and Comments: Model Êt = 0.0222 + 0.9962Et−1 (0.0458) (0.0079) For regime Et−1 < 5.8306 Number of observations 344 Êt = 0.3486 + 0.4394Et−1 + 0.3057Et−2 + 0.1951Et−3 (0.2391) (0.0889) (0.1098) (0.0866) Et−1 ≥ 5.8306 103 • Estimation is performed using the first 450 observations (which leaves the last 50 observations for out-of-sample forecasting). • Ceiling in the ERM corresponded to 5.8376 (log of FRF per 100 DEM). • The estimated threshold is 5.8306, just below the ceiling as expected. • This confirms the expectation that the central bank is likely to intervene before the exchange rate actually hits the ceiling. 4 Out-of-sample forecasts using 4 competitive models: Steps ahead 1 Panel A: mean Random walk 1.84E-07 AR(2) 3.96E-07 One-threshold SETAR 1.80E-07 Two-threshold SETAR 1.80E-07 2 3 squared forecast error 3.49E-07 4.33E-07 1.19E-06 2.33E-06 2.96E-07 3.63E-07 2.96E-07 3.63E-07 Panel B: Median squared forecast error Random walk 7.80E-08 1.04E-07 2.21E-07 AR(2) 2.29E-07 9.00E-07 1.77E-06 One-threshold SETAR 9.33E-08 1.22E-07 1.57E-07 Two-threshold SETAR 1.02E-07 1.22E-07 1.87E-07 5 10 8.03E-07 6.15E-06 5.41E-07 5.74E-07 1.83E-06 2.19E-05 5.34E-07 5.61E-07 2.49E-07 5.34E-06 2.42E-07 2.57E-07 1.00E-06 1.37E-05 2.34E-07 2.45E-07 Source: Chappell et al. (1996). Reprinted with permission of John Wiley and Sons. • Overall the 1-threshold SETAR model seems to perform best: • 1-threshold SETAR performs better than the other competitors according to the MSE. • The random walk model marginally outperforms 1-threshold SETAR at short horizons according to the Median SE, but not at longer horizons. 5